Top Markets for Rental Demand Growth

- Houston’s population growth rate of 2.6% led all large markets in 2024.

- Orlando’s and Raleigh’s robust labor markets have attracted a growing number of new residents.

- Lakeland led all small metropolitan markets due to its proximity to Tampa and Orlando.

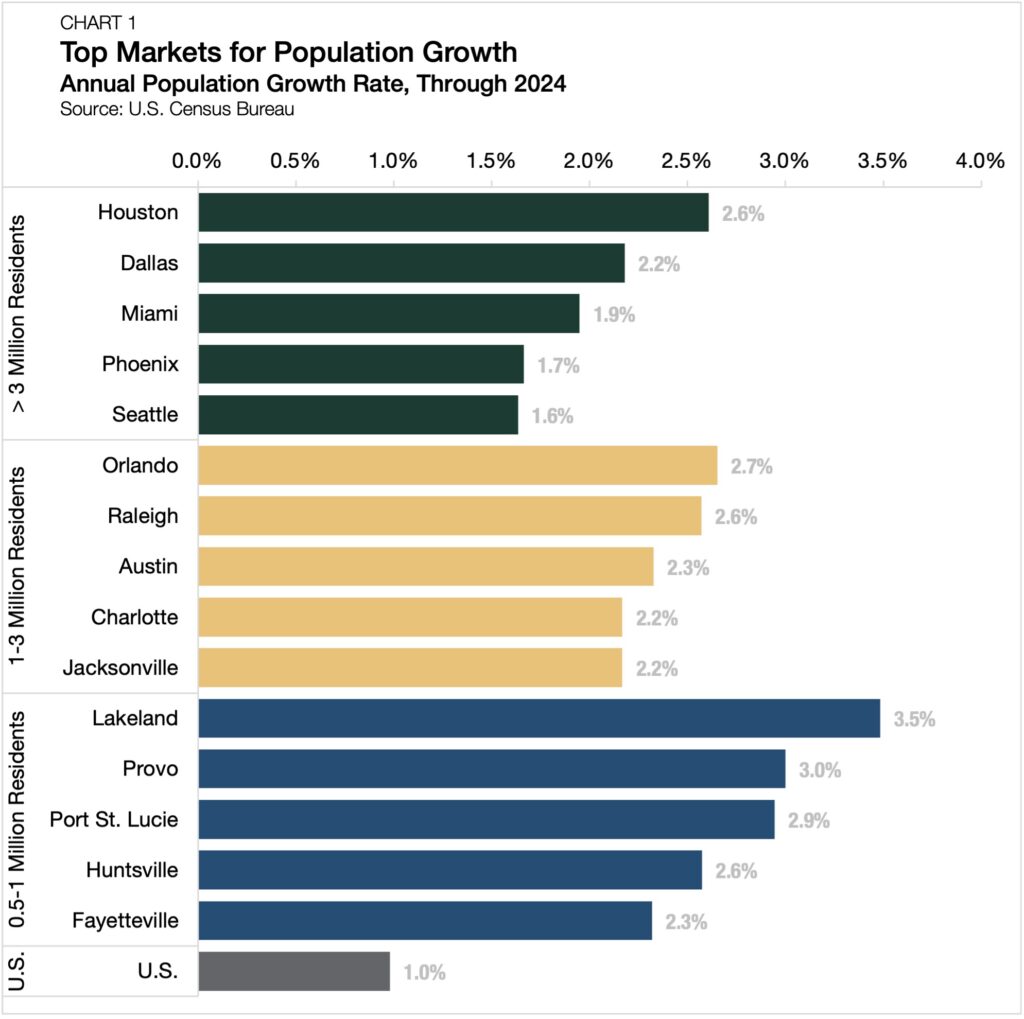

Population growth, a critical factor in assessing rental housing demand, increased 0.9% in the U.S. during 2024, the fastest annual rate since 2008. However, growth rates were much higher for many markets, especially those in Texas, Florida, and the Carolinas. As first explored in Arbor’s Top Markets for Multifamily Investment Report Spring 2025, we dive deeper into metro-level population growth in markets with at least 500,000 residents to find the nation’s top markets for rental housing demand growth.

Top Markets for Residential Population Growth

According to the U.S. Census Bureau, Houston, TX, had the largest population growth in 2024 among metropolitan areas with more than three million people, with its resident base swelling by 2.6% (Chart 1). The metro also grew by the same percentage last year, showing signs of a strong market for rental demand. Dallas followed closely behind Houston among large markets, with a solid population growth rate of 2.2% last year.

Texas metros have a long history of attracting and retaining residents. The Lone Star State has recorded faster population growth than the U.S. average yearly since 1990. Its affordability, land availability, and pro-business policies have been a potent formula for consistently recording positive net domestic and international migration.

Among mid-sized metros, which we define here as having between one and three million residents, Orlando, FL, has a touch of magic when it comes to population growth. Driven by a rapidly diversifying local economy that is less reliant on tourism, Orlando’s population jumped 2.7% in 2024.

Right behind Orlando is Raleigh, NC, which captured second place in Arbor’s Spring 2025 Multifamily Opportunity Matrix rankings. Raleigh is another example of a metro whose labor market continues to attract new residents. Driven by tech, healthcare, and advanced manufacturing, Raleigh’s population increased by 2.6% in 2024.

Smaller markets also saw big growth last year.

Lakeland, FL’s 3.5% population growth rate led all metros with between 500,000 and one million residents. This relatively affordable Central Florida metro, conveniently located along the I-4 corridor, has benefited from the economic growth of its two larger neighboring metros: Orlando and Tampa.

The Bottom Line

While 2024 marked a strong year for U.S. population growth, momentum isn’t expected to be sustained. The Congressional Budget Office forecasted that net immigration to the U.S. will slow in 2036 and beyond. As a result, the ability of metros to attract and retain population will only become a more critical component of sustaining local rental demand growth.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.