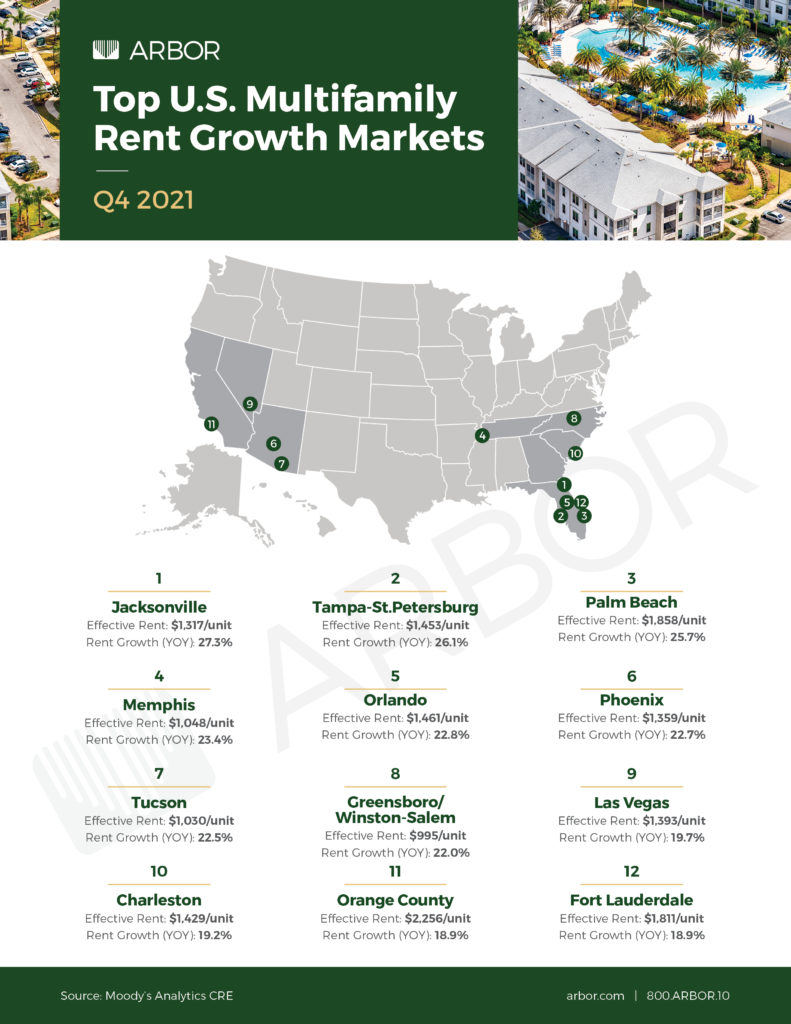

Top U.S. Multifamily Rent Growth Markets — Q4 2021

Despite a slow start to the year, multifamily effective rent growth for the U.S. overall was up 12.5% during 2021, the largest annual gain since Moody’s Analytics CRE began tracking data in 1980, as Sun Belt markets continued to drive the recovery.

As was the case throughout the year, Florida markets were found up and down the list of top rent growth markets. Jacksonville led the way, rising a whopping 27.3%. The city is one of the fastest growing in the U.S., driven by a revitalization of the downtown area into a walkable urban center. Other Florida multifamily markets making the list of top rent growth markets were Tampa-St. Petersburg (up 26.1%), Palm Beach (up 25.7%), and Orlando (up 22.8%), with Fort Lauderdale (up 18.9%) rounding out the list.

The two primary Arizona markets remained among the year’s leaders, finishing sixth and seventh, respectively. Rents in Phoenix increased 22.7%, while rents in Tucson increased 22.5%. Las Vegas remained high on the list, up 19.7% for the year. These cities are also all among the nation’s fastest growing, and continued to benefit from renters seeking more affordable options outside of the pricier markets in the region.

Here’s a full look at the top U.S. multifamily rent growth markets for Q4 2021, with data provided by Moody’s Analytics CRE.

For more multifamily market insights, read our latest Small Multifamily Investment Report and check out our other multifamily research.