Single-Family Build-to-Rent Starts Remain Robust

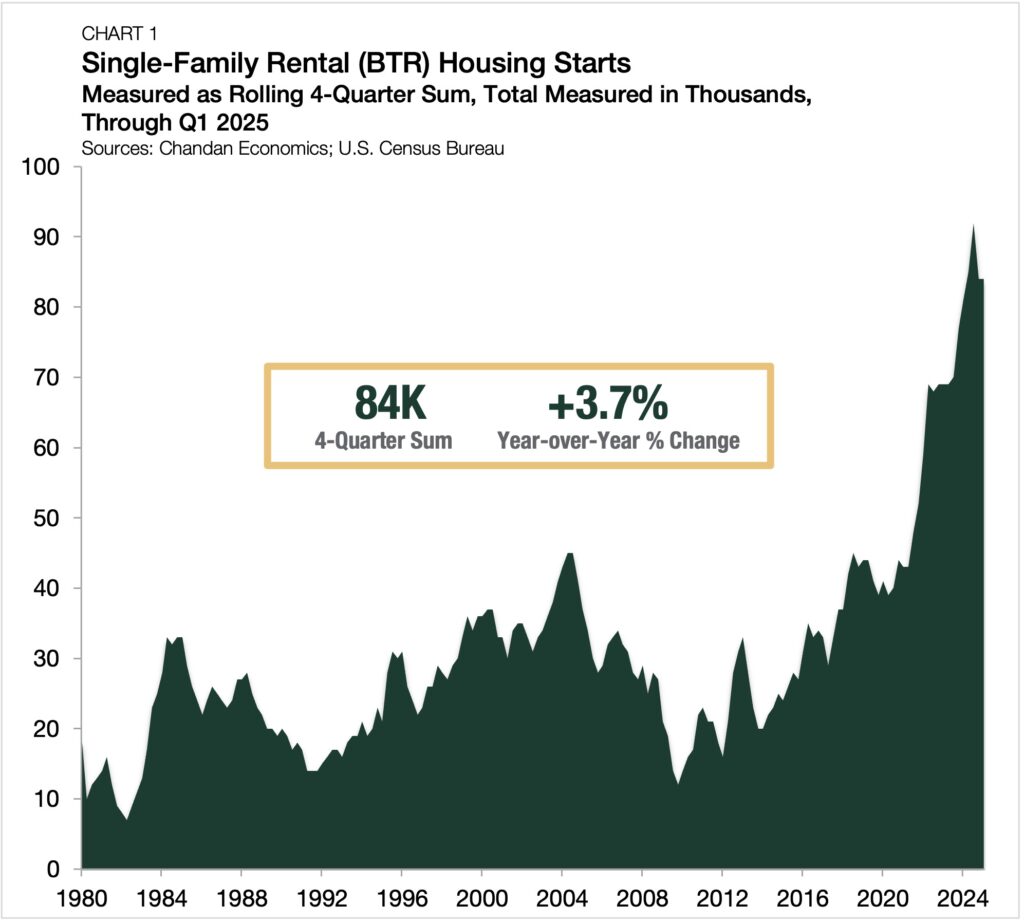

- SFR/BTR housing starts remained level with the previous quarter, totaling 84,000 units over the year ending in the first quarter of 2025.

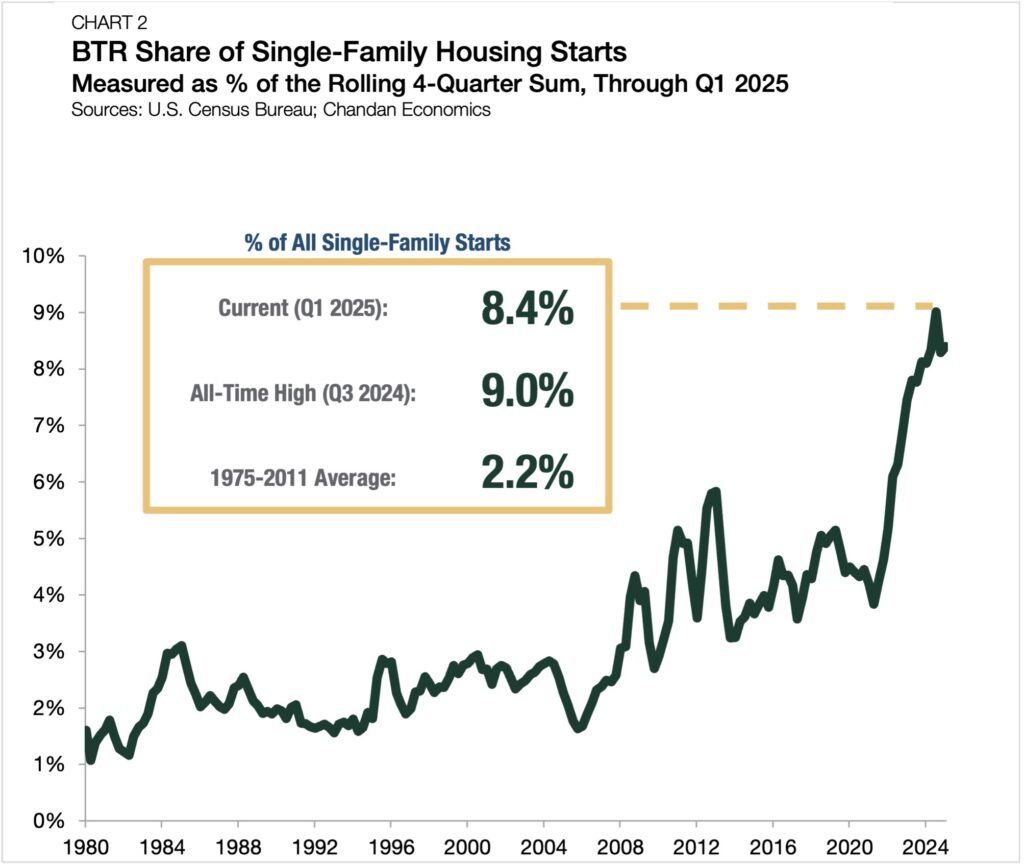

- BTR accounted for 8.4% of all single-family housing starts, a slight increase from the previous quarter and the first quarter of 2024.

- With Millennials and Gen Z increasingly looking beyond homeownership, SFR/BTR is filling the gap.

As build-to-rent (BTR) demand rises, single-family rental (SFR) development has become more efficient in creating a distinct, community-focused experience for renters. Newly released U.S. Census Bureau data confirms that SFR/BTR development continues to be robust and stable, with its annualized pace of construction in the first quarter of 2025 matching the previous quarter’s tally.

SFR Construction Starts Remain Strong

As detailed in Arbor’s Single-Family Rental Investment Trends Reports, developed in partnership with Chandan Economics, SFR construction development remains strong. SFR/BTR starts totaled 84,000 units in the 12 months ending in March 2025 (Chart 1). Although the rolling annual sum recorded in the first quarter of 2025 represented a retreat from the record high set in the third quarter of last year, the sum was up 3.7% compared to the first quarter of 2024.

Beyond unit totals, the BTR share of all single-family construction modestly increased to start the year. Over the year ending in the first quarter of 2025, BTR accounted for 8.4% of all single-family construction starts — up from 8.3% in the fourth quarter of 2024 (Chart 2). After years of uninterrupted growth, BTR’s single-family construction market share shows signs of settling into a stable equilibrium. In five of the past six quarters, BTR’s market share held between 8.1% and 8.4%.

As a whole, the SFR/BTR development ecosystem remains robust. According to Point2Homes, 18 of the 20 leading U.S. markets for BTR units under construction reached their five-year high last year.

Structural tailwinds are also still firmly behind the sector’s growth. A recent ResiClub analysis noted that the average age of a first-time home buyer rose from 28 years old in the early 1990s to 38 last year. By and large, younger generations now opt for affordable apartments in suburban neighborhoods over starter homes. The SFR communities under construction nationwide are well-positioned to fill a market need that generational shifts in housing preferences compound.

Outlook

As discussed in greater detail in Arbor’s upcoming Single-Family Investment Trends Report Q2 2025, BTR starts settled into a stable equilibrium last quarter as the pace of increase tempered. While the quarter-to-quarter change was negligible, purpose-built communities are beginning to flourish in new parts of the country, opening more avenues for investment.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.