Current Reports

Arbor Realty Trust’s Small Multifamily Investment Trends Report Q1 2026, developed in partnership with Chandan Economics, shows that lending activity in the sector increased for the second consecutive year amid a sharp increase in refinancings. Even with persistently high interest rates and rigorous underwriting standards, small multifamily entered the first quarter on steady footing.

Analysis

Over the past 12 months, the leading rent growth markets spanned multiple regions, each exhibiting distinct strengths and characteristics.

Articles

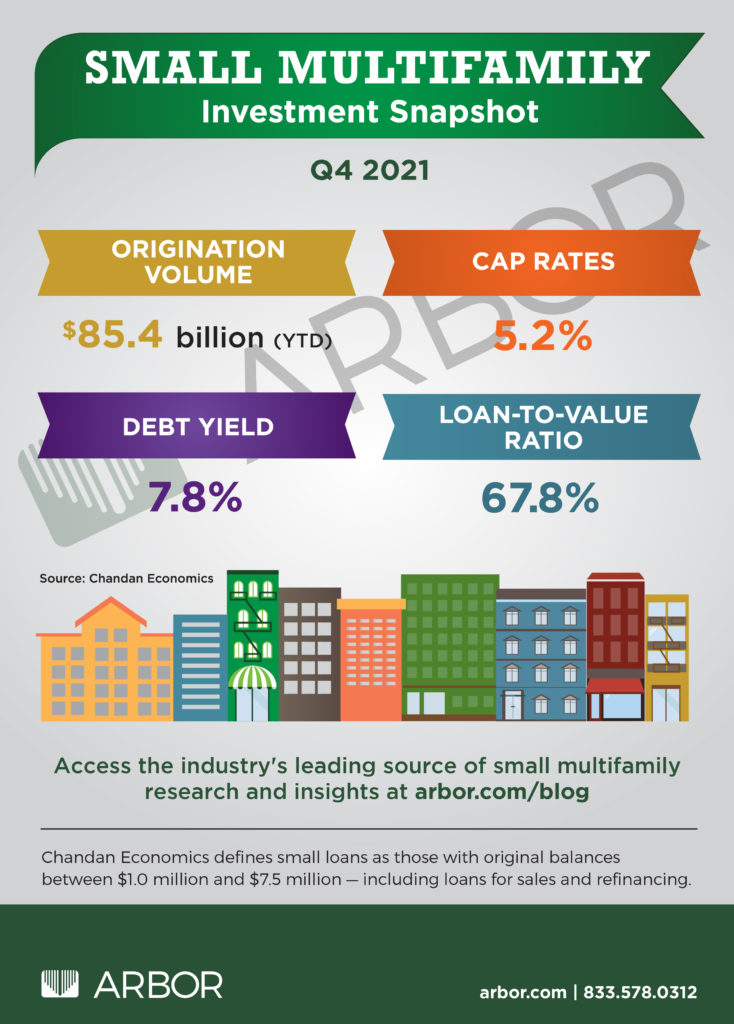

Multifamily cap rates remain stable nationally, even as regional pricing diverged through the end of last year. While some regions saw compression and others late-stage repricing, regional cap rates show less variation as affordability-driven migration and capital reallocation compressed yield gaps.

Analysis

The U.S. multifamily market finished 2025 with growing optimism and resilience. Investment volume accelerated to a three-year high, bolstered by greater interest rate clarity and the tightest cap rates across major real estate sectors.

Articles

The number of households renting single-family homes rose 1.7% in 2025, reaching a seven-year high, according to a new Arbor Realty Trust and Chandan Economics forecast, based on an analysis of newly released U.S. Census Bureau data. Since the pandemic, the single-family rental (SFR) sector has stabilized, reversing recent household losses and regaining momentum.

Articles

The latest report in Arbor Realty Trust’s Affordable Housing Trends series, developed in partnership with Chandan Economics, explores lingering challenges and new opportunities in this critically important multifamily real estate sector. In a new video, Dr. Sam Chandan, one of the commercial real estate industry’s leading scholars, shares his take on the new research report and what its findings could mean for the future of affordable housing finance.

Uncategorized

With homebuying out of reach for many, more tenants are staying in the rental market longer than in previous cycles. This dynamic offers multifamily investors a strategic opportunity to focus on tenant retention, according to Dr. Sam Chandan, one of the commercial real estate industry’s leading scholars, who recently shared his expert insights on the 2026 Housing Outlook webinar with RentRedi.

Articles

Normalization was the thread that tied together multifamily real estate narratives in 2025. Asset valuations stabilized, cap rates held steady, and rent growth was balanced. Entering the new year, normalization is still driving the conversation, as shown by newly released data from the Federal Reserve Bank of Atlanta on real estate conditions and associated trends.