The Most Active Markets for New Multifamily Development in 2025

- Out of the top 100 largest metros by population, 47 had more multifamily permits through the first six months of 2025 than they did over the same period last year.

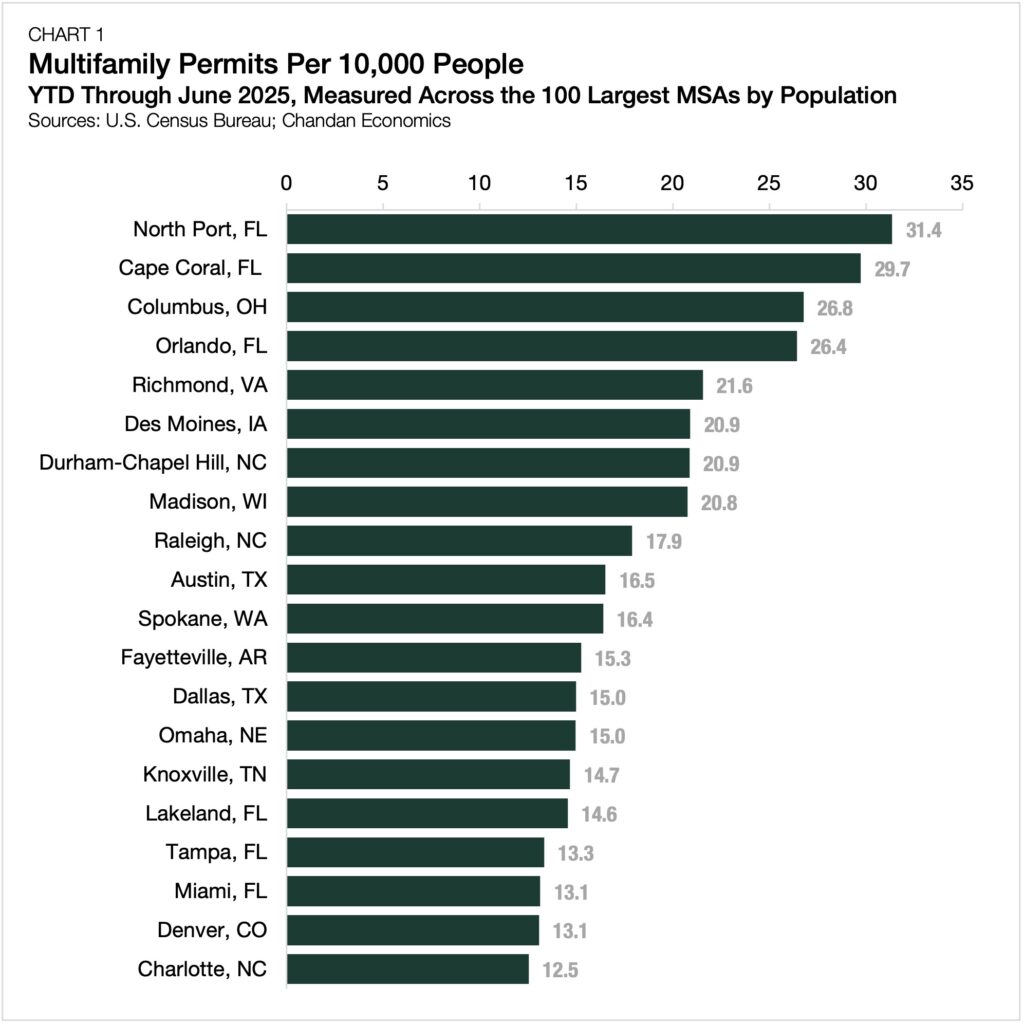

- Two southwestern Florida markets, North Port and Cape Coral, led the nation in multifamily permitting per capita in the first half of 2025.

- Development-friendly markets with more permissive zoning regulations had the most multifamily permits relative to their population size.

After the volume of multifamily permits fell nationally in 2023 and 2024, this year is on pace to be a year of stabilization for multifamily development. According to the U.S. Census Bureau, out of the top 100 largest U.S. metropolitan statistical areas (MSA) by population, 47 had more multifamily permits through the first six months of 2025 than they did over the same period last year. Driven by strong underlying multifamily demand, attractive investment opportunities are leading to rebounding construction pipelines. As multifamily permitting rises, we explore the markets where new permits issued are most concentrated and where construction activity is gaining momentum.

Most Multifamily Permits per Capita

Two MSAs in southwestern Florida, North Port and Cape Coral, led the country with the most multifamily permits per capita in the first half of 2025. For every 10,000 residents, North Port and Cape Coral have authorized 31.4 and 29.7 multifamily units for construction respectively this year as of June (Chart 1).

Florida’s multifamily development momentum may seem counterintuitive, considering its southwest corridor is in the middle of a deep housing market price correction. However, as a result of the for-sale market’s softness, many would-be buyers are staying on the sidelines — supporting rental demand. Robust population growth also has strengthened the rental markets in North Port and Cape Coral. Both metros have been gaining new residents at twice the annual national rate (+1.0%).

Filling out the top five for most multifamily permits per capita are Columbus, OH, Orlando, FL, and Richmond, VA. All three also were ranked in the top ten of Arbor’s Top Markets for Multifamily Investment Report Spring 2025. Among Midwest markets, Columbus remains a standout. With a stable employment base and the anticipated expansion in its semiconductor manufacturing sector, the Columbus labor market provides both stability and upside potential. One notable commonality is that the top five markets are development-friendly. More permissive zoning ordinances and fewer governmental restrictions have spurred construction activity.

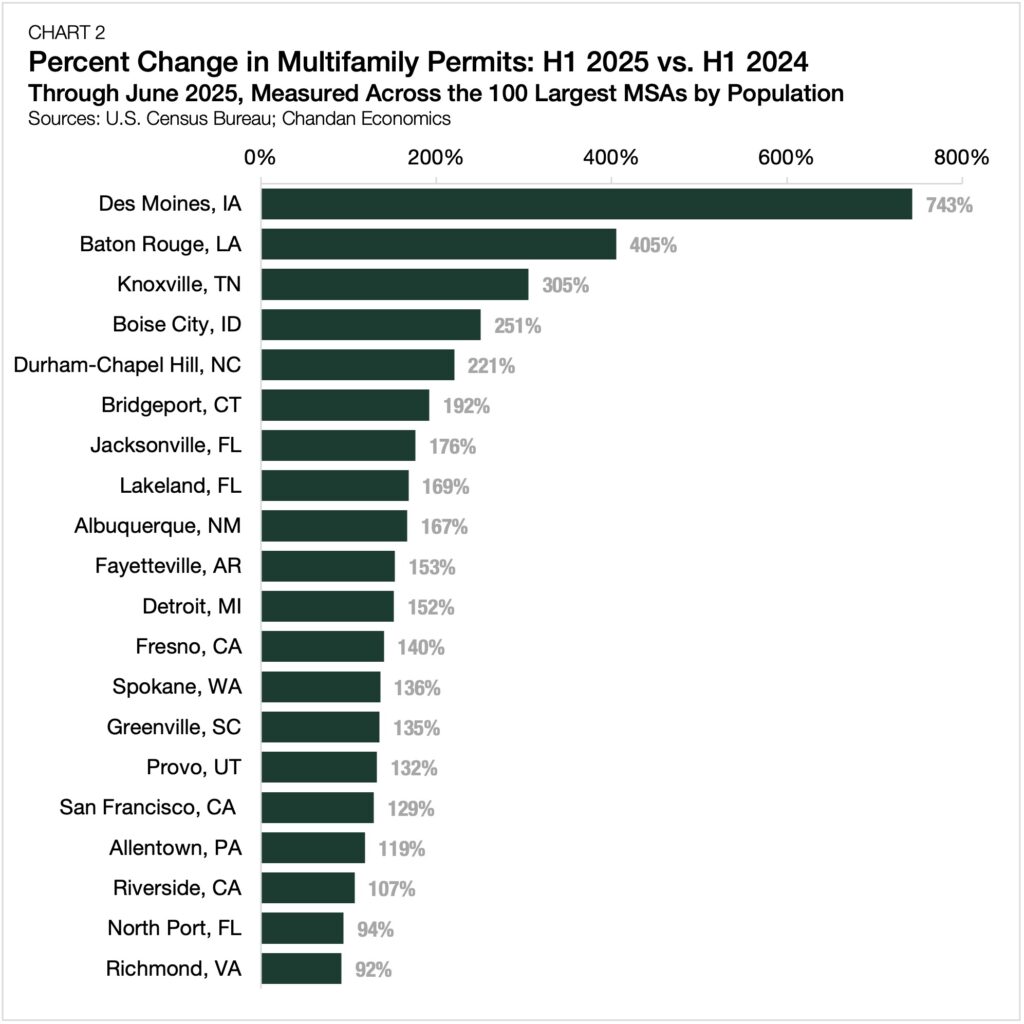

Where Momentum is Building Most Quickly

Among the 100 largest MSAs by population, nowhere is seeing a larger increase in the pace of multifamily permits than Des Moines, IA. So far this year, 1,576 multifamily permits have been issued in Des Moines, up from 187 at the same time last year (+743%) (Chart 2).

According to a report earlier this year, more than 4,600 apartment units are planned to begin construction in Des Moines before the end of 2026. Recent population inflows have put pressure on existing inventory and spurred local developers into action. Since 2020, the population of Des Moines has cumulatively increased by 6.0% — more than double the national population increase over the same period (2.9%).

Baton Rouge, LA, follows behind with its volume of multifamily permits up 405% year-to-date compared to the same time in 2024. Baton Rouge’s multifamily uptick is notable. It has not experienced the kind of population growth typically associated with a ramp-up in development. Since 2020, the population in Baton Rouge has risen by only 1.4%.

However, a recent surge in property insurance premiums, together with elevated mortgage rates, has made homeownership less affordable across the Baton Rouge metro area, keeping many middle-income households in the rental sector. Further, the combination of the metro’s aging rental stock, the need for hurricane-resistant housing, and a growing number of students looking for off-campus apartments has contributed to new multifamily development.

Knoxville, TN, rounds out the top three with a 305% increase in multifamily permits. Both the for-sale and rental housing markets in Knoxville are forecast to see growing pricing pressures over the next year due in part to rising demand.

The Bottom Line

New multifamily development momentum has picked up in many pockets of the country. As employers push for workers to return to the office and elevated mortgage rates keep homeownership out of reach for many would-be-buyers, the investment outlook in many markets continues to brighten.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.