Small Multifamily Price Growth Trends Show Stabilization

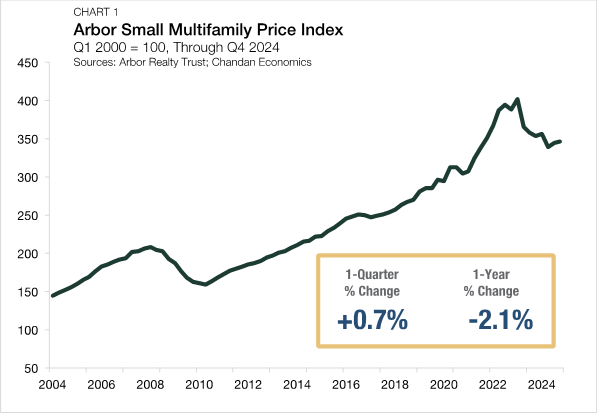

- Small multifamily prices rose for two consecutive quarters to close out 2024.

- Stable occupancy rates and rising property-level incomes have driven the pricing turnaround.

- Prices were down compared to a year earlier by 2.1% despite gains over the past two quarters.

Small multifamily price growth trends indicate a stabilization may be ready to take hold. Expanding on the findings of Arbor’s latest Small Multifamily Investment Trends Report, our research teams more closely examined valuations to determine if trends in pricing and other fundamentals are supporting a turnaround.

Back-to-Back Quarters of Growth

Small multifamily prices rose again (+0.7%) in the fourth quarter of 2024, marking the first time since mid-2022 that valuations increased in back-to-back quarters. Following a rapid rise in asset prices in 2021 and 2022, valuations in small multifamily and other types of commercial real estate have cooled over the past two years as prices adjusted to higher capital costs. Small multifamily asset valuations hit a high watermark in early 2023, then fell in five of the next six quarters, declining by a cumulative 15.6%.

Stability Settles In

Recent quarterly data points suggest pricing has stabilized. Even though prices remain down by 2.1% from a year earlier, the pace of annual declines has slowed in each of the past three quarters.

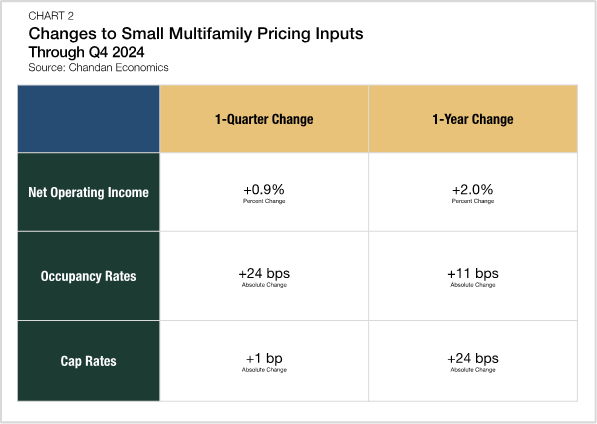

Several supportive factors are driving the small multifamily sector’s recent pricing stability. Occupancy rates (97.5%) were up slightly from the previous quarter (+24 bps) and the same time last year (+11 bps) (Chart 2). Improving occupancy and positive rent growth have led to an increase in average net operating incomes (NOI). A Chandan Economics model of small multifamily properties estimates that NOIs rose 0.9% in the fourth quarter of 2024 compared to the previous period and climbed 2.0% during the 12 months prior.

While rising small multifamily cap rates have slowed price increases, they averaged 6.0% in the fourth quarter of 2024 — up one bps from the previous quarter and 24 bps from the same time one year ago.

The Road Ahead

As detailed in Arbor’s Special Report Spring 2025, public market valuations signal that multifamily prices are well-positioned for a bounce back. With small multifamily price growth already turning a corner, cautious optimism is building. However, the extent of the incoming administration’s effect on the economy — which will influence everything from rental demand and construction prices, to inflation and interest rates — remains in flux. Nevertheless, small multifamily’s increasing stability gives it momentum to build on gains seen in recent quarters, regardless of unforeseen economic turbulence.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.