Top U.S. Markets for Small Multifamily Rental Inventory Growth

- Small multifamily has grown the quickest as a share of rental inventory outside of the largest U.S. metro markets.

- Kansas City, Columbus and Virginia Beach topped the list of metros with the fastest small multifamily inventory growth.

- Large multifamily inventory is growing across both large and midsize metro markets.

Small Multifamily Growth Across Metro Markets

Building on our previous two blogs, we now further explore some of the individual metropolitan markets capturing significant rental inventory growth across the country.

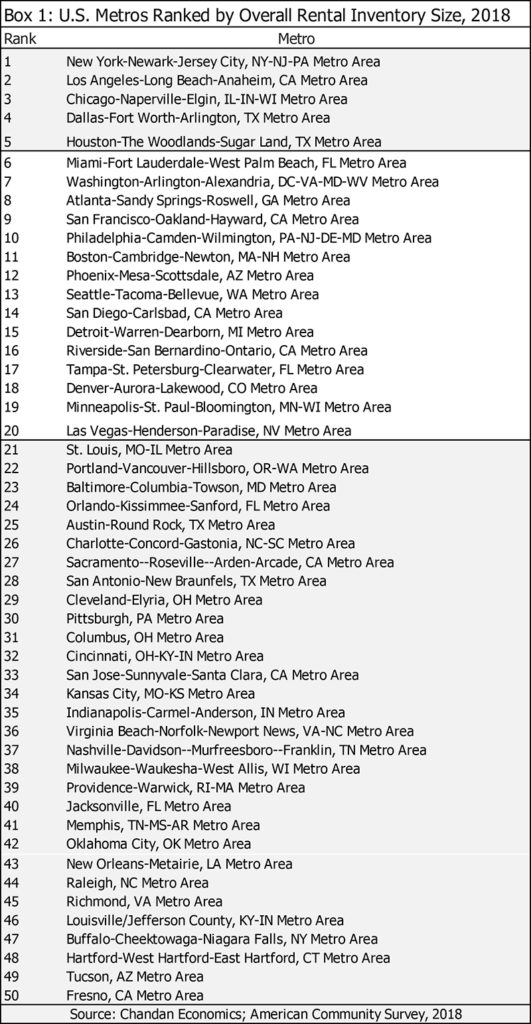

Ranking metros by size of rental inventory, we analyze the Top 50, which account for 73% of all U.S. multifamily rentals. When examining their inventories of small and large multifamily properties, these markets captured 70% of all small apartment units, and a whopping 80% of all large multifamily units. (See Box 1 below for a complete ranking of the top 50 metros by rental inventory size.)

Leading the way for small multifamily inventory share growth between 2016 and 2018 was Kansas City (3.6%), Columbus (3.4%) and Virginia Beach (2.7%).

These three midsize metros all fell outside of the Top 20 markets by inventory size, highlighting small multifamily’s growth in smaller cities. Including the three mentioned above, seven of the 10 fastest-growing small multifamily inventory shares were in metros in the Top 21-50 group.

Among the five largest U.S. metros, only New York’s small multifamily inventory increased (60 basis points). Los Angeles’ share remained unchanged, while the other three saw modest declines.

Large Multifamily Rental Inventory More Widespread

The metros with growing shares of large multifamily inventories are markedly different than those seeing growth in small multifamily.

The three fastest-growing markets for large multifamily included Phoenix (3.4%), Seattle (3.1%) and San Diego (2.6%). All of these cities have the scale and population necessary to support new large multifamily development. They are also within the Top 20 markets by inventory size.

Of the top 10 cities with the fastest-growing large multifamily inventory shares, five are in the Top 5-20 and five are in the Top 21-50. The only metro to have both small and large apartment shares increase among the national leaders was Portland, with gains of 2.7% and 2.2%, respectively.

Among the largest five U.S. metros, Houston, which did not make the list of growing markets for small multifamily, had its large multifamily share rise by 2.1%. Again, New York’s increase came in above the U.S. average, while Los Angeles’ share remained flat.

The emerging data supports many of the widely reported themes of this cycle to date. Namely, the densification into large multifamily continues in large and midsize metros. On the other hand, the growth of small multifamily is following the migration trends of young adults into smaller metros with favorable cost-lifestyle balances.

For more metro-level insights on the small multifamily market, read our 2019 Metro-Level Small Multifamily Investment Trends Report or visit our small multifamily research page.

Note: All data is sourced from the 2018 American Community Survey (ACS), unless otherwise stated. ACS statistics are sample-based estimates of the compositional profile of the total population in the given year of data collection, and include a margin of error.