Where is the Multifamily Market?

Where Were We?

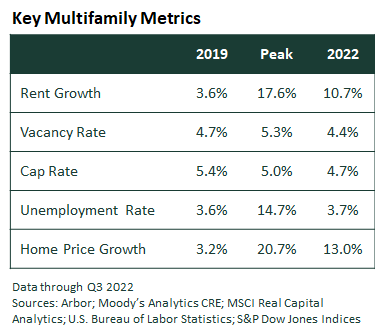

The U.S. multifamily market experienced an unprecedented run from 2010 to 2019. The national vacancy rate tightened and rent growth was positive for 10 consecutive years. Investment volume and loan originations reached record highs, while cap rates bottomed. The labor market experienced its longest expansion in history, with some of the lowest unemployment rates on record.

However, there were signs of slowing, even predating the COVID-19 pandemic. The pace of construction spending and residential investment decreased, consumer debt and inflation increased, and the Federal Reserve began modestly hiking interest rates.

As Arbor’s Chairman and CEO Ivan Kaufman said during his panel at eCore22, “I think actually in 2019 pre-COVID, you started to see the beginning of a correction. Rates started to rise; rent started to flatten out. We all forgot about that. There was a correction that was taking place. Then what happened? Then we had the pandemic.”

COVID-19 Pandemic Recession and Recovery

The COVID-19 pandemic recession was the shortest in U.S. history, lasting only two months. More than 22 million jobs were lost, and the unemployment rate spiked to over 14%. To combat the pandemic, Congress authorized $5 trillion in stimulus spending, leading to a sharp increase in household savings and income, alongside a sharp decrease in consumer debt.

The effects of the pandemic on the housing market were widespread. The flight to affordability and more space, along with the increased adoption of remote work, led to a suburban boom. Housing demand skyrocketed, diminishing existing supply and rapidly increasing home prices. Supply chain interruptions hampered new construction as costs of materials rose, compounded by the Russian invasion of Ukraine.

It took 29 months for the total number of jobs in the U.S. to return to pre-pandemic levels. The economic recovery continued to expand during that time, with increased wage growth, elevated job openings, and high corporate profits. However, all these factors led to the highest inflation rate the country has seen in 40 years.

Where Are We?

At the start of 2022, inflation was widespread throughout the economy, driven by rising housing costs (for both homeowners and renters), high food and energy costs, and continued supply chain interruptions. The Federal Reserve took action, with four consecutive rate hikes of 0.75%, and a final hike of 0.50% at the end of the year, with further hikes expected in 2023. Inflation peaked at 9.0% in June and slowed to 7.1% by November, although it remained well above the 2.0% inflation target objective.

For the U.S. multifamily market, 2022 will go down as one of the strongest on record. Rent growth skyrocketed to 17.7% year-over-year in the second quarter of 2022 and remained high to finish the year, although at a more modest pace. The vacancy rate further improved to 4.4% by the end of the third quarter, reaching a new five-year low, driven by a wide range of factors including new household formation. However, investors and developers remained cautious, with sales volume and new construction expected to finish the year well below pre-pandemic highs.

As we move into 2023, all eyes will once again be on the Federal Reserve, the job market, and the housing market. The multifamily sector has begun showing signs of a pullback, but such is the case with the cyclical nature of our business. Investors who are in a good position going into the correction will be able to take advantage of opportunities.

Where is Arbor guiding investors? Once again from Ivan: “If people can get their assets in order, really focus on managing what they have, getting themselves into a great position in the first and second quarters, I actually think 2023 is going to be one of the best opportunities to aggregate multifamily assets.”

Watch a full recording of Ivan’s eCore22 Fireside Chat, here: eCore22 Panel 2: Fireside Chat: Navigating Through the Changing Times.

For more market insight, read our 2022 Top Opportunities in Large Multifamily Investment Report and view our other market research and multifamily posts in our research section.