Build-to-Rent (BTR) Development Continues to Outpace Historical Highs

- SFR/BTR housing starts are outpacing historical highs, despite a slowdown in the second quarter of 2025.

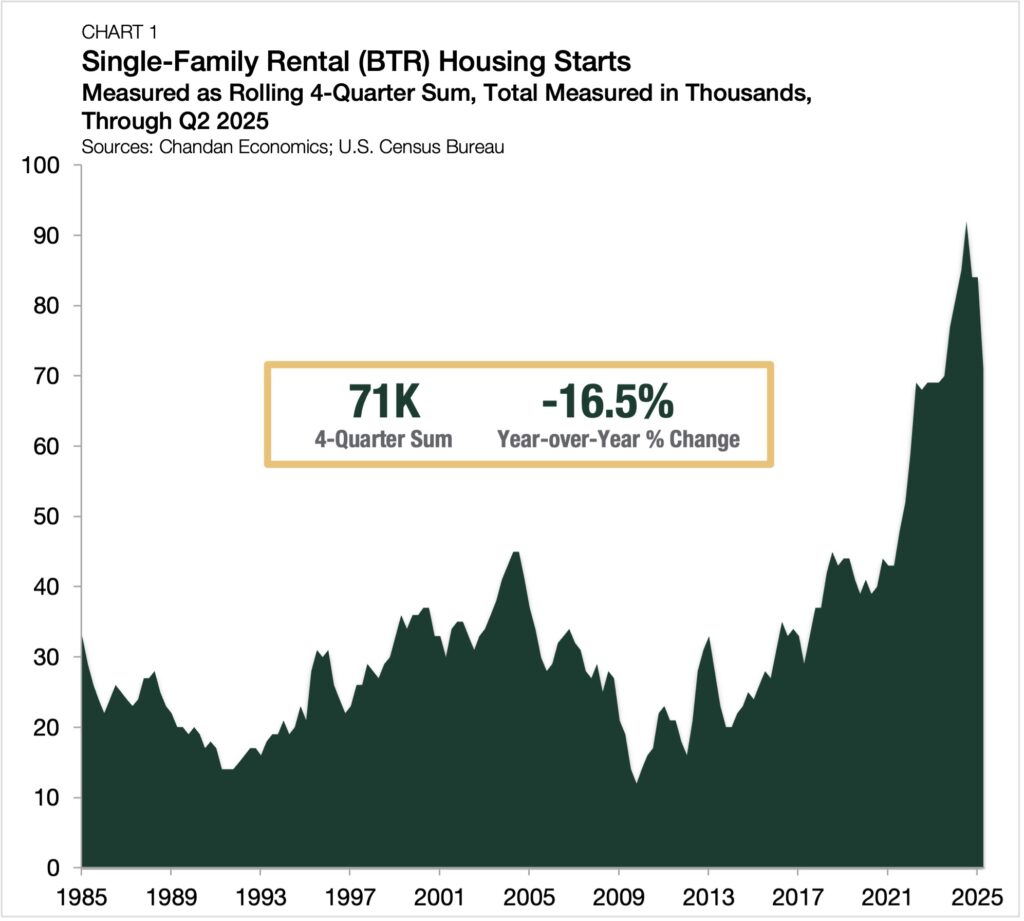

- Over a 12-month period ending in June 2025, 71,000 BTR units were started nationwide.

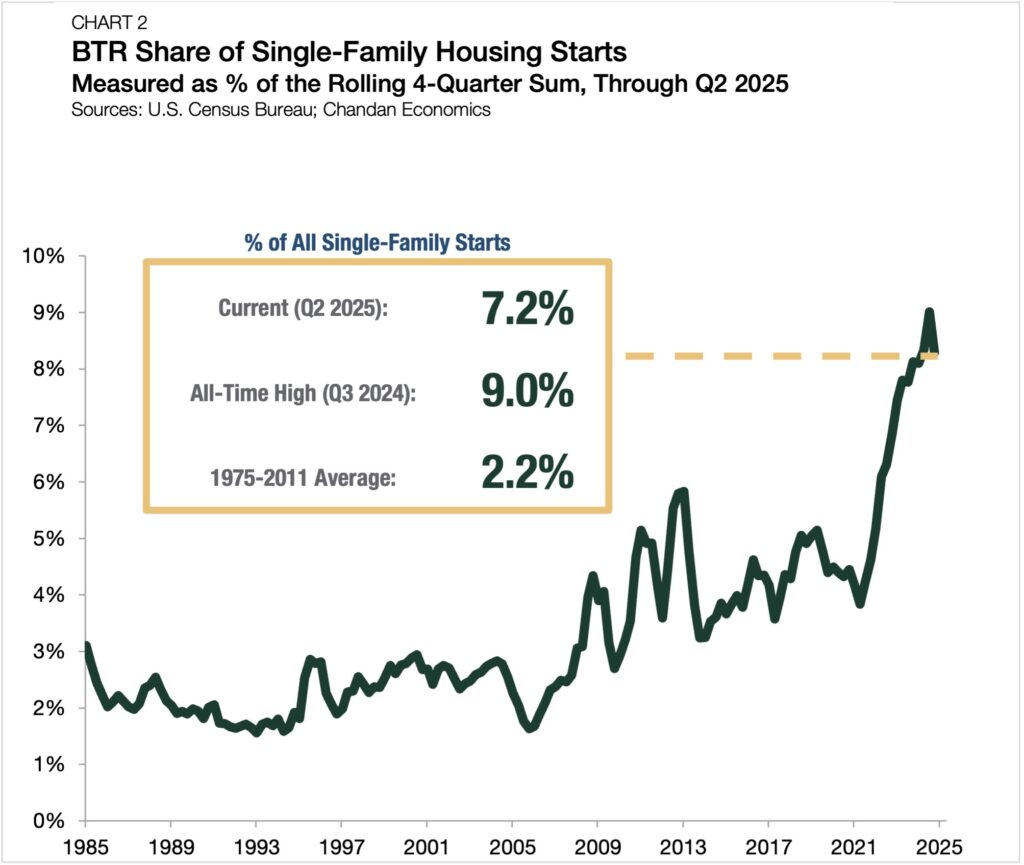

- BTR’s share of single-family housing starts stood at 7.2% in the second quarter.

As single-family rental (SFR) demand has risen, build-to-rent (BTR) development has become more efficient at creating a distinct, community-focused experience for renters. Newly released U.S. Census Bureau data confirms that while the pace of SFR/BTR construction slowed during the second-quarter, development has remained robust compared to historical trends.

SFR Construction Cools

As detailed in Arbor’s Single-Family Rental Investment Trends Report, developed in partnership with Chandan Economics, the SFR construction pipeline remains near historical highs, reaching 71,000 units in the 12 months ending in June 2025 (Chart 1).

SFR/BTR starts hit an all-time high of 92,000 in the third quarter of 2024, although the pace of new construction has slipped in three of the last four quarters. Compared to the same time last year, the rolling sum was down, but BTR development remains robust compared to where it has been historically. The annual sum recorded in the second quarter of 2025 exceeded every other quarter’s tally before the fourth quarter of 2023.

BTR’s share of all single-family construction modestly decreased during the past few months. Over the year ending in the second quarter of 2025, BTR accounted for 7.2% of all single-family construction starts — down from 8.4% during the prior quarter and 9.0% in the third quarter of 2024 (Chart 2). Still, BTR’s single-family construction market share remains above its trailing five-year average (6.5%).

BTR’s market share had never eclipsed 6% before 2022, highlighting that while BTR development has fallen slightly below recent record highs, it remains substantially above where it was just a few years ago.

With the inventory of existing homes for sale rising through the first half of 2025, single-family rental developers have responded accordingly. According to Zonda’s New Home Lot Supply Index, the availability of finished lots hit a five-year high in the second quarter as new home production slowed. Notably, many of the markets with the highest rates of finished lot availability (such as Austin, Atlanta, and Dallas) are also epicenters of SFR/BTR activity.

Outlook

As discussed in greater detail in Arbor’s Single-Family Investment Trends Report, the SFR/BTR sector remains in a strong position entering the second half of the year. Although the pace of construction has retreated from historic highs, increased demand for a limited supply of quality rental housing continues to support nationwide and metro-level SFR rent growth.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.