Multifamily Households Set Yet Another Record

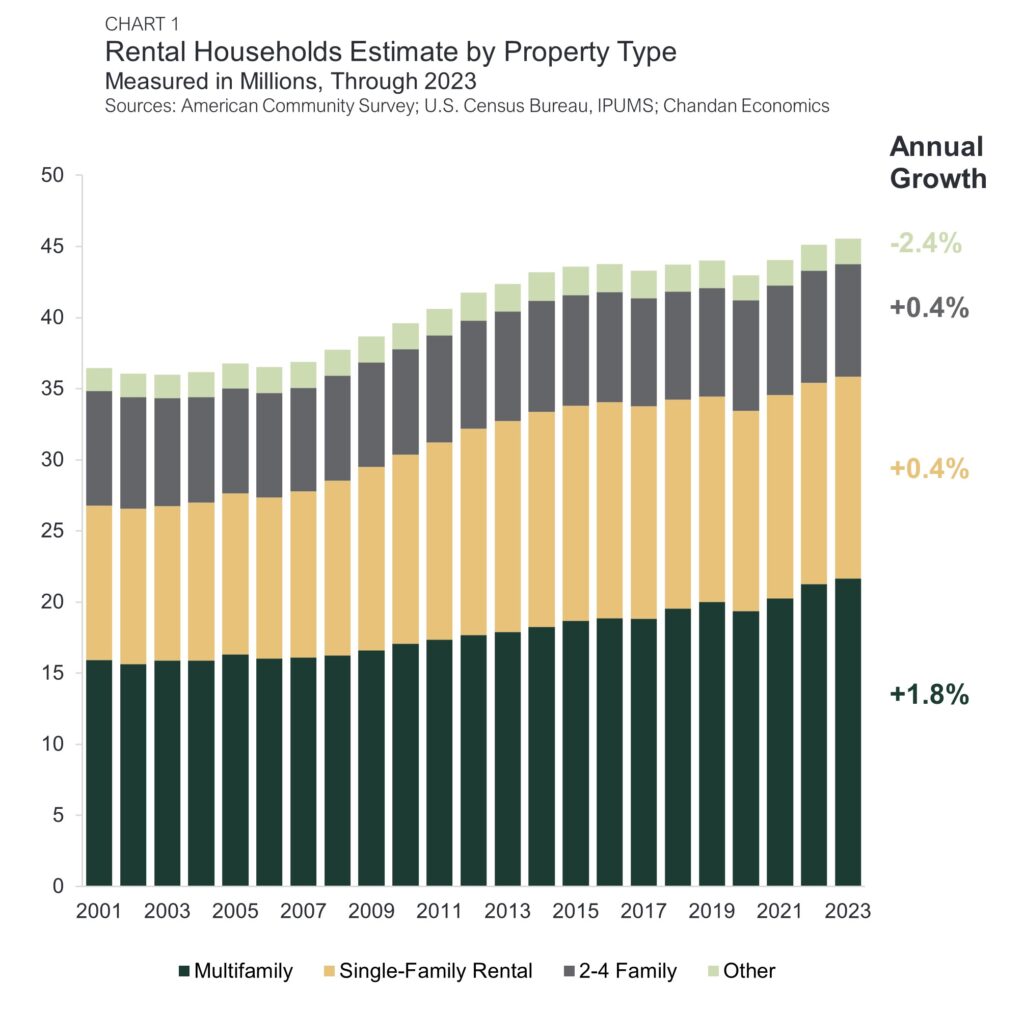

- The number of multifamily households rose to a new high of 21.6 million in 2023.

- Multifamily, the largest rental housing property type in the U.S., now accounts for nearly half of all rental households.

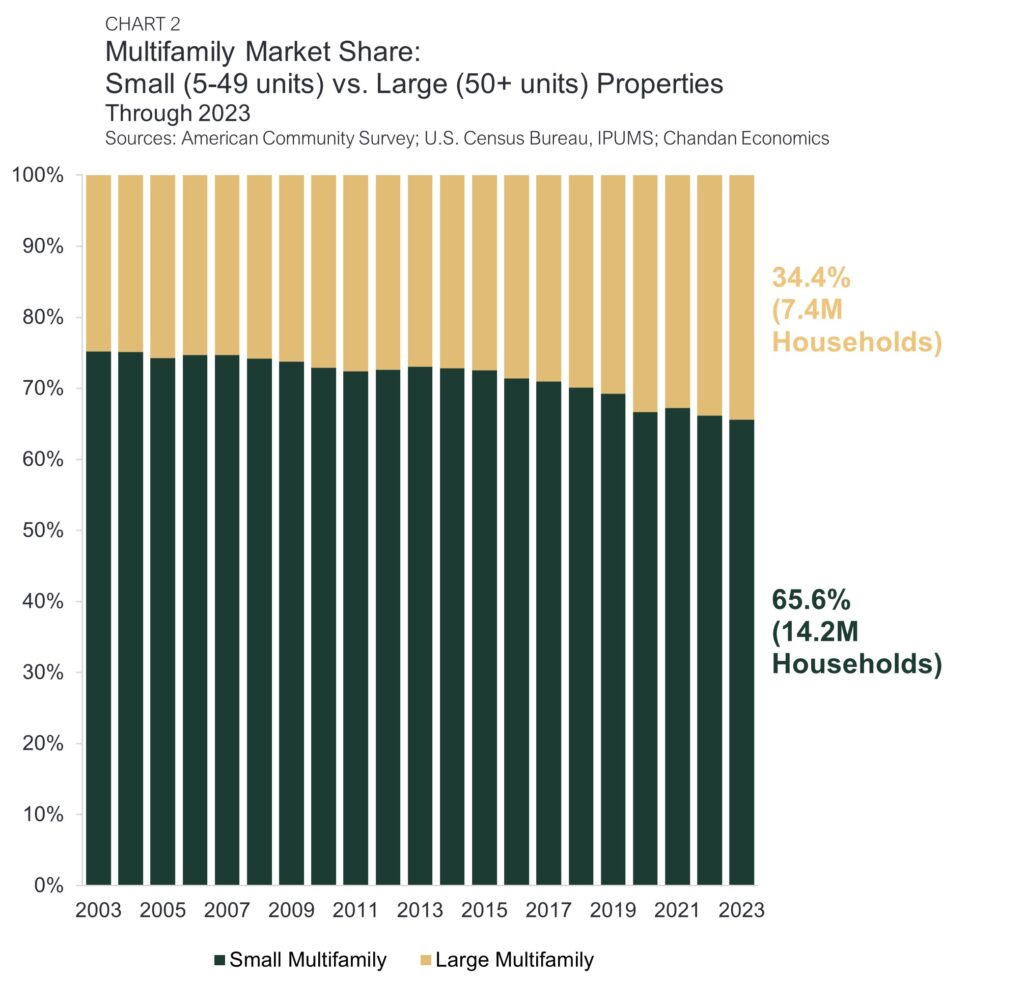

- The lifestyle renting boom has contributed to closing the gap in market share between large and small multifamily.

Multifamily households reached a new high for the third consecutive year in 2023, extending a growth spurt that began after the 2008 housing crisis. With strong tailwinds at its back, multifamily’s latest record may not stand for very long.

Multifamily households in the U.S. climbed to 21.6 million in 2023 — another new all-time high (Chart 1), according to new data from the U.S. Census Bureau’s American Community Survey. The number of multifamily households rose by 1.8% in 2023, exceeding the pace of all other rental sub-types and overall U.S. household growth (+1.3%). With household formations outnumbering housing additions, rental demand is strong and will continue to be boosted by a growing cohort of lifestyle renters.

Multifamily has long been the rental sector’s principal asset class in terms of investment activity and renter demand. In the past decade, multifamily has seen its market share rise by 5.2 percentage points to now comprise nearly half (47.5%) of all rental households. During this time, the total number of multifamily households edged higher, growing by more than one-fifth (20.9%), outpacing all other rental sectors.

The long-term growth of the multifamily sector received a boost from a robust influx of apartment completions. In 2023, 438,300 new multifamily units were delivered, a 22.1% jump from the prior year and the most substantial increase since the late 1980s.

Small and Large Multifamily

The multifamily sector includes two sub-property types: small multifamily (5-49 units) and large multifamily (50+ units). Small multifamily, representing the majority (65.6%) of all multifamily units, saw its market size rise by 1.0% to 14.2 million households in 2023 (Chart 2).

Although large multifamily remains the smaller (34.4%) subset, the market share gap between the small and large multifamily sub-sectors has been closing. In 2023, large multifamily households rose to 7.4 million, jumping 3.4% from a year earlier. For the past two decades, the large multifamily sub-property type has steadily gained market share, rising from 24.8% in 2003 to the current mark of 34.4% — a net gain of 9.6%.

The narrowing of the gap between small and large multifamily is likely the result of the lifestyle renting boom, where relatively high-earning households are choosing highly amenitized rentals over homeownership. Consequently, developers have devoted more attention and resources toward building rental units to satisfy growing demand. According to data from the U.S. Census Bureau’s Survey of New Construction, large multifamily has accounted for more than half of newly built multifamily rentals for the past seven years. Twenty years ago, large multifamily did not represent even a quarter of all multifamily construction, highlighting the seismic shift afoot.

Outlook

The multifamily sector saw healthy growth throughout 2023, extending its steady expansion. Looking ahead, sustained high mortgage interest rates and record-high home values will remain significant barriers to affordable homeownership. As a result, the need for high-quality, affordable rental options will persist, giving multifamily a strong tailwind in 2025 and beyond.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.