Small Multifamily Continues Steady Price Growth

- Small multifamily properties showed positive year-over-year price growth, and their valuations rose for the third time in the past four quarters.

- Steady rent growth, operating expense ratio improvements, and cap rate stability continue to drive the sector’s resilience.

- While the macro economy remains highly uncertain, small multifamily has a steady wind at its back.

Small multifamily valuations realized positive year-over-year growth in the second quarter of 2025, demonstrating the sector’s ongoing resilience in an unsettled economic environment. Steady rent growth, improving operating expense ratios, and stable cap rates helped move price growth into positive territory.

Valuations Turn a Corner

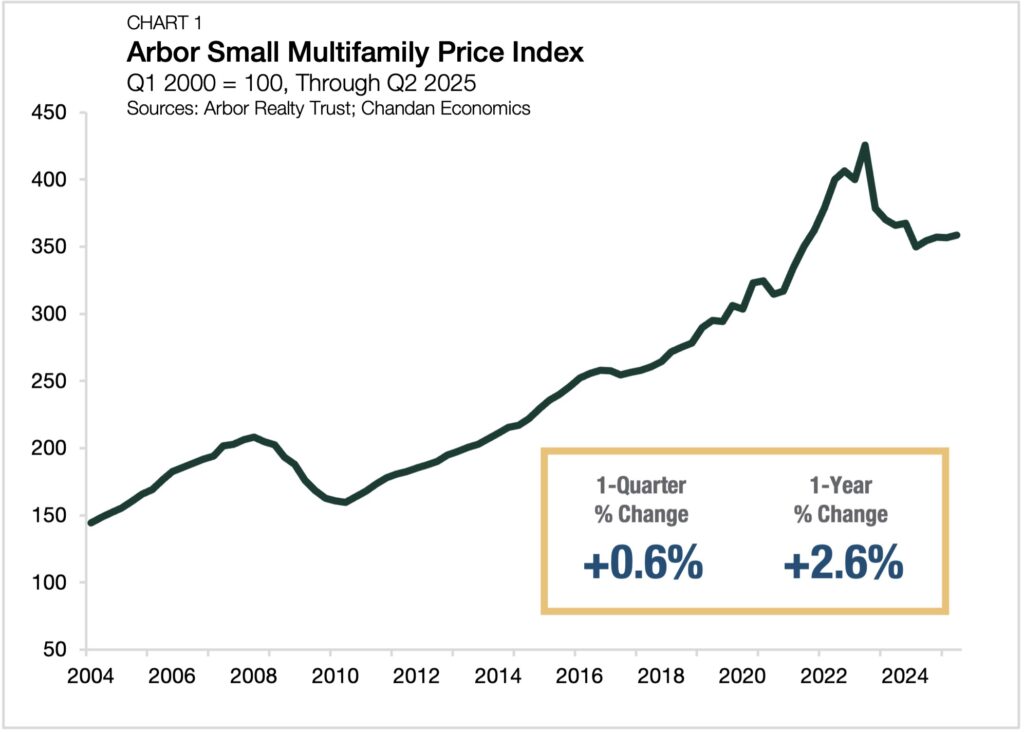

Small multifamily prices rose (+0.6%) last quarter, the third increase in the past four quarters (Chart 1). However, the year-over-year change is more noteworthy. Compared to a year earlier, small multifamily prices increased by 2.6%, the first time valuations have risen year-over-year in more than two years.

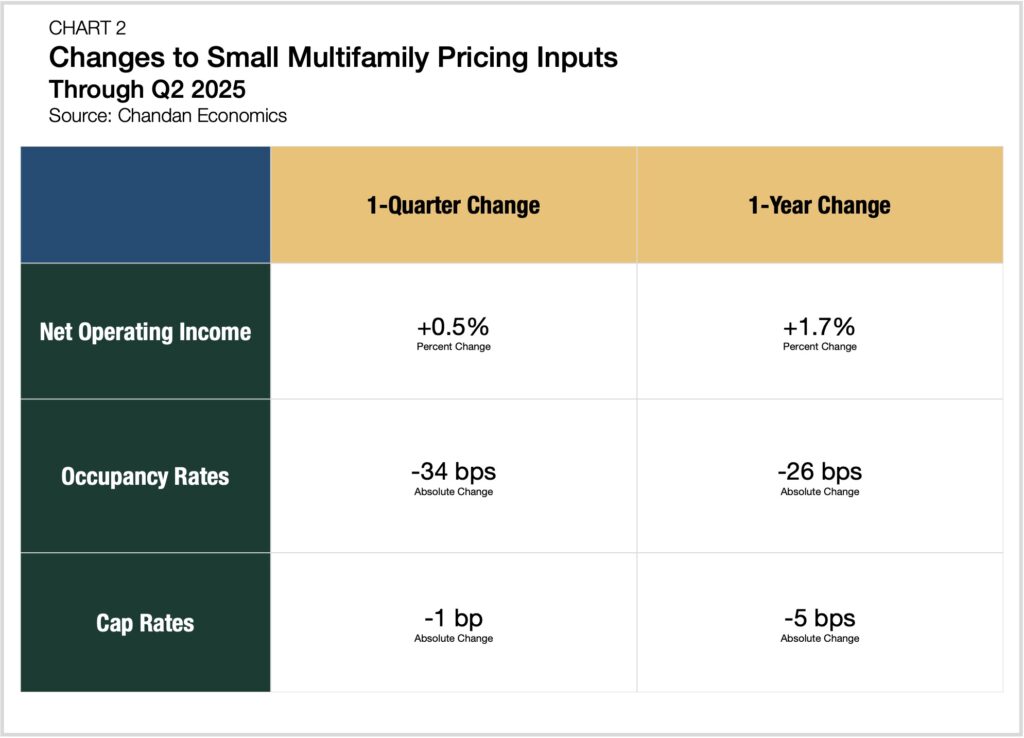

Several supportive factors fueled the small multifamily sector’s recent pricing inflection. Steady rent growth and a slight improvement in operating expense ratios both contributed to a higher average net operating income (NOI) and, consequently, higher valuations.

A Chandan Economics model estimated that NOIs rose 0.5% in the second quarter compared to the previous three-month period, and increased 1.7% from the same time last year (Chart 2). Cap rates remained mostly unchanged at 6.0% — neither aiding nor weighing down valuations. However, occupancy rates declined by 34 basis points in the second quarter, limiting the scope of the overall pricing increase.

The Pricing Road Ahead

While the macro economy remains highly uncertain, small multifamily has a steady wind at its back. Compared to a market high in 2023, small multifamily valuations ended the second quarter of 2025 at a 15.7% markdown. The price corrections that occurred over the last two years place the sector in an advantageous position in an improving economic climate. With demand for rental housing continuing to grow and valuations at a relative discount, a pricing rebound could be a bellwether of the start of a new investment cycle filled with compelling opportunities.

Explore Arbor Realty Trust’s latest Small Multifamily Investment Trends Report, developed in partnership with Chandan Economics, to read our full findings.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.