Affordable Housing Scores Key Victories in 2023 Federal Spending Package

- The Fiscal Year 2023 federal spending package includes a 10% increase to HUD's budget.

- The funding in the bill covers all existing Housing Choice Vouchers and Project-Based Rental Assistance and extends vouchers to an additional 12,000 households.

- Other key recent proposals, including an expansion of Low-Income Housing Tax Credits (LIHTCs), were left out of the final version of the bill.

Passed in the 11th hour of the 117th Congress, the $1.7 trillion federal spending package prioritizes the expansion of affordable housing in 2023 through increased funding for targeted programs.

Big Picture Items

Affordable housing advocates scored several key victories in the Fiscal Year 2023 Omnibus Appropriations Bill, which was signed into law on December 29, 2022. The final version allocates an additional $6.4 billion in funding for the U.S. Department of Housing and Urban Development (HUD) over 2022 levels, totaling $60.18 billion in 2023 — a 10% funding increase.

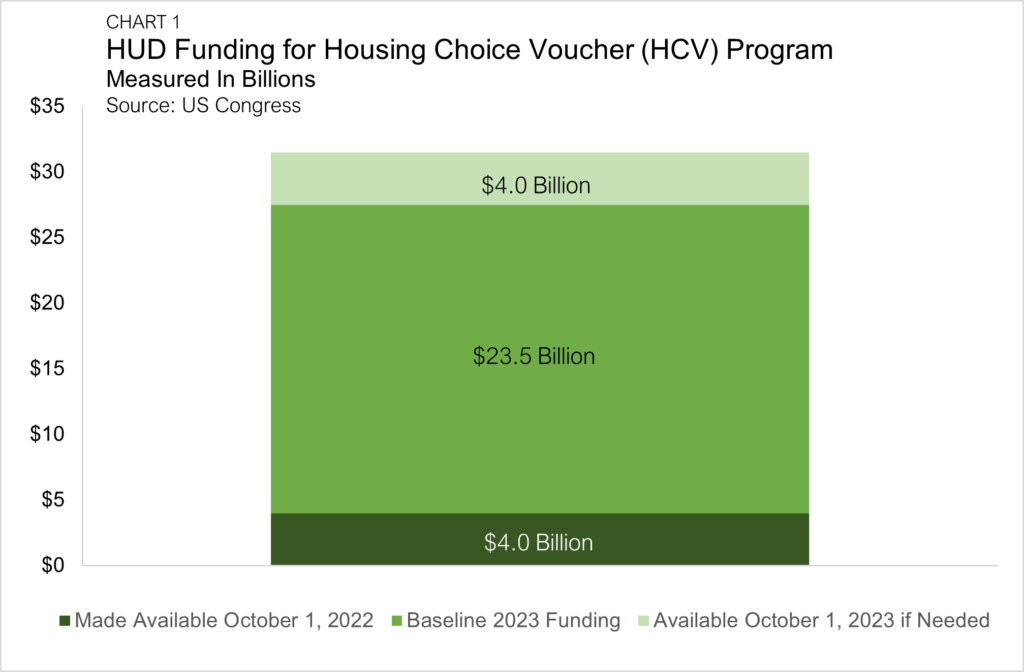

HUD’s appropriation includes funds to cover all current in-place Housing Choice Voucher (HCV) contracts, which will reach $27.3 billion in 2023. Included in HUD’s total is $4 billion that was made available to the agency in October of 2022. A separate $4 billion will become available to the agency in October of 2023 if the previous amount is expended (Chart 1). In addition to covering current in-place HCVs, the funding would also cover an additional 12,000 households through the HCV program. The incremental vouchers will prioritize individuals and families experiencing or at risk of homelessness.

Beyond HCV funding, Congress appropriated $13.9 billion towards Project-Based Rental Assistance (PBRA) in addition to the approximately $969 million previously made available until expended. PBRA, which is notably tied directly to rental units rather than low-income tenants, is crucial to preserving affordability for low-income renters within areas of high population growth. While 2023 funding for PBRA has been set at $2.4 billion below 2022 levels, analysts expect it to cover the renewal of all existing contracts.

Funding for Community Development Block Grants (CDBGs) maintained its 2022 levels at $3.3 billion. However, Congress also appropriated an additional $1.47 billion in CDBG earmarks designated for specific projects, for a total of $2.98 billion — almost double 2022 levels. Also included in the Omnibus Appropriations bill is a novel “Yes In My Back Yard” initiative. The provision aims to incentivize localities away from exclusionary zoning and land use policies, which advocates hope will spur new housing construction.

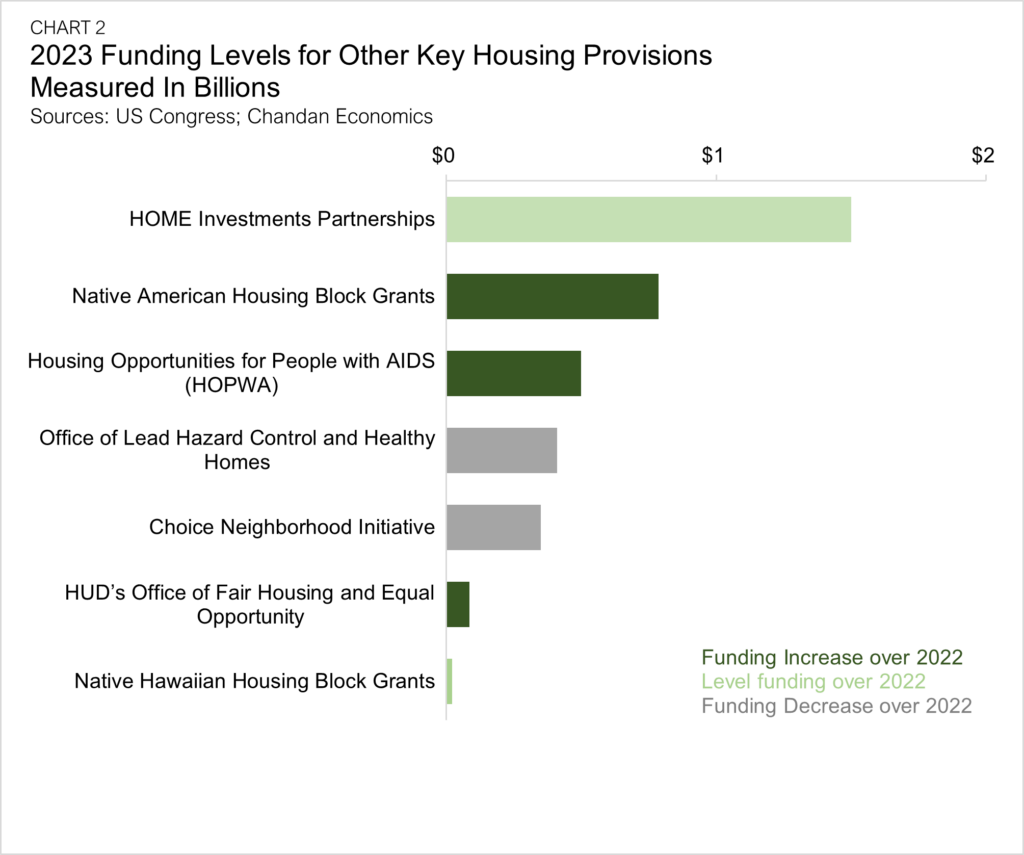

The 2023 Federal spending package included additional provisions of interest to the housing market (Chart 2).

What Was Left Out

Some wish list items sought by both industry and tenant advocacy groups were left out. Most notable was the exclusion of significant tax provisions to help boost the country’s tight housing supply, specifically a proposed expansion of Low-Income Housing Tax Credits (LIHTCs).

Provisions introduced in the proposed Affordable Housing Credit Improvement Act to provide financing mechanisms that would encourage more construction were also left out. Additionally, while Congress secured a modest expansion to the HCV program, a more ambitious House of Representatives proposal to expand the HCV program to cover an additional 140,000 households has yet to come to fruition.

The Outlook

HUD program increases included in the final spending package were largely celebrated by industry groups and advocates alike, with some already preparing for additional efforts in 2023.

“Although the increased investment in HUD project-based subsidy is profoundly advantageous for all Americans, it also leads to complex challenges for those developers looking to expand the stock of affordable housing,” said Arbor Realty Trust’s Brian Blue, Managing Director of Affordable Housing and FHA Operations. “Affordable housing advocates are continuing to call for the expansion of programs that positively impact project capital stacks, such as LIHTC. Since becoming permanent in the early 1990s, this public-private partnership has been the main catalyst for not only the preservation but also the creation of new affordable housing units.”

The National Apartment Association, which among other industry groups, championed a number of proposals throughout the legislative process, cheered what it called “several victories in this legislation.” However, the group still vows to continue its efforts to advance rental housing industry priorities. A push to expand LIHTC will likely continue to define the national housing debate over the coming year while states and localities continue their own efforts to address the country’s growing housing affordability crisis.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.