Who is Making Single-Family Rentals the New Starter Homes of Choice?

- Renters of single-family homes are younger and tend to have more children than the typical homeowner, and they're more affluent than the average renter.

Driven by cyclical, demographic, and technological factors, the single-family rental (SFR) sector has matured as an institutional investment class over the past decade. The once-fragmented industry has both coalesced and professionalized. While the evolution of the SFR sector has been explored at length, a clear picture of its core set of residents is just now coming into focus.

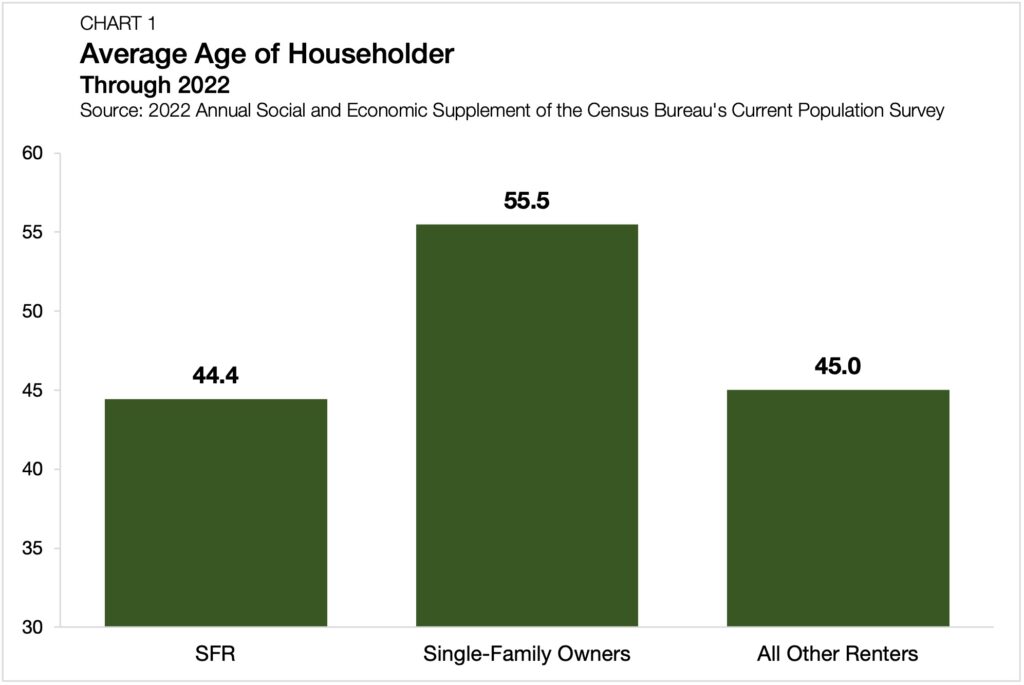

Age of Householders

Looking at the age profile of SFR renters uncovers a tenant base that skews young — a trend consistent with single-family rentals stepping in as the modern version of the starter home. The average age of an SFR householder is 44.4 years — about 10 years younger than the age of the average single-family homeowner (55.5 years) (Chart 1). The wide age gap between single-family owners and renters includes a significant share of Generation Z renters. In fact, 19.5% of SFRs have a head of household that is age 30 or younger. For owner-occupied single-family, this under 30 share accounts for just 5.2% of households.

Comparing the age profile within SFR to that of other renters reveals more similarities than differences. The average head of household age in all other rental units is 45.0 years — in line with the SFR average.

Despite SFR householders being younger than single-family owners and all other renters, their average age has increased by the most in the past decade. Since 2012, the average age of the head of household in an SFR has risen by 2.4 years. Meanwhile, the average age of owners and all other renters has increased by 1.1 and 2.0 years, respectively.

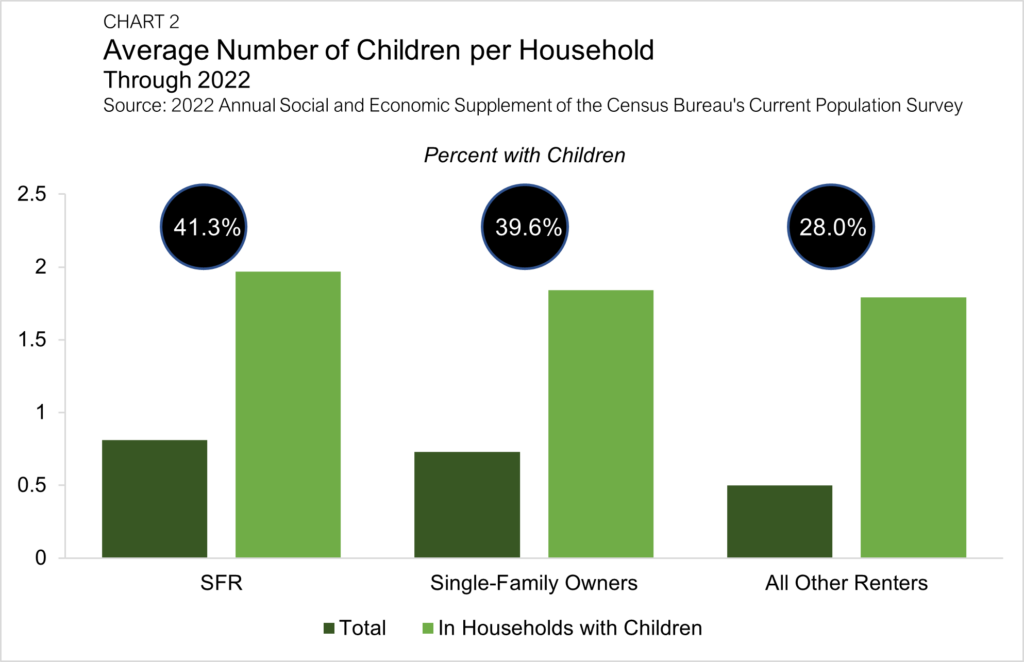

Number of Children

Young families are choosing single-family rentals in increasing numbers. The share of households with at least one child is higher in SFR (41.3%) than it is for both single-family owners (39.6%) and householders of all other rental types (28.0%) (Chart 2).

The average SFR household has 0.81 children. The average is lower for single-family homeowners and all other renters at 0.73 children and 0.50 children, respectively.

However, narrowing in on the households with at least one child, the average number of children rises to 1.96 for SFR (single-family owners: 1.84, all other renters: 1.79).

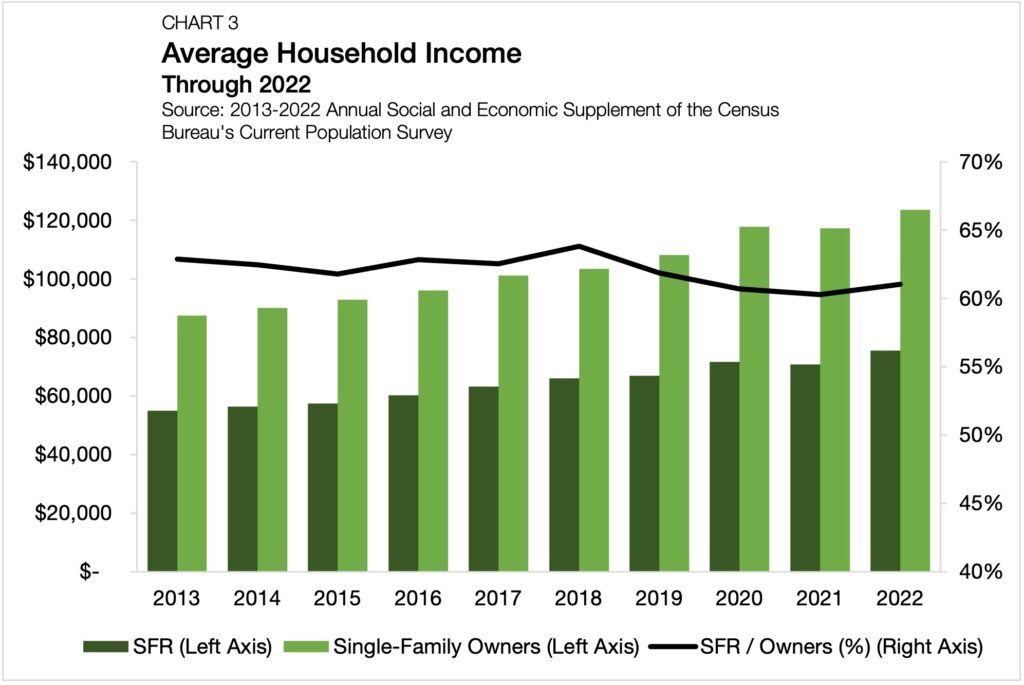

Income

SFR households have an average total income of $75,458, which is more than $10,000 higher than that of other rental types. The average household income for renters of all other unit types was $64,798 in 2022.

Meanwhile, compared to owners of single-family properties, SFR households earn considerably less. On average, single-family owners have household incomes 63.8% higher than their renter neighbors, coming in at $123,626.

Data from the past 10 years demonstrates that income differentials in owner- and renter-occupied single-family homes have remained highly consistent. Over the past decade, SFR households have earned between 60.8% and 63.8% of their owner neighbors’ incomes, with the 2022 average coming in at 61.0% (Chart 3). These data suggest that, despite the SFR sector’s formalization, how the sector fits into the fabric of the housing market has not radically changed.

Wrap Up

These data paint a picture of the SFR sector filling a critical need for young households. The average SFR renter has a more youthful head of household compared with single-family owners while having a higher average number of children. As structural and cyclical trends continue to support the sector, SFR’s importance, and our understanding of its core tenant base, is poised to grow.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of single-family rental financing options and view our other market research and multifamily posts in our research section.