Strong Demand Readies Multifamily for Monetary Tightening

- The Federal Reserve raised the Federal Funds rate by 50 bps in May as it looks to tackle inflation, its most aggressive rate-hike in more than 20 years.

- Despite fears of a hard landing, housing demand sits on the backdrop of a supply shortage that supports the multifamily sector.

- Historically, apartment valuations have risen during monetary tightening cycles.

After spending the last two years encouraging U.S. economic growth with stimulative policies, the Federal Reserve (“Fed”) has shifted its focus to tackling inflation. On May 4, the Federal Open Markets Committee (FOMC) moved to raise the Federal Funds rate – the short-term interest rate that banks pay to borrow – by 50 basis points (bps) from a range of 25-50 bps to a range of 75-100 bps. The increase was the steepest by policymakers in any single meeting since 2000 and followed an initial 25 basis-point hike in March. Investors are gauging the potential implications that monetary tightening could have on economic growth.

The Fed’s Tone Shift

While rising rates have the potential to dampen aggregate demand, it is a risk that the Federal Reserve appears willing to take. In a May 6 speech, Governor of the Federal Reserve, Christopher Waller, noted that the central bank underestimated “the strength of inflation that revealed itself in late 2021.” The Fed falling behind the inflationary curve has led to increased economic uncertainty across markets, including in multifamily investment. In the National Multifamily Housing Council’s most recent Quarterly Survey of Apartment Conditions, 97% of institutional operators indicated a degree of concern when asked to what extent they were “concerned about the combined impact of inflation and rising interest rates.” More than 40% of respondents indicated that they are “very concerned” about the impact.

Fed policymakers are hoping that recent policy rate moves will re-anchor market expectations. The CME FedWatch tool alongside recent FOMC press releases shows that futures markets’ expectations have grown more hawkish as the Fed shifts its tone. After the committee nixed the term “transitory” following its September 2021 meeting, rate-hike forecasts jumped and as mentions of “COVID-19” fell off transcripts following the January 2022 meeting, markets responded similarly.

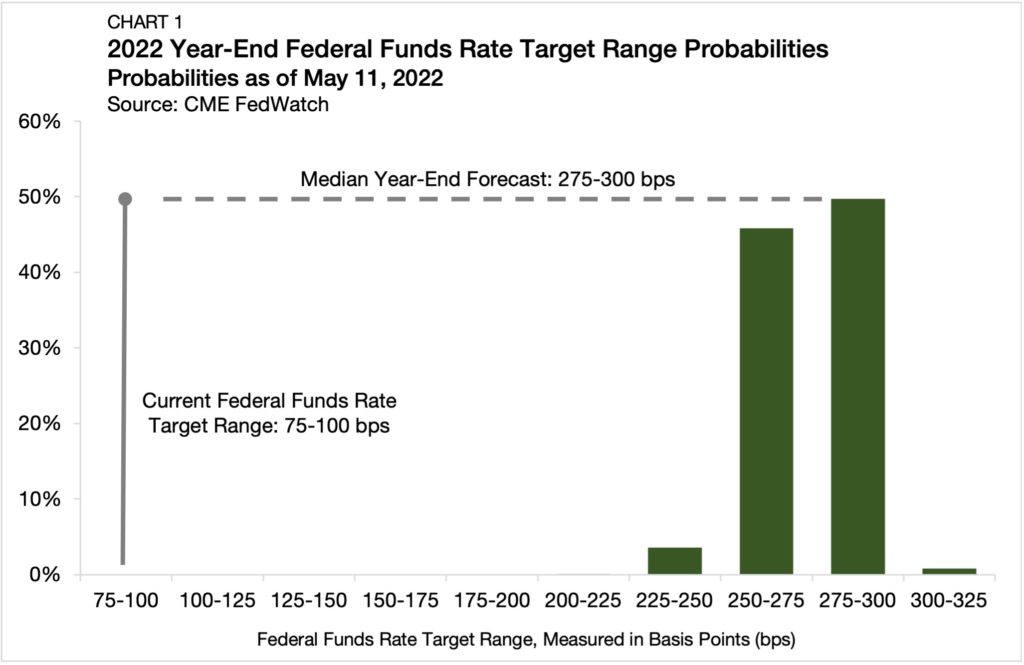

The most recent FOMC statement brought inflation concerns front and center while referencing the risks posed by COVID-19 lockdowns in China and the invasion of Ukraine by Russia. Futures have taken note and now see the Fed raising its policy rate by an additional 200 bps by the year-end (Chart 1).

Multifamily Staying Power

Recession fears have risen amid concerns of a monetary policy hard landing, where rising rates and the unwinding of accommodative policy measures could become restrictive to economic growth and increase the cost of capital. While the risk is plausible, housing demand remains strong and sits on the backdrop of a persistent housing shortage. According to Freddie Mac, the U.S. had a shortage of 2.5 million homes in 2020. This supply shortage will likely serve as a stabilizing characteristic for housing – and would be a differentiating characteristic from past recessions if the U.S. economy is heading for a recession.

Rents, while slowing in some regions and household income segments, continue to climb. According to Yardi Matrix, multifamily rents have now risen above a 14% annual rate for five consecutive months through April 2022. Further, despite an economic contraction in the first quarter, household spending and residential fixed investment remain strong. Historically, the performance of residential investment can be a key signal for the overall performance of the economy released. Advanced figures by the Bureau of Economic Analysis showed that residential investment rose by a seasonally adjusted annualized rate of 2.1% in the first quarter, just 10 bps below its fourth-quarter 2021 pace.

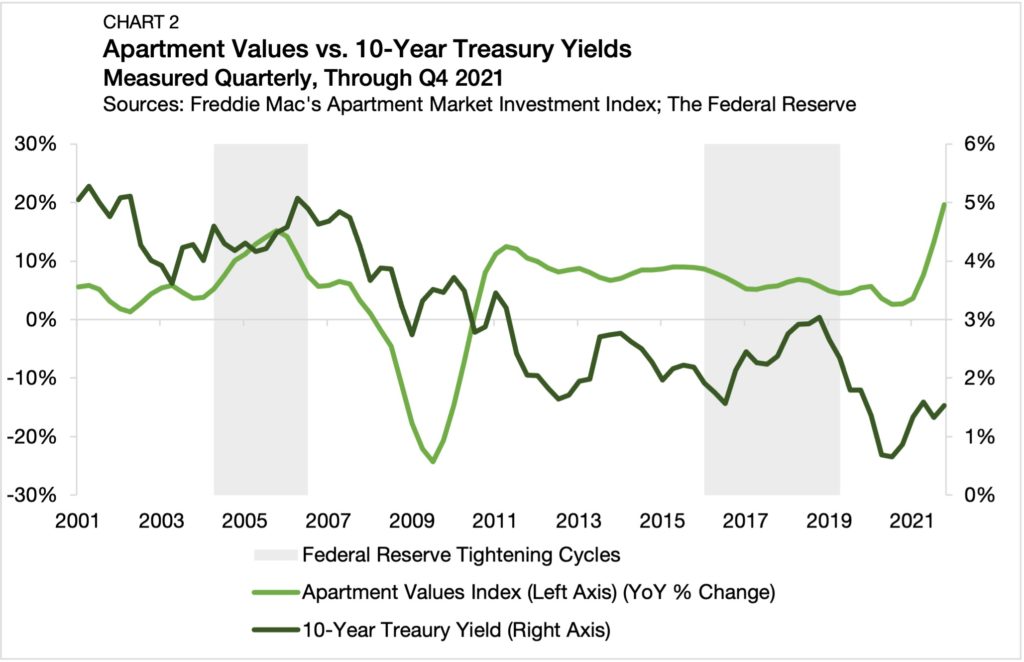

With the Fed commencing its monetary policy tightening cycle, benchmark interest rates, including on the 10-year Treasury, have climbed reflecting the increased cost of debt capital. The yield on a 10-year Treasury averaged 2.75% at the end of April 2022, rising 134 bps from December 2021. The 10-year Treasury yield is one of the most important benchmarks in commercial real estate as it influences both borrowing costs and cap rates. While the cost of capital is one of the key drivers of multifamily performance as an asset class, it is one of many – which helps to explain why moves in valuation are not explained entirely by changes in benchmark rates (Chart 2). Analyzing Freddie Mac’s apartment valuations series as part of its Apartment Investment Market Index alongside the 10-year Treasury over the past two decades produces a very weak -11% correlation. Further, during the past two tightening cycles, apartment valuations have maintained positive annual growth rates throughout.

Adding to the case that rising interest rates are not an overly concerning storm cloud for multifamily real estate is a 2019 Federal Reserve research paper, which concluded that “housing rents increase in response to contractionary monetary policy shocks.”[1] Moreover, as covered in a recent Arbor-Chandan research article, current housing market dynamics are conducive to rising rental housing demand, as homeowner borrowing costs have risen and mortgage lending standards have tightened.

Landing Safely

The Fed faces the challenging task of trying to tamper price pressures without restricting economic growth in the process. Since it began its monetary tightening, markets have been rocked with volatility. All sectors of the economy will be impacted during the tightening cycle, including the rental housing sector. However, the sector is well-positioned to absorb much of the shock. The current supply-demand mismatch, where there are more households in need of quality rental housing compared to the available supply, will provide a more solid foundation than many other sectors of the economy. Further, increasing obstacles to homeownership, such as higher borrowing costs and tighter underwriting standards, may drive rental demand, creating a more balanced outlook for the sector. So, while the future remains unclear, the multifamily market appears to have strong fundamentals to help it weather the storm.

[1] Dias, Daniel A. and João B. Duarte (2019). Monetary Policy, Housing Rents and Inflation Dynamics. International Finance Discussion Papers 1248.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.