Harvard Housing Study: State of the Rental Housing Industry

The most recent America’s Rental Housing 2024 report published by Harvard’s Joint Center for Housing Studies (JCHS) takes a detailed look at the state of the rental housing industry.

Cost-Burdened Renter Households

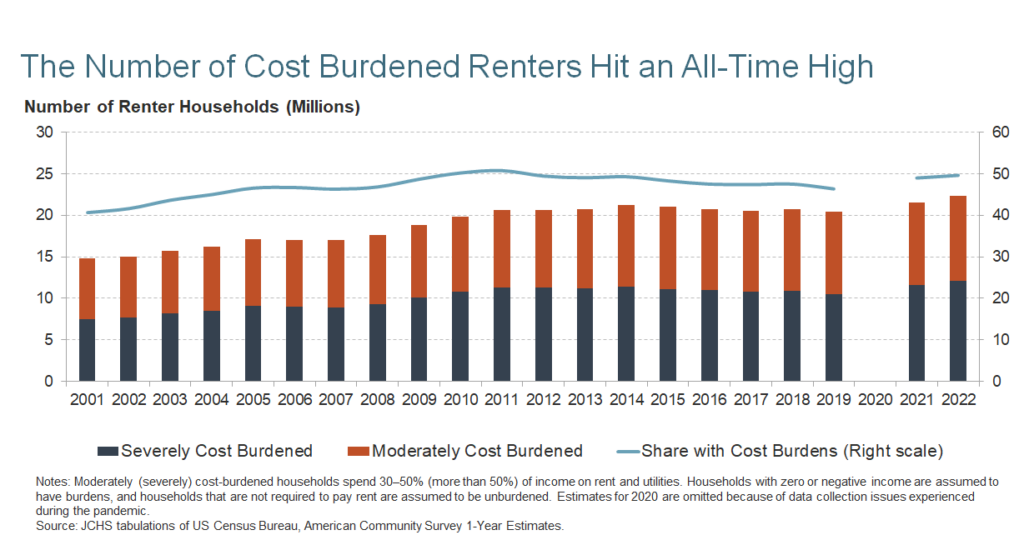

Even as rent growth has decelerated nationally, housing affordability concerns have worsened. According to the report, half of all rental households in the U.S. are cost-burdened (spending more than 30% of their income on rent and utilities), a total of 22.4 million households and an all-time high. The country is witnessing the highest levels of homelessness on record, and evictions are on the rise.

In 2022, there were 22.4 million cost-burdened renter families in the U.S. An increase of two million from 2019. Additionally, half of all renter households experienced cost burdens, up 3.2% from 2019 and up 9.0% from 2001. Larger metro areas, where rents are typically higher, had the highest cost-burden proportions.

“We saw rental demand return toward the end of 2023, and the longer-term prospects for demand are looking good,” Whitney Airgood-Obrycki, PhD, a senior research associate at Harvard’s Joint Center for Housing Studies, told Arbor. “While new supply should help moderate rent growth in the coming year, the slowdown in multifamily starts and the historically unaffordable conditions highlight the need for expanded rental assistance and affordable housing development.”

Operators and Developers Scramble

Although the skyrocketing pace of rent growth over the past few years has shown signs of slowing, operating expenses and insurance premiums are rising for multifamily operators, impacting cash flows. The report showed that net operating income peaked in 2021 with a dramatic 25.0% increase. These increased operating costs have driven rents even higher.

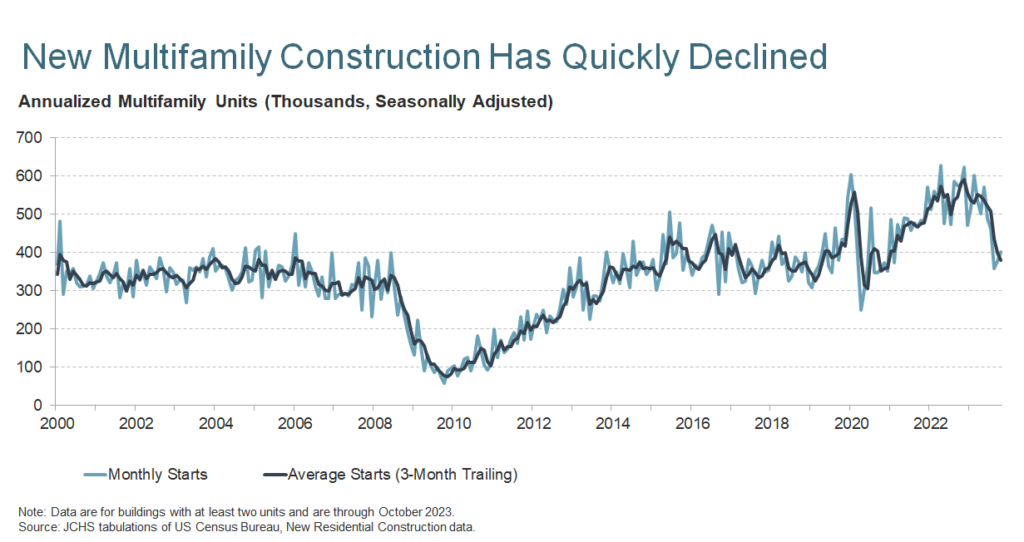

While high levels of new multifamily construction activity have recently helped to alleviate rising rents, the pace of development has slowed considerably. The JCHS report attributes the slowdown to factors such as rising interest rates and vacancy rates, alongside slowing rent growth. Multifamily starts fell to 402,000 units as of October 2023, a 30% drop from the previous year’s pace. On the other hand, single-family built-for-rent starts hit a new record high of 70,000 homes.

Strong Demographics

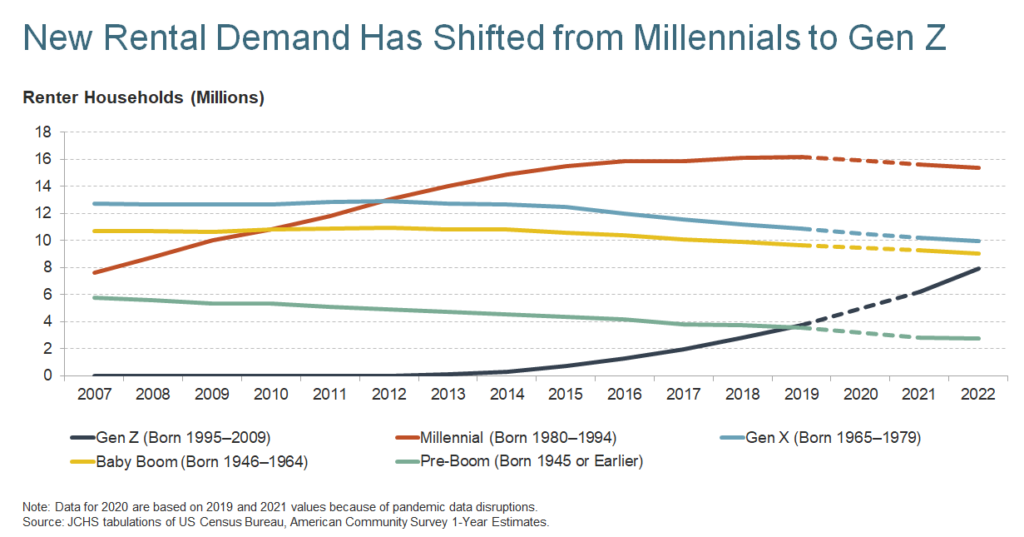

Even amid the affordability issues, rental demand remains strong, especially as younger generations embrace lifestyle renting. Millennial-headed rental households increased by 6.2 million between 2009 and 2019, peaking at 16.2 million. Gen Z is coming fast behind them, rising to 7.9 million households. Furthermore, higher-income households have added to rental demand. JCHS reports that the number of renter households with incomes above $75,000 has risen 43% since 2010.

Outlook

Affordability issues continue to be an issue throughout the country. The level of cost-burdened renter households is at record highs amid high levels of homelessness and with evictions on the rise. Strong demand for housing has driven rents sharply upward over the last few years — despite a recent slowdown — and yet operators are still struggling with increasing costs. Younger generations of higher-income lifestyle renters will continue to drive demand, although the need for more significant investment in affordable housing and rental assistance is greater than ever.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily articles in our research section.