Small Multifamily Refinancings Account for Four in Five Originations

- Refinancings accounted for 78.8% of small multifamily loans in the third quarter of 2020.

- Average cap rates on refinanced loans were 60 bps lower than on acquisitions.

- LTVs on refinanced loans averaged 440 bps below acquisitions.

The ongoing pandemic continues to disrupt the U.S. economy. Across the multifamily sector, investment sales significantly declined, compared to figures from the same time last year. According to Real Capital Analytics, apartment transaction volumes year-over-year were down -67.0% in the second quarter and down -51.0% in the third quarter.

This data comes with buyers and sellers remaining far apart on what each considers to be “fair value” in the age of COVID-19. By and large, hopeful buyers are playing a waiting game, anticipating that sellers will eventually capitulate to discounted demands. However, ample levels of liquidity have afforded existing owners the luxury of patience.

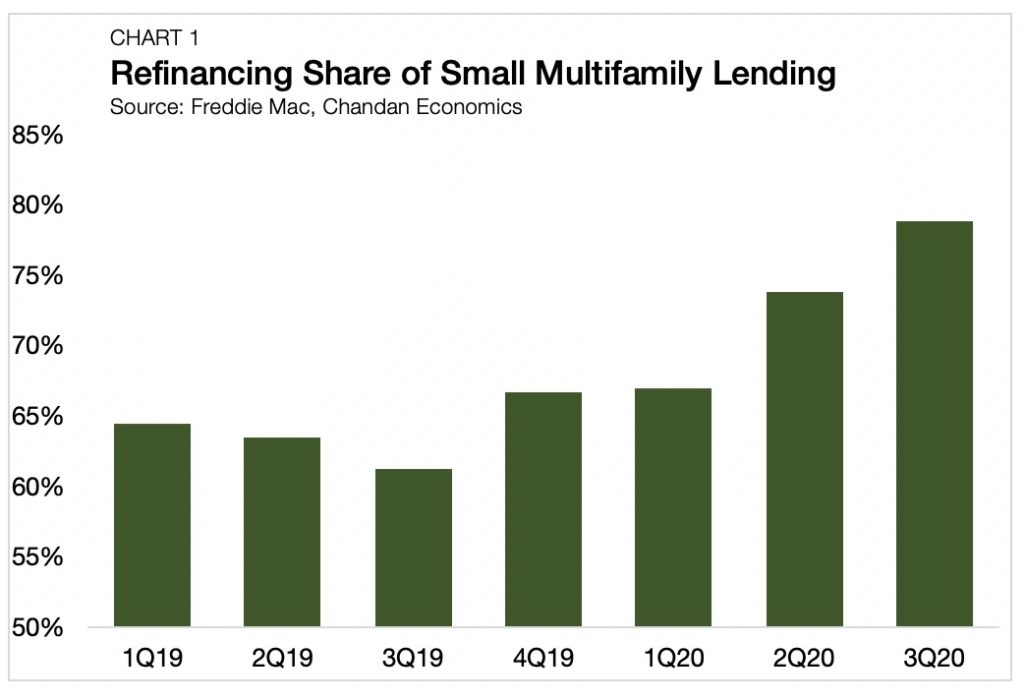

As covered in the Q3 2020 Arbor Small Multifamily Investment Trends Report prepared with Chandan Economics, the refinancing share of small multifamily originations has risen dramatically during the pandemic. In 2019, the refinancing share of small multifamily lending averaged 64.0% and remained in a relatively narrow band between 61.2% and 66.7% (Chart 1).

(All small multifamily lending data, unless otherwise stated, is based on a Chandan Economics analysis of loans in Freddie Mac’s Small Balance Loan program. Quarterly observations are assigned by deal-level closing dates. Only loans with loan-to-value ratios (LTVs) above 50.0% are included in the observation sample.)

When the full weight of the COVID-19 shutdown hit in the second quarter of 2020, the refinancing share soared to 73.9%. In the third quarter, the refinancing share climbed even higher, accounting for 78.8% of small multifamily lending.

The shift toward refinancing comes as agency participation has supported lenders in maintaining near pre-coronavirus levels of production. Existing owners accessing refinancing capital are benefiting from two significant advantages. The first is lower debt servicing costs. Benchmark interest rates fell through the end of 2019 and then precipitously at the onset of COVID-19.

The second is that lenders have not materially pulled back on their asset valuations. Owners looking to put cash back into their pockets are finding a growing divide between the valuation they can achieve by refinancing versus the price they would transact at in an arm’s length sale.

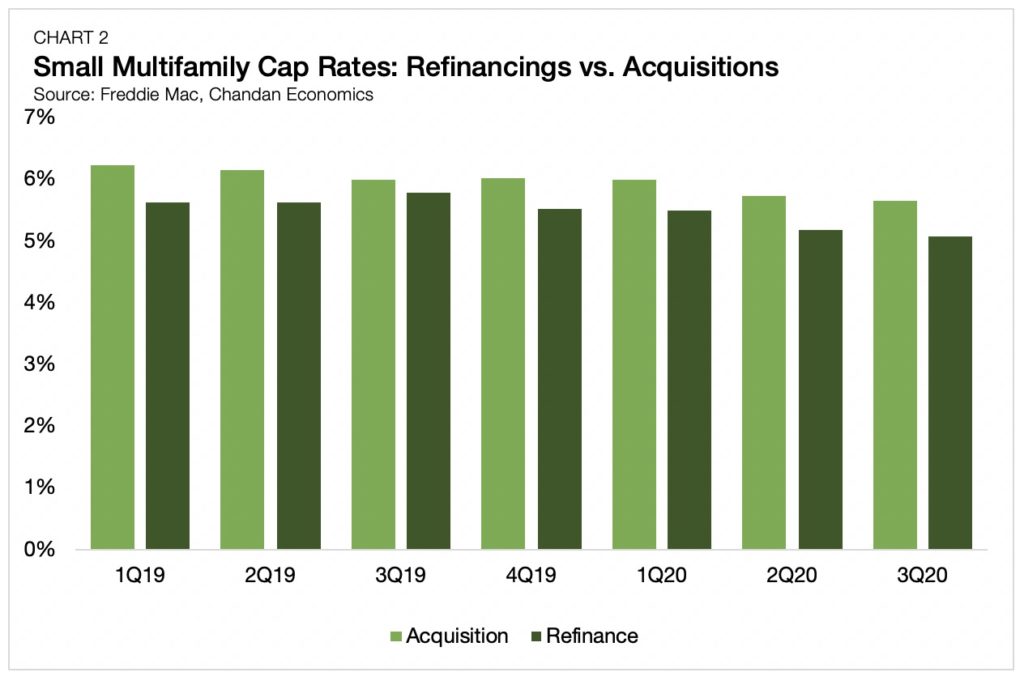

In the third quarter, the cap rate on a transacted small multifamily asset averaged 5.7% (Chart 2).

Meanwhile, refinanced assets had an average cap rate of 5.1%. The cap rate spread between transacted and refinanced cap rates has risen for two consecutive quarters and stands at 60 bps, the largest gap since early 2019.

However, cap rates are not the only metric to see a widening difference between transacted and refinanced assets. Community banks, which make up one of the largest sources of small multifamily lending capital, have pulled back on the reins. Lenders that have had the capital resources to remain fully active are now fielding an outsized number of refinancing requests, allowing them to prioritize the highest credit profile deals.

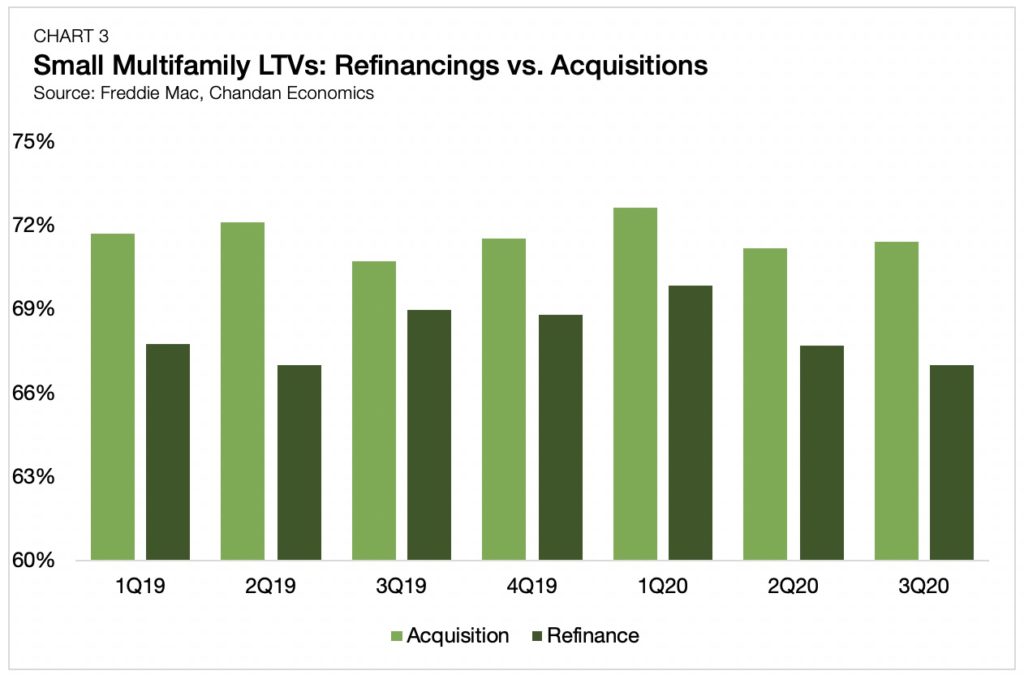

Nowhere is this more apparent than in average LTVs. In the third quarter, LTVs on acquired and refinanced assets averaged 71.4% and 67.0%, respectively (Chart 3). The spread between the two measures of small multifamily LTVs has pushed higher for four consecutive quarters and now stands at 440 bps.

The availability of refinancing capital, supported by the agencies, has provided a lifeline to existing owners, while buyers cautiously remain on the sidelines. The data reflects that small multifamily asset owners are active in the lending market, hoping to take advantage of preferred valuations and lower interest rates.

Keeping an eye on the share of lending capital going towards acquisitions and refinancings, as well as the profile differences between the two loan types, will provide leading insights into the subsector’s continuing trends.

Visit the Arbor Chatter blog to stay informed on the latest multifamily trends. Contact Arbor today to learn how our different products can support your business goals.