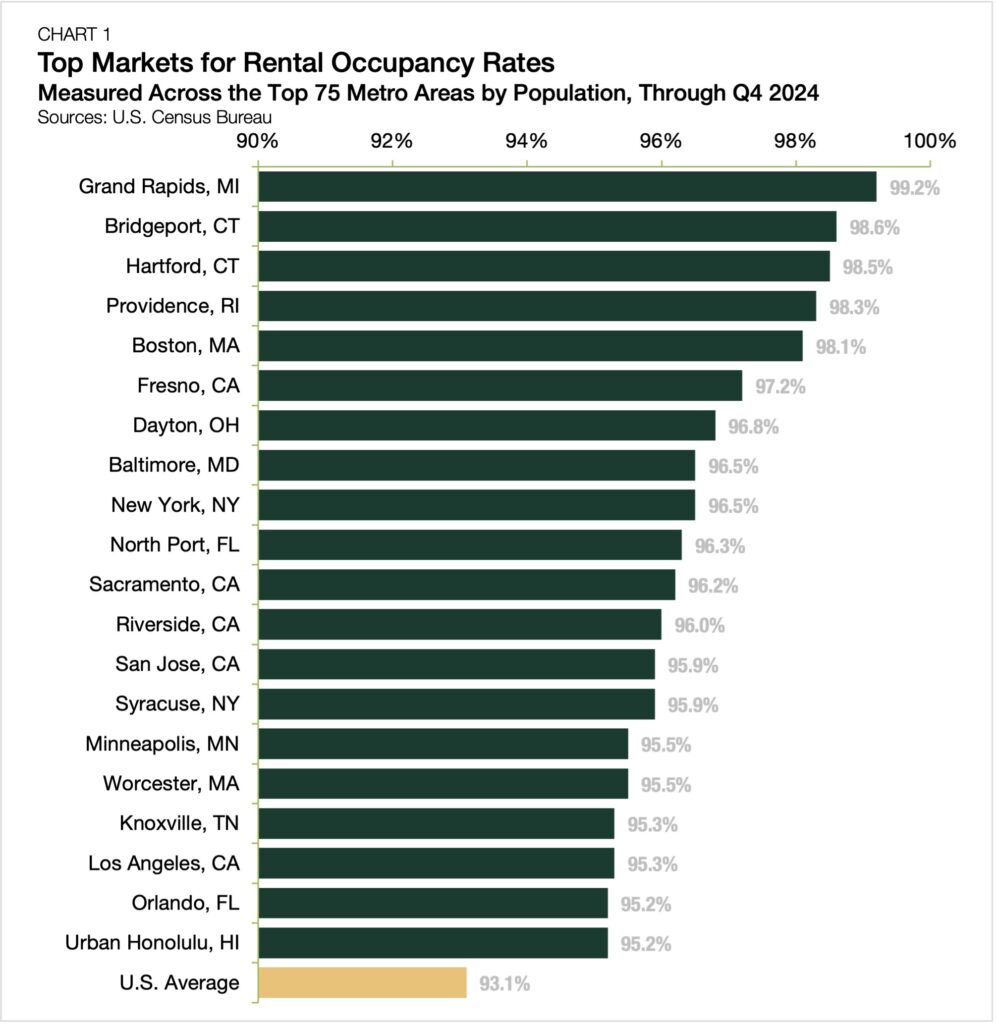

Top Markets for Rental Occupancy

- Grand Rapids, MI, has the tightest rental market in the country, with an occupancy rate above 99%.

- Four of the top five markets with the highest occupancy rates last year were in New England.

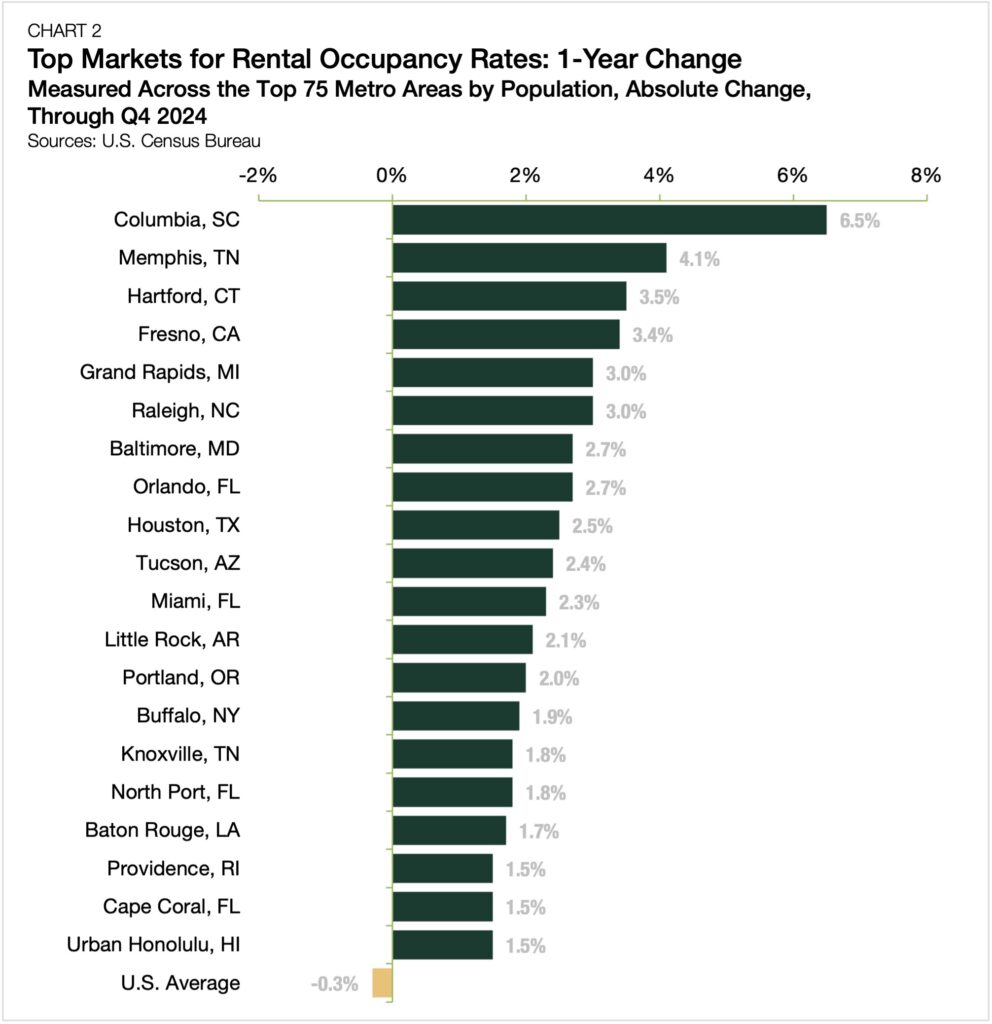

- Columbia, SC, and Memphis, TN, had the largest year-over-year rental occupancy improvements.

Nationally, vacancies have risen, but the performance of rental housing is extremely localized. Out of the 75 largest U.S. metropolitan areas, the occupancy rate for all types of rental properties, including single-family rentals, 2-4 family, multifamily, and mobile homes, increased in 36 markets last year, while exceeding 95% in nearly one-third of all markets, according to an analysis of newly released U.S. Census Bureau data.[1] From Grand Rapids, MI, to Columbia, SC, the top markets for rental occupancy show where conditions are tightest and demand is strongest.

The Tightest Rental Markets by Occupancy

Grand Rapids, MI metro area had the nation’s highest rental occupancy rate in 2024, with 99.2% of all rental units fully occupied (Chart 1). According to RentCafe, Grand Rapids was the country’s fifth most competitive market last year, driven by lease renewal rates rising above 70%. The second-most populous city in Michigan is an increasingly popular place to live that features a thriving arts scene, vibrant culture, and family-friendly recreation.

Aside from Grand Rapids, many of the tightest rental markets are in New England. Bridgeport, CT (98.6%), appears in the top five for the second consecutive year. Meanwhile, Hartford, CT, Providence, RI, and Boston, MA, all climbed into the top five rankings following steep year-over-year improvement in their occupancy rates.

The reduction in available rental units has predictably had a material impact on pricing across New England, including Hartford. In a recent Chandan Economics-Arbor Realty Trust analysis of rents in the single-family rental (SFR) market, Hartford ranked second nationwide in annual SFR rent growth (+8.1%) as a drop in vacancies squeezed rents higher.

The tight rental conditions felt in New England today are decades in the making. A recent analysis by the Boston Federal Reserve Bank identified several factors, including the prevalence of zoning restrictions like density limitations and minimum lot sizes, as factors that contributed to chronic underbuilding. A lack of available buildable land has also historically limited new development.

Top Markets for Rental Occupancy Growth

Columbia experienced the most rental occupancy growth of any U.S. market in 2024, with its rate surging 6.5 percentage points. The number of vacant rental units in South Carolina’s capital city nearly halved in the past year, as its rental occupancy rate jumped to 92.5% (Chart 2). Home to the University of South Carolina, Columbia’s vacancy rate is quickly falling as many millennials have moved there.

Underpinning Columbia’s rental sector tightening is a homebuying environment that has seen significant affordability erosion. Between early 2020 and the end of 2024, average home prices in Columbia jumped by 63.7% — well above the local increase in average wages over the same period (+24.2%).

Memphis, TN, also quickly filled vacancies. In 2024, the rental occupancy rate in Memphis rose by 4.1 percentage points to reach 90.6%. Realtor.com’s Market Hotness Index indicates the Memphis real estate market has cooled off considerably in recent years following a pandemic-era surge. Zillow rental data confirms this assertion as rents have slid from recent highs. However, Census Bureau occupancy data suggests that Memphis has momentum toward absorbing its excess supply levels.

The Bottom Line

While rental occupancy rates experienced headwinds over the past two years amid a nationwide post-pandemic boom in deliveries, many major markets continue to be tight. With nearly half of all markets showing occupancy rate improvements in the past year, the outlook for the health of the nation’s rental housing sector is promising.

[1] Data are from the U.S. Census Bureau’s Quarterly Housing Vacancies and Homeownership Survey. Reported data include all rental property types.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.