The Size and Scope of the Single-Family Rental Sector

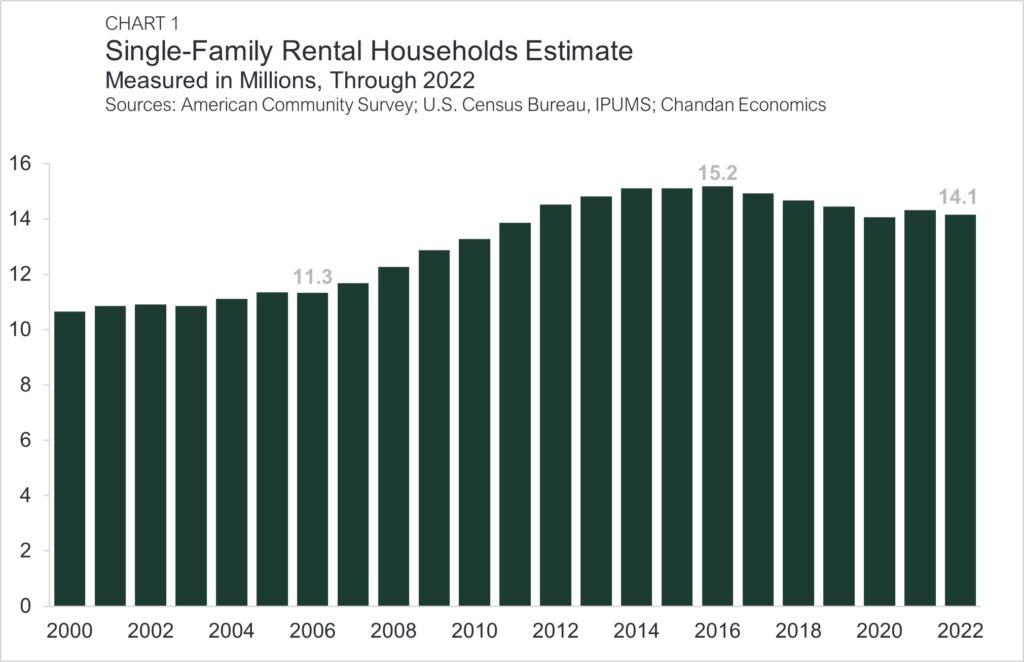

- Single-family rentals (SFR), the second-largest rental housing type in the U.S., account for approximately 14 million households.

- The number of SFR households has fallen nationally in five of the past six years, even while institutional investor activity grew.

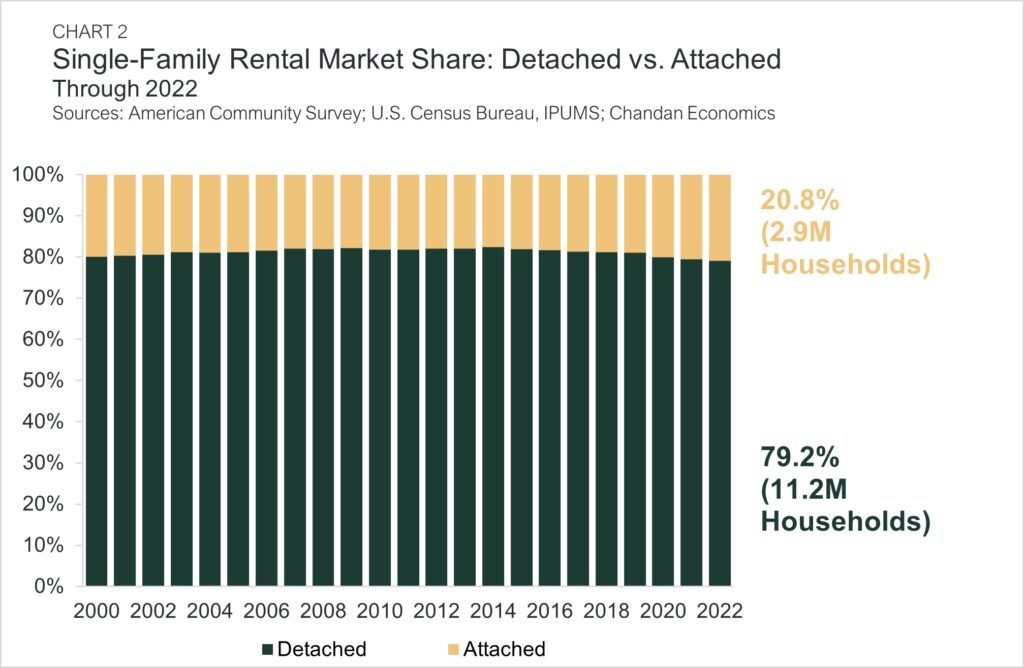

- The share of single-family renters living in attached single-family homes has increased in each of the past five years, reaching about 20% of all SFR households last year.

Even as the single-family rental (SFR) sector has attracted increased investor activity, the total number of SFR households has moderated due to the influence of overarching housing trends.

SFR Households Slide

Perhaps surprisingly, the number of renters living in single-family homes in the U.S. fell to 14.1 million in 2022 down 1.2% from 2021 (Chart 1). Despite the slight decline, SFR remains the second-largest rental housing type, representing 31.5% of all rental households. SFR households surged from 11.3 million in 2006 to 15.2 million in 2016. Since then, the number of SFR households has declined in five of the past six years.

Recent declines in SFR households are due to many SFRs being sold as owner-occupied homes. Despite recent increased activity from institutional investors, SFR remains dominated by small-scale, “mom-and-pop” operators — many of whom sold their properties at a profit when the housing market was strong from 2016 to 2022.

Attached vs. Detached

Single-family renters may live in two housing sub-types: attached single-family homes that are physically connected to one another and detached single-family homes that are distinctly separated.

Detached homes comprise nearly 80% of the market share in the SFR sector, accounting for 11.2 million households (Chart 2). However, detached homes are slowly losing market share after declining 1.6% in 2022, while the number of households living in attached single-family homes has grown.

Driven by institutional SFR developers and the introduction of purpose-built SFR communities, many of which utilize attached units, households renting attached single-family homes grew by 0.6% (or 2.9 million households) in 2022. While still accounting for just about one in five SFR households (20.8%), the market share of single-family attached rental homes has increased in each of the past five years.

The SFR sector has seen intense growth in recent years, attracting new investment capital and developing new business models, such as purpose-built communities. An important consideration going forward will be how SFR interacts with the broader housing market ecosystem, where trends in homeownership and mom-and-pop investors will continue to impact the size and scope of the sector.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily articles in our research section.