Build-to-Rent Construction Starts Surge to New High in 2023

- SFR/BTR housing starts totaled 75,000 units in 2023 — a new all-time high.

- BTR properties accounted for 7.9% of all single-family housing starts last year, a new record.

- More housing developers are focusing on BTR as the affordable housing shortage persists and barriers to homeownership increase.

Over the last decade, single-family rental (SFR) operators have been increasingly focusing on build-to-rent (BTR) development as the needs and preferences of renters have shifted. As explored in the latest Arbor Single-Family Rental Investment Trends Report, SFR/BTR development has surged at a time when new, for-sale, single-family home starts have declined.

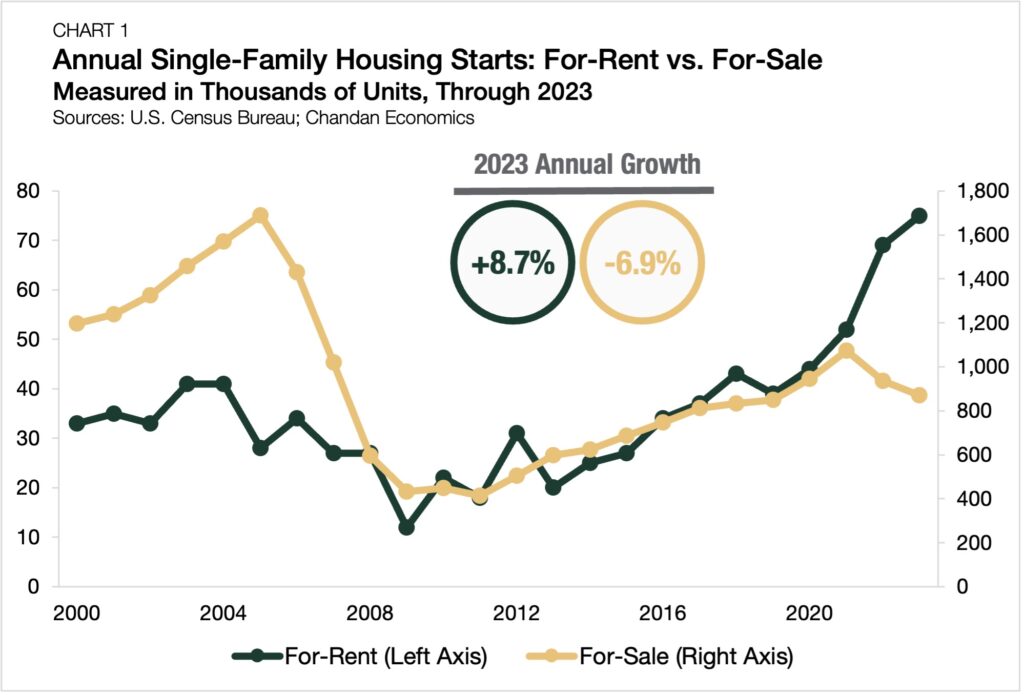

Last year, SFR/BTR construction starts reached 75,000 units — an all-time high and an annual increase of 8.7%, while for-sale starts recorded a second-straight yearly decline of 6.9% (Chart 1).

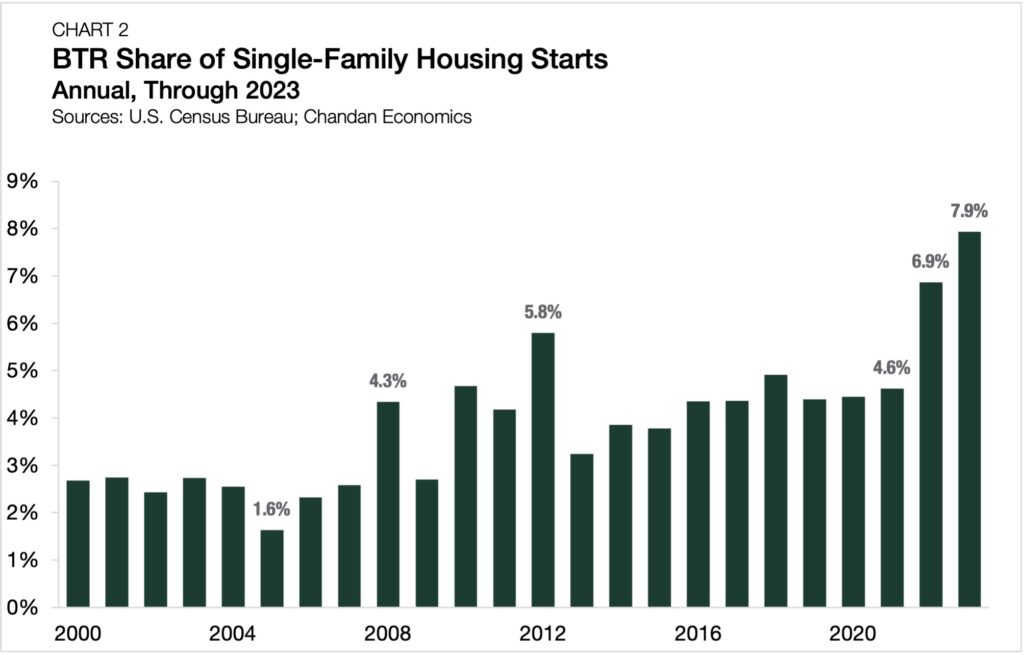

BTR’s share of all single-family construction reached a high in 2023, climbing to 7.9% (Chart 2). This rapid growth represents a significant change in residential development. Before the acceleration of SFR investment after the 2008 housing crisis, BTR’s share of single-family construction was less than half as high as it is now, never exceeding 3.1%.

Building for Demand

As homeownership costs climb and many opt for lifestyle renting, developers are increasingly pursuing BTR strategies, leading to a sustained uptick in construction activity.

According to the Federal Reserve Bank of Atlanta, buying a home is 33% less affordable today than in July 2020. As a result, developers are focusing on delivering more units where opportunity is greatest, boosting supply where demand is high. A recent National Association of Realtors analysis noted that developers are “dipping their toes into BTR to diversify their portfolios since that segment represents a high-performance asset class offering faster lease-ups and lower turnover than apartments.”

With BTR investment rising and homeownership affordability declining, this multifamily subsector now accounts for a substantial portion of new single-family development, making it a strong source of opportunity within commercial real estate.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.