Single-Family Rental Investment Trends Report Q2 2024

SFR Construction Soars as Rent Growth Remains Robust

Key Findings

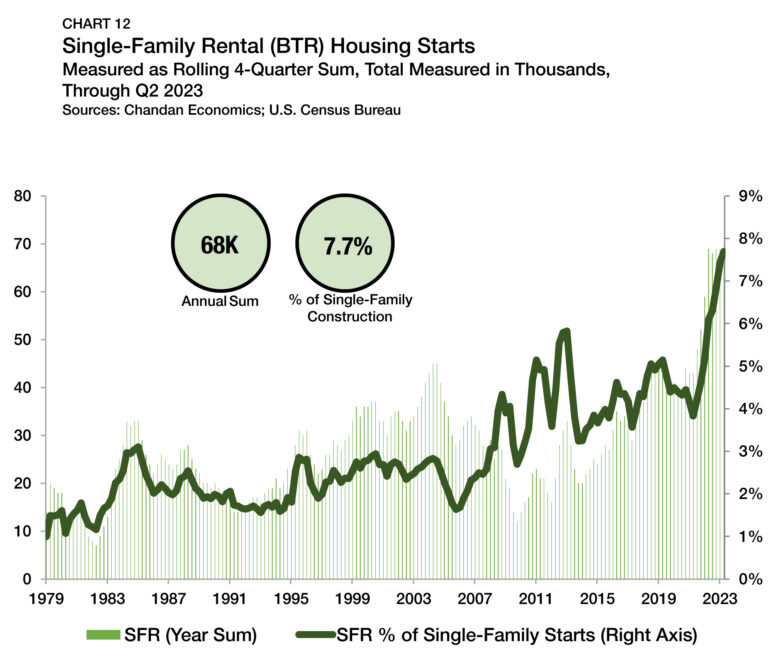

- SFR/BTR construction starts surged to another new record high.

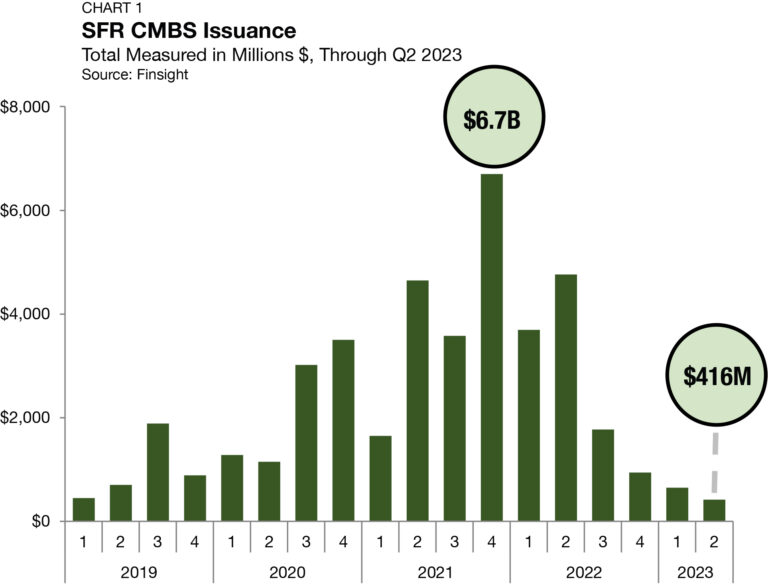

- CMBS activity jumped, signaling improvements in structured capital markets.

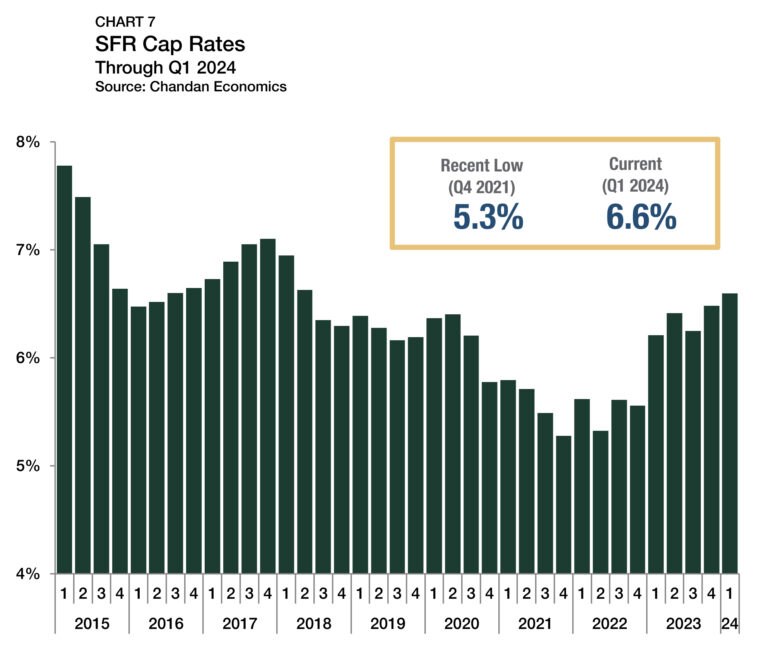

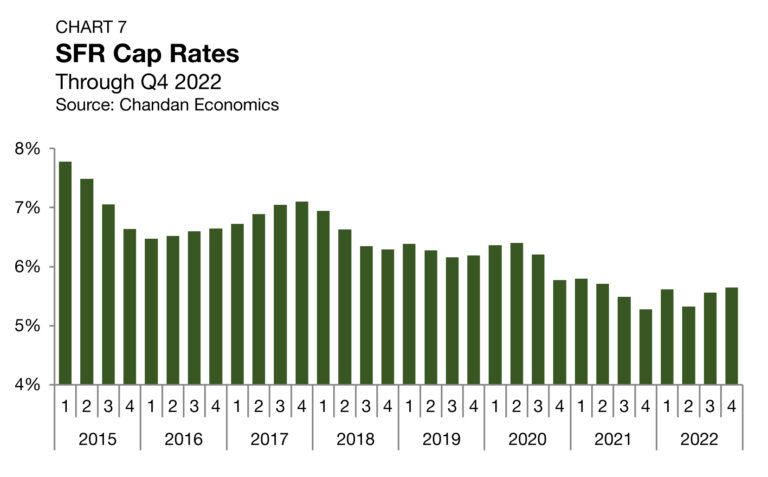

- Cap rates climbed to 6.6% amid high interest rates and robust rent growth.

Table of Contents

State of the Market

Despite ongoing challenges in the capital markets environment, the strength of the single-family rental (SFR) sector has become fully apparent. As it reaches new highs quarter after quarter and build-to-rent (BTR) construction surges, optimism is building in SFR’s long-term prospects.

SFR construction has shown considerable gains since homeownership became substantially less affordable after interest rates started rising in March 2022. According to data from the Atlanta Federal Reserve Bank, buying a home is about 29% less affordable today than at the onset of the pandemic. As a result, BTR communities have attracted the attention of tenants and investors, driving the number of SFR/BTR construction starts to an all-time high.

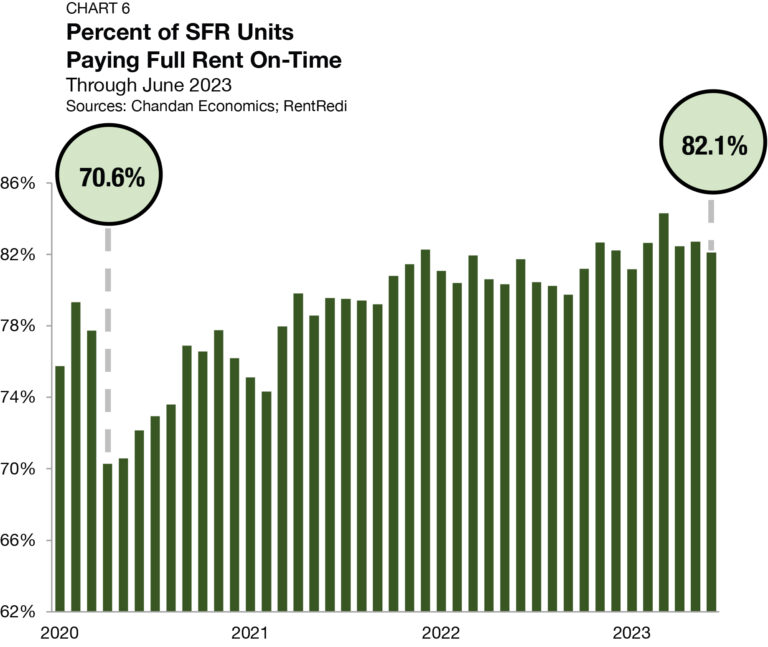

While the interest rates have presented real challenges, the SFR sector’s favorable balance of tailwinds is unmistakable. Occupancy rates are stable, rent growth remains robust, and construction momentum has never been stronger. As 2024’s midpoint approaches, SFR’s structural strengths continue to outweigh cyclical headwinds.

Performance Metrics

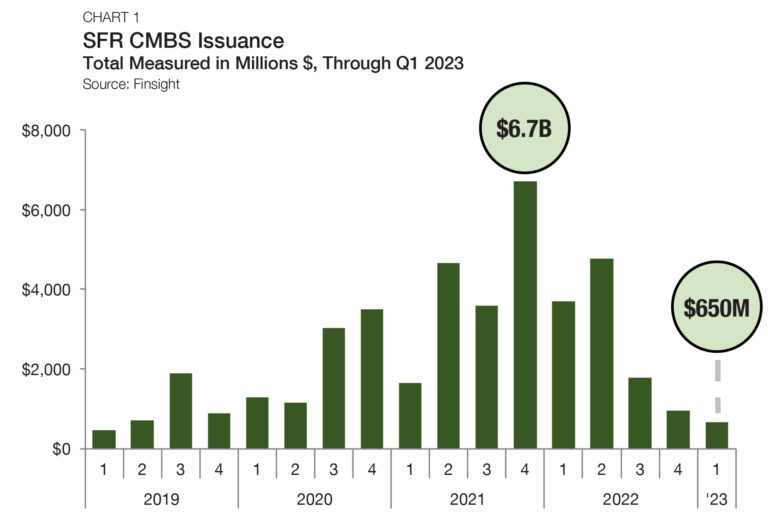

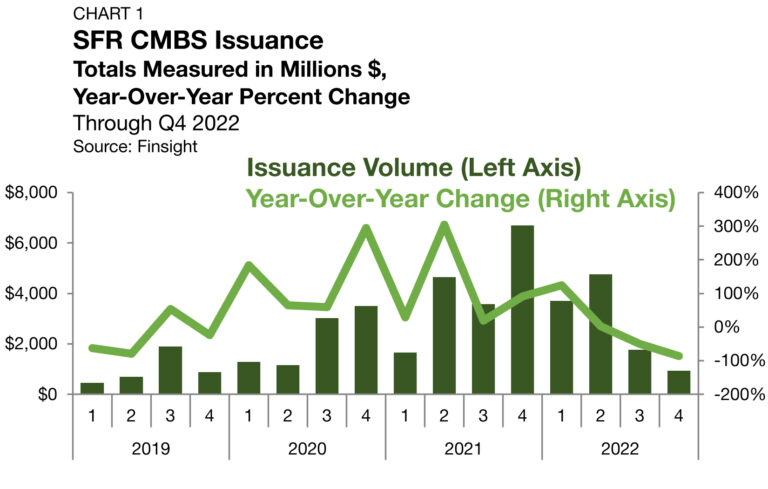

CMBS Issuance

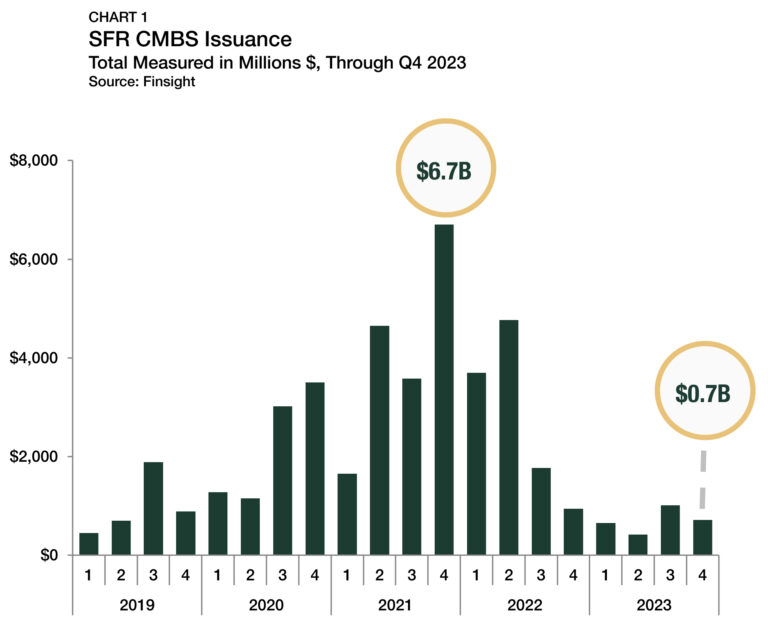

Structured SFR capital markets registered high levels of activity to start the year. According to Finsight, SFR CMBS issuance totaled $1.9 billion in the first quarter of 2024 — more than doubling the output of $713 million in the fourth quarter of 2023 (Chart 1). Additionally, issuance in the first quarter reached its highest quarterly total since the middle of 2022. If SFR CMBS issuance were to sustain its first-quarter pace through the balance of the year, the annual total would reach $7.7 billion, a 45% increase from its 2015-2019 average of $5.3 billion.

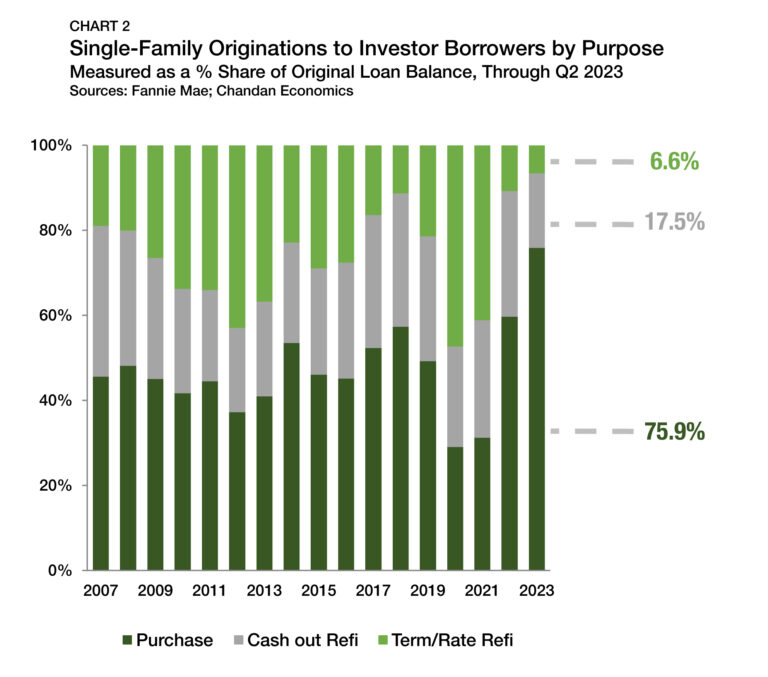

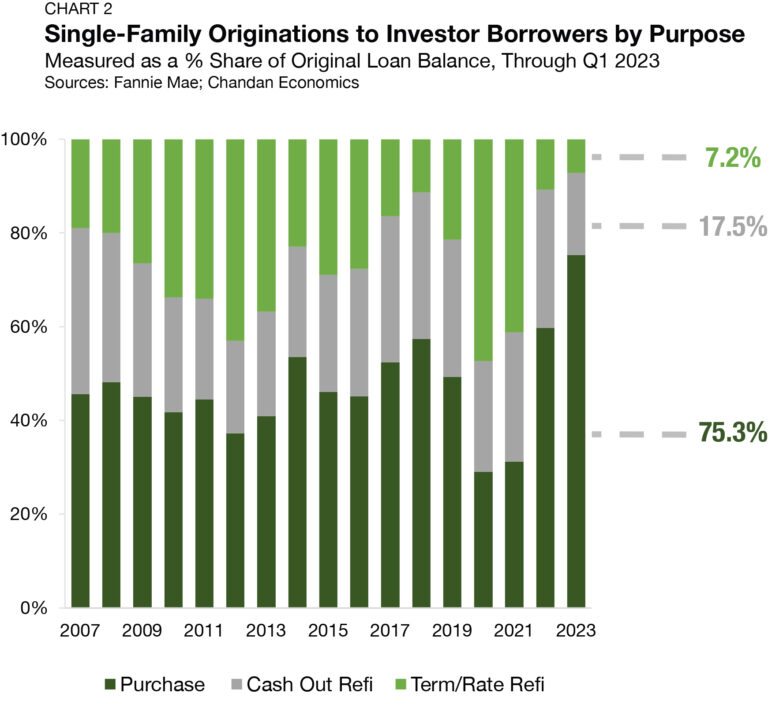

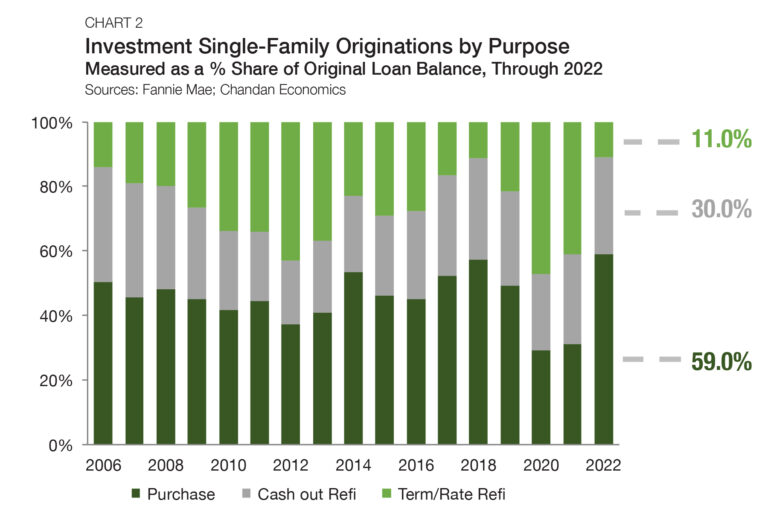

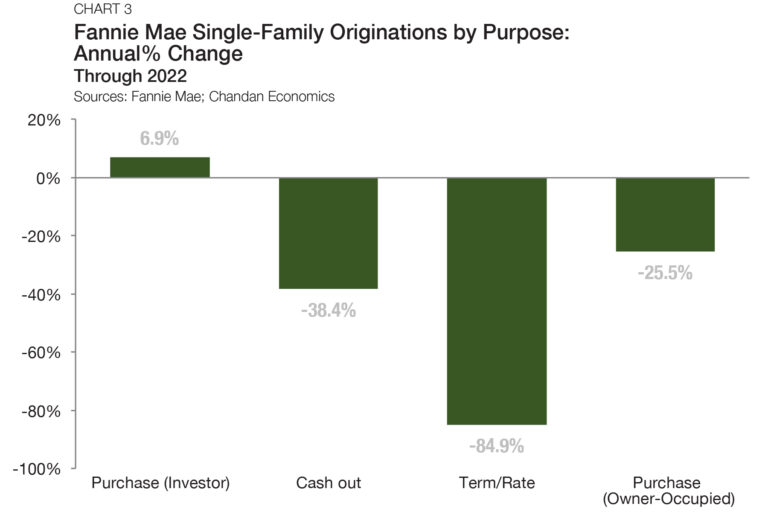

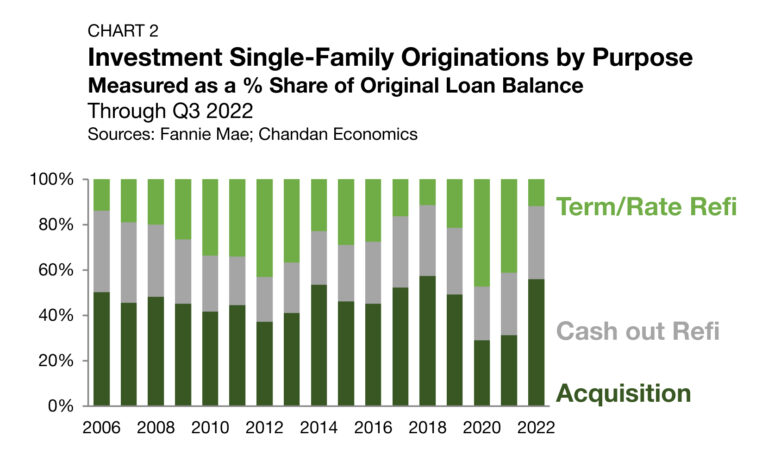

Originations by Purpose

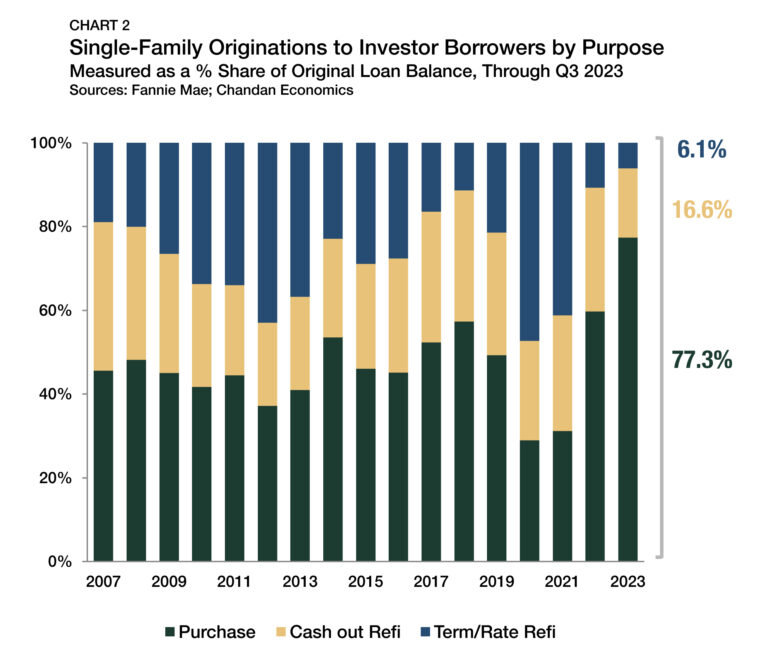

With elevated interest rates reducing the incentive for refinancing, new acquisition loans have accounted for the lion’s share of SFR originations over the past two years. According to Fannie Mae, new loans intended for purchasing accounted for 78.0% of SFR lending activity in 2023 — the highest share on record going back to 1999 (Chart 2). Simultaneously, rate-and-term refinancing loans, which accounted for nearly 50% of originations as recently as 2020, were 5.8% of 2023’s lending activity.

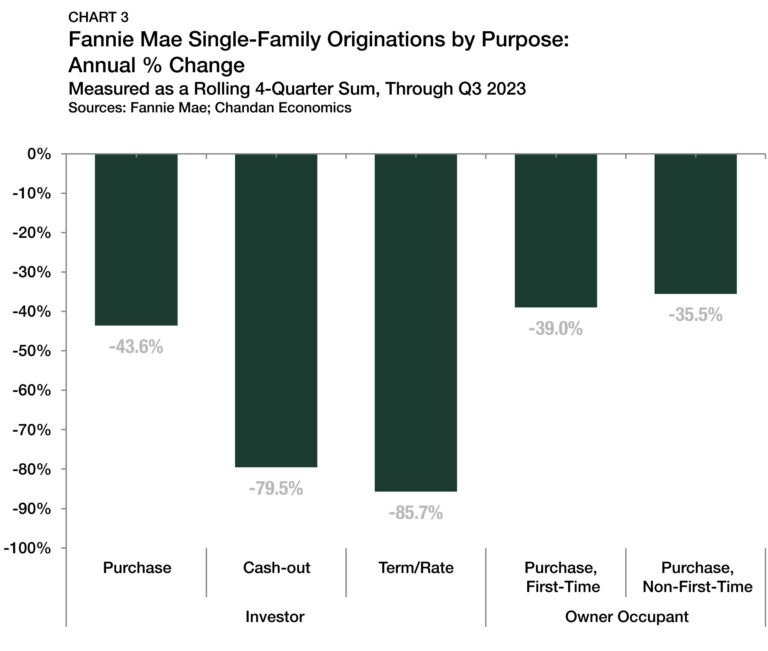

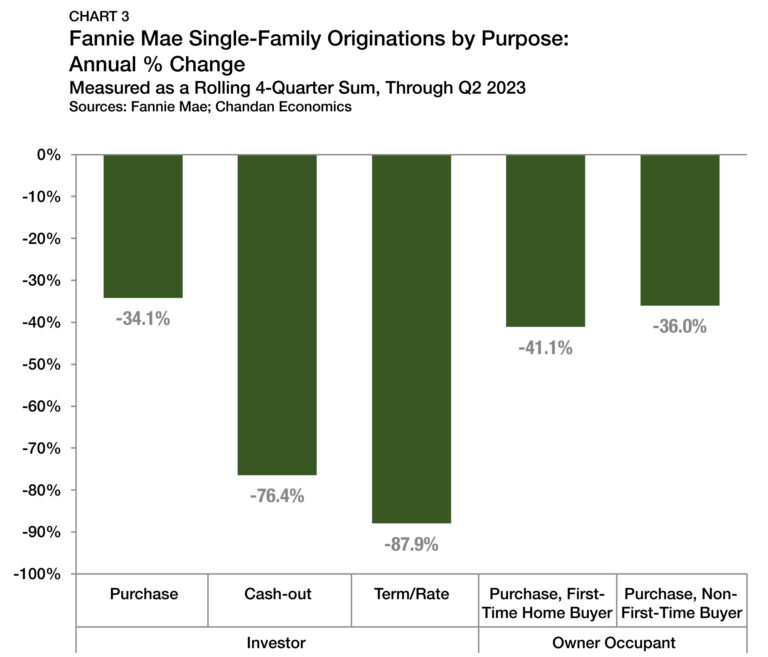

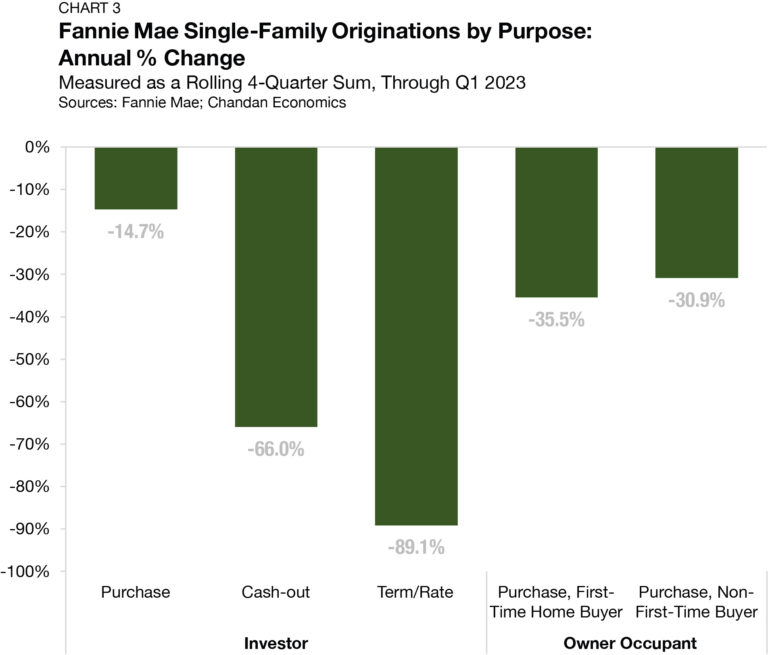

In 2023, the dollar volume of rate-and-term refinancings fell by 74.5% from the previous year, according to an analysis of Fannie Mae data (Chart 3). Cash-out refinancings dropped similarly, decreasing 74.2%. However, investor pullback in single-family purchases was only 38.6%, about half as severe as the decline was for refinancings. The recent slide in SFR purchasing activity has been comparable to trends in other commercial real estate sectors. For example, single-family home purchases by first-time and non-first-time homebuyers fell by 30.0% and 27.0%, respectively.

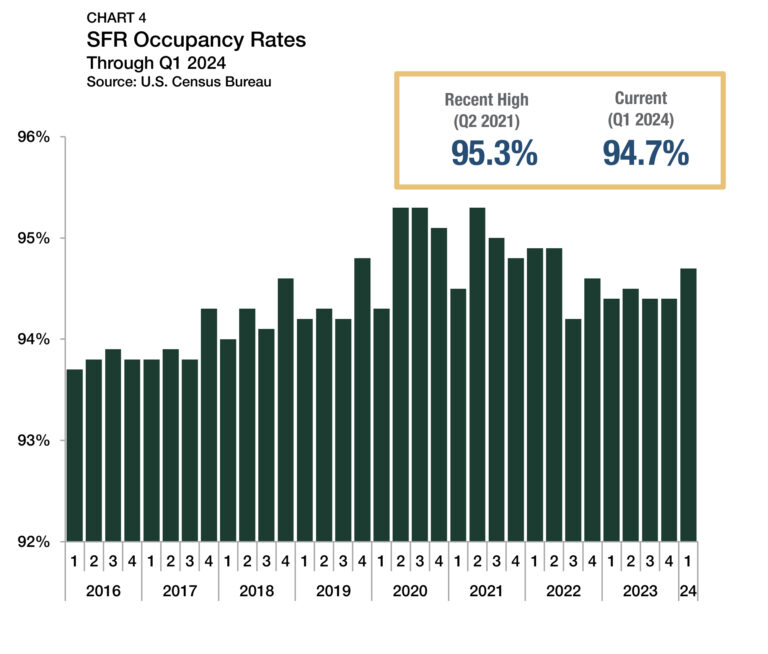

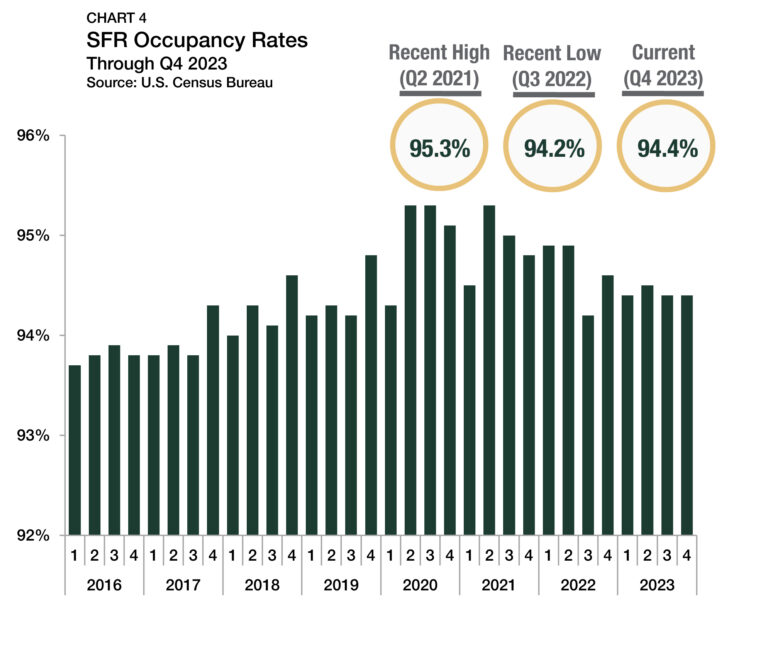

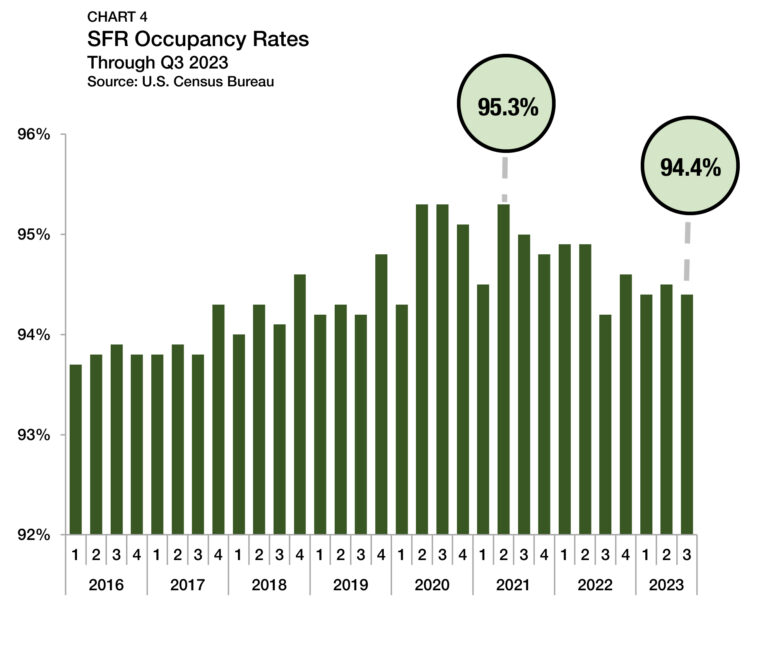

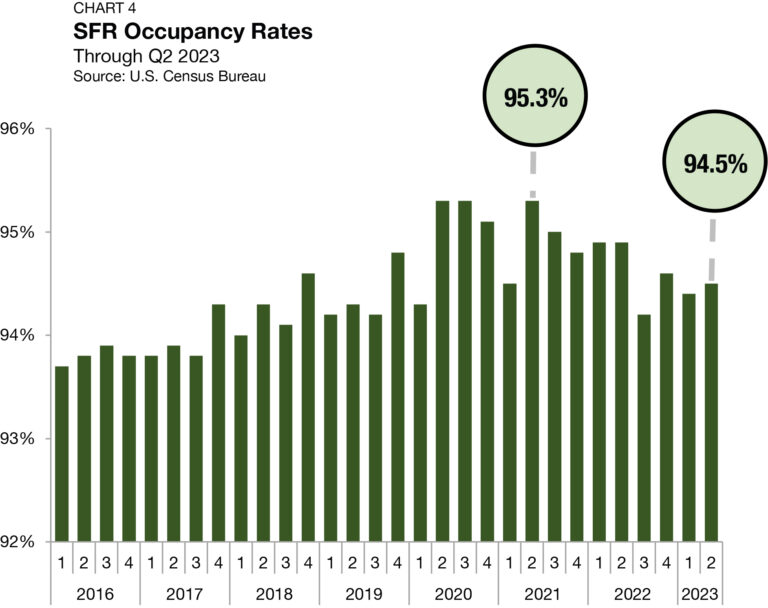

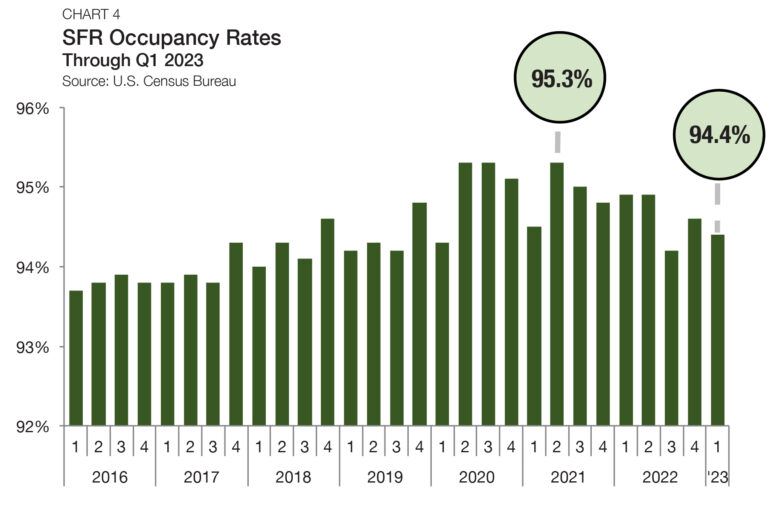

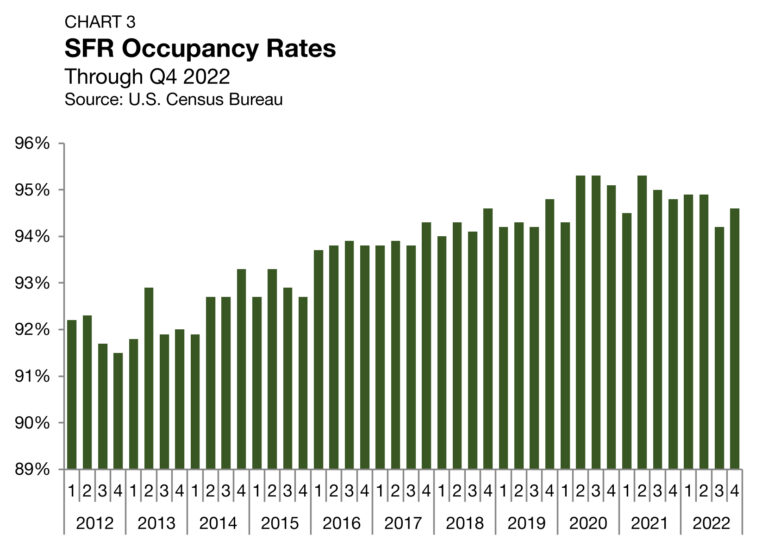

Occupancy

SFR occupancy rates remained strong through the first three months of the year and continued to support the sector’s structural health. Occupancy rates across all SFR property types averaged 94.7% in the first quarter of 2024, according to U.S. Census Bureau data (Chart 4). The first quarter average SFR occupancy rate was an improvement of 30 bps over the prior quarter and an increase of 30 bps over the same time last year. DBRS Morningstar, which tracks the performance of 128,350 SFR units within its rated CMBS transactions, reported a similarly healthy SFR occupancy rate of 92.9% through February 2024, another sign that renter interest in SFR continues to be high.

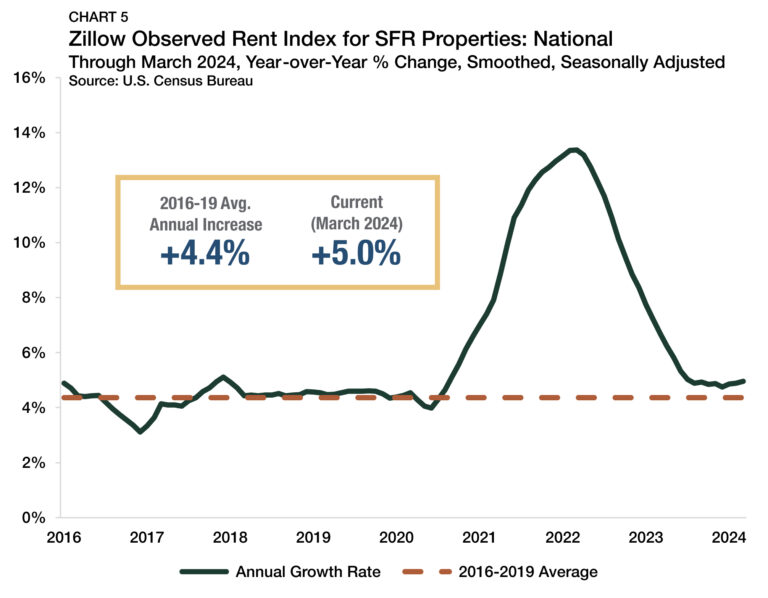

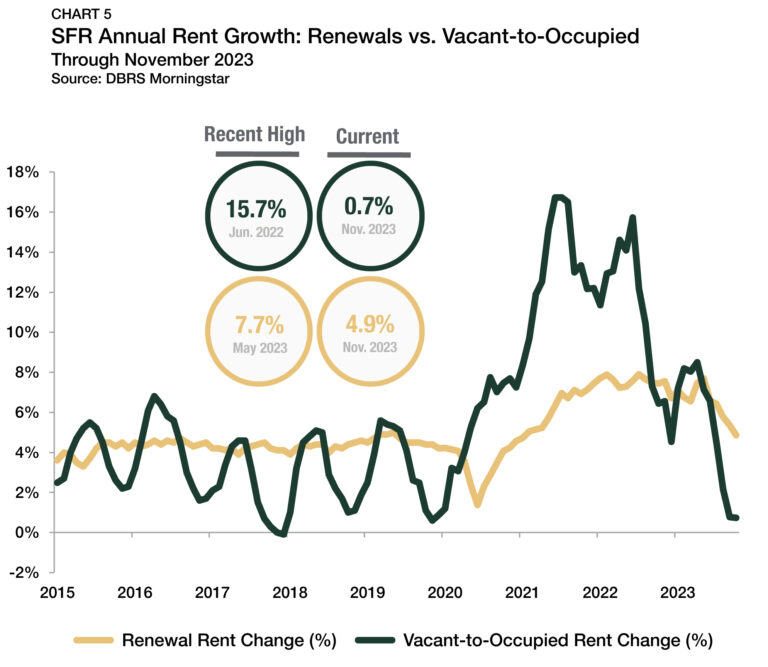

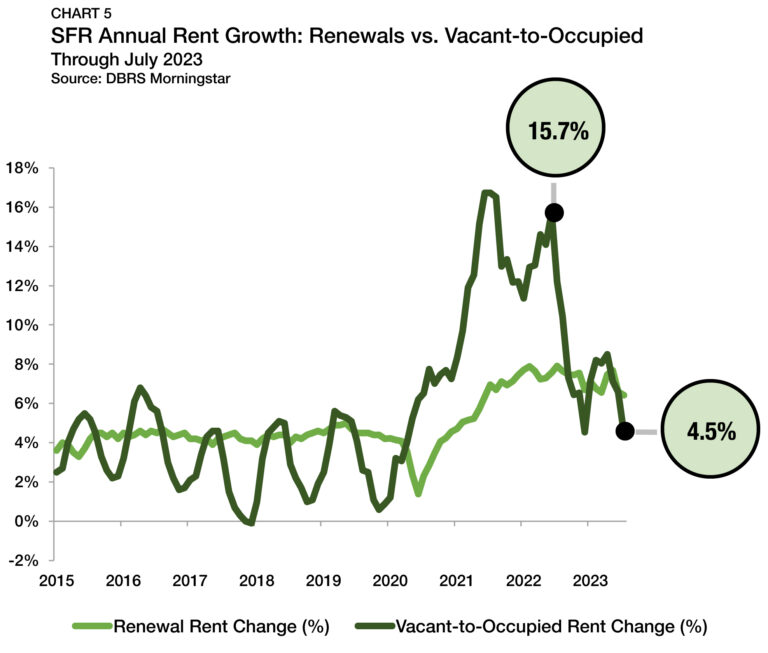

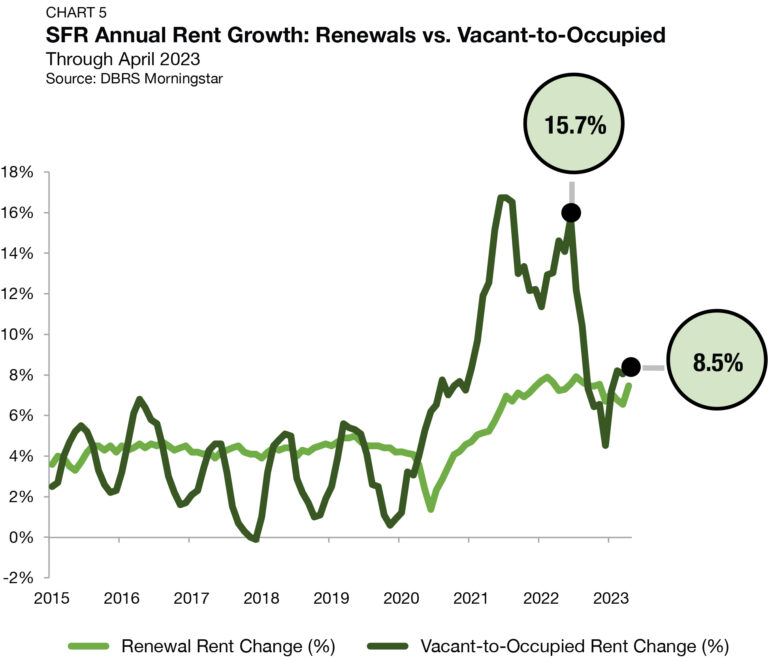

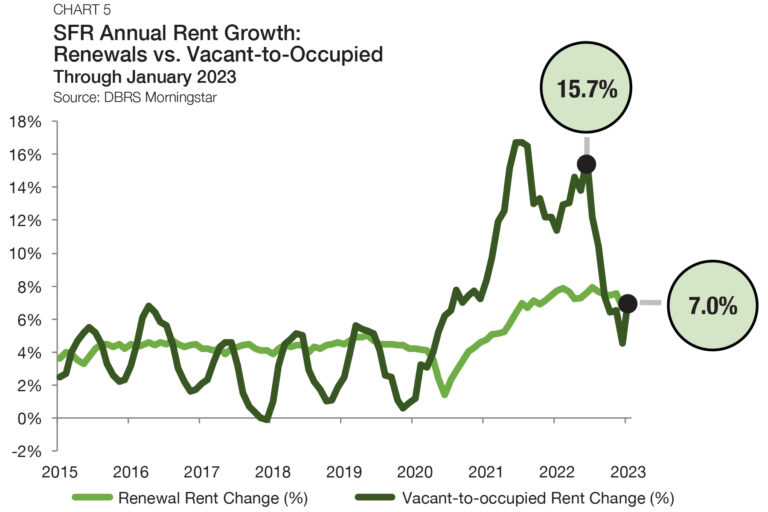

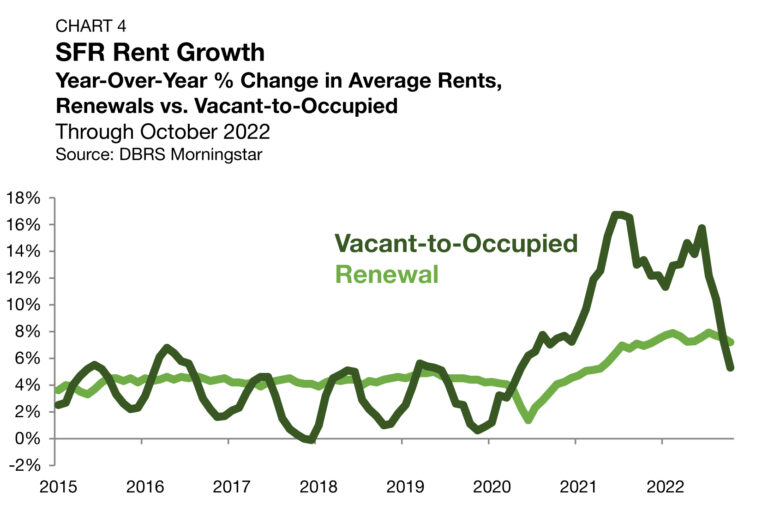

Rent Growth: National

National SFR rent growth climbed at a healthy pace through 2024’s first quarter mark. According to Zillow’s Observed Rent Index (ZORI) for single-family rental properties, rents in the sector were up 5.0% from a year earlier through March 2024 (Chart 5). While rent growth slowed from the lofty, unsustainable double-digit growth rates seen in 2021 and 2022, the pace of increase remained robust by historical standards. The first quarter’s growth rate sits well above the pre-pandemic (2016-2019) average of 4.4% for the sector.

Data from DBRS Morningstar helps to shed light on the difference in rent growth trends between renewing leases and properties that have turned over with a new set of tenants. According to the company’s latest report, vacant-to-occupied (V2O) rent growth resumed seasonal patterns, where rent growth peaks in the spring and bottoms out in the fall, with current V2O growth sitting at 2.0% through January 2024. Rent growth for renewals, which generally accounts for more than 80% of the sector’s leased units, stood higher at 4.7%.

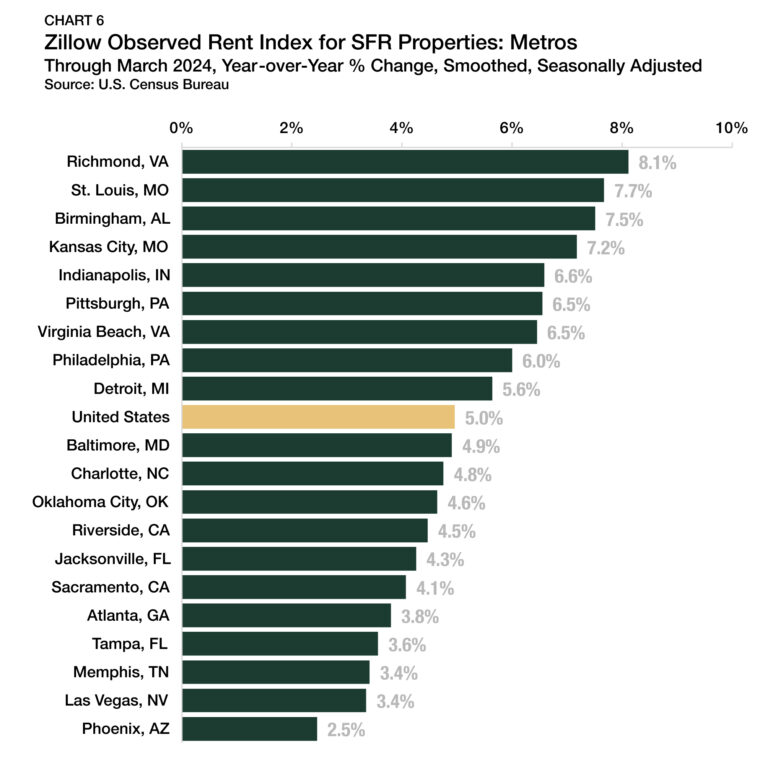

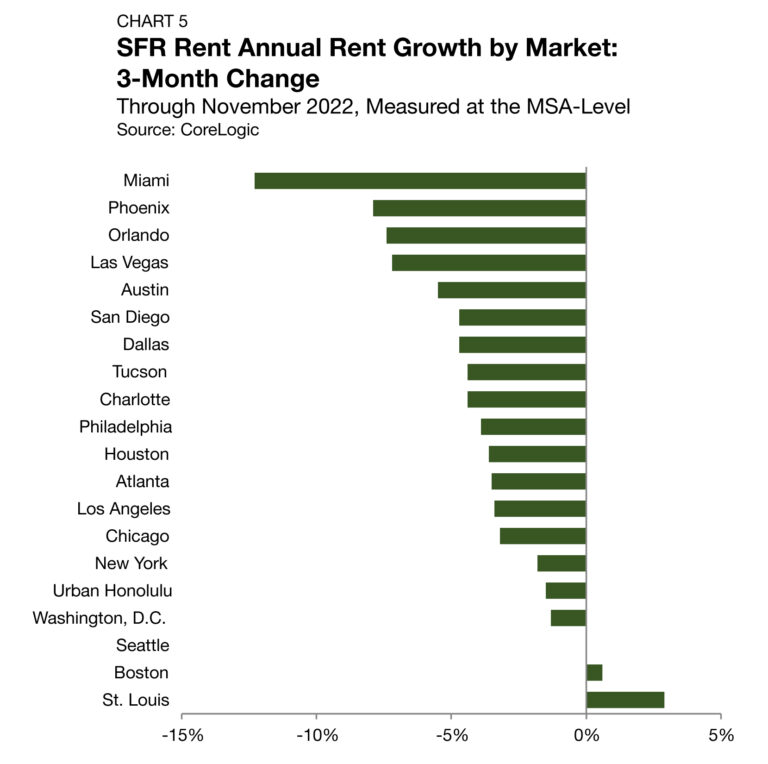

Rent Growth: Metros

Of the top 20 SFR hotspot markets — those with the highest SFR share of rentals among the 50 most populous metros — Richmond, VA, had the most robust levels of SFR rent growth through March 2024, with prices rising 8.1% from a year earlier (Chart 6). Following closely behind was St. Louis, MO, with an increase of 7.7% and Birmingham, AL, which saw 7.5% growth. At the other end of the spectrum are a few markets where rent growth accelerated most quickly during the post-pandemic boom and has since cooled, including Phoenix, AZ (+2.5%), Las Vegas, NV (+3.4%), and Memphis, TN (+3.4%).

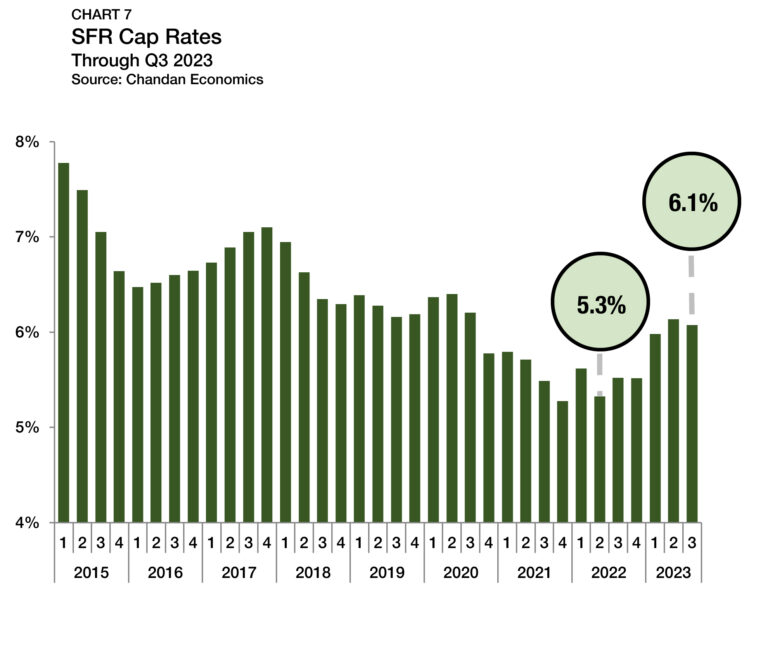

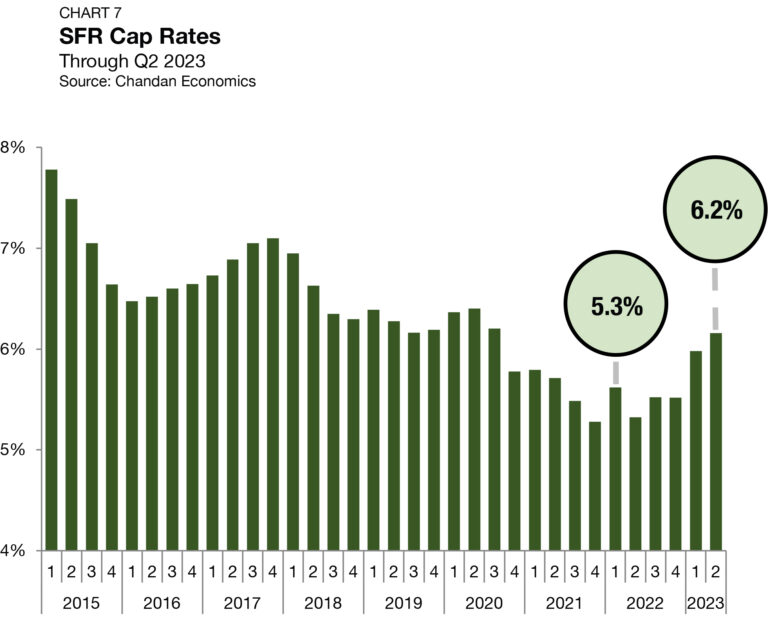

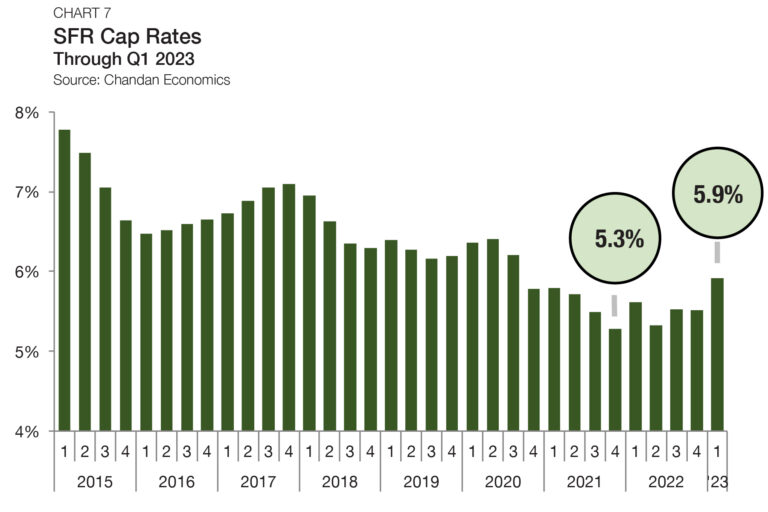

Cap Rates

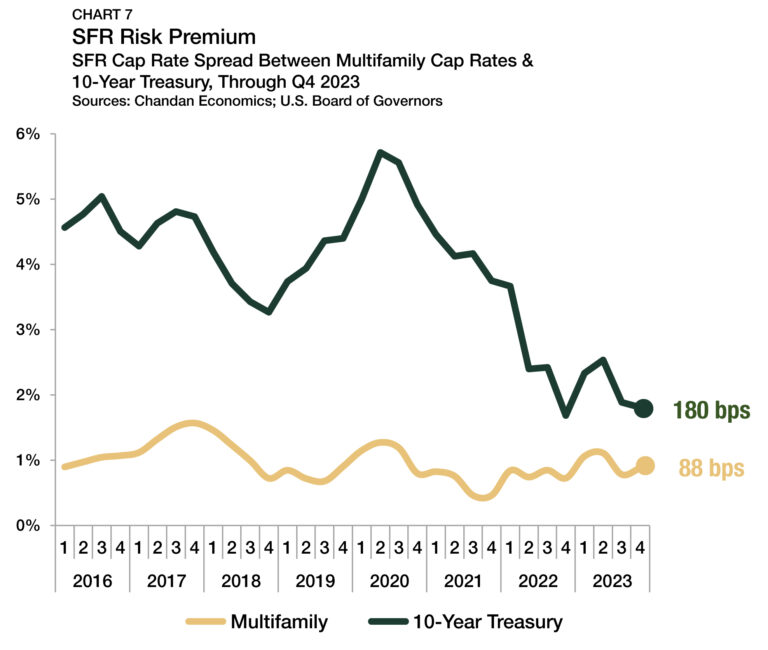

SFR cap rates ascended again in the first quarter of 2024, climbing 11 bps to 6.6% (Chart 7).1 Cap rates have now risen in six of the past nine quarters, increasing by a total of 132 bps to hit their highest point since the second quarter of 2018. In today’s elevated interest rate environment, investors have broadly revised their yield requirements. The ongoing upward movement of cap rates comes as home prices slid slightly nationally in the first quarter of 2024 and resilient rent growth continues to support rising property-level incomes.

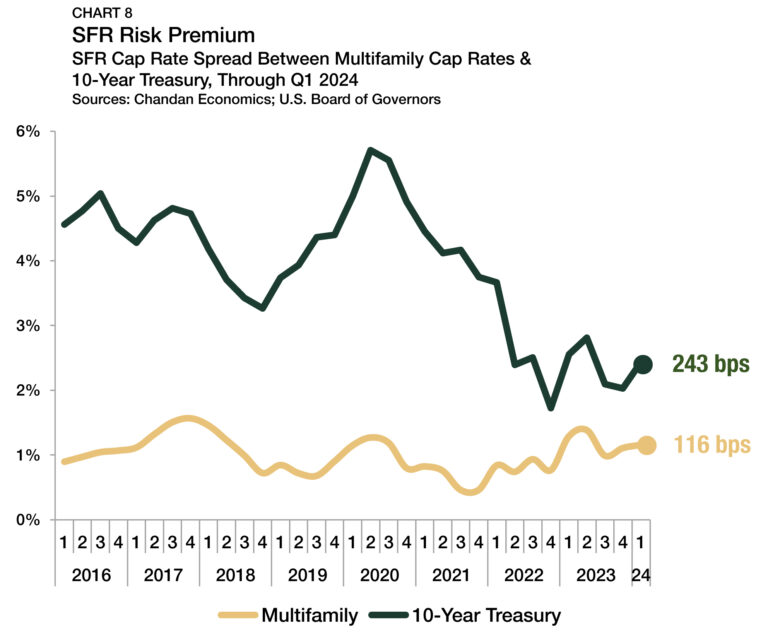

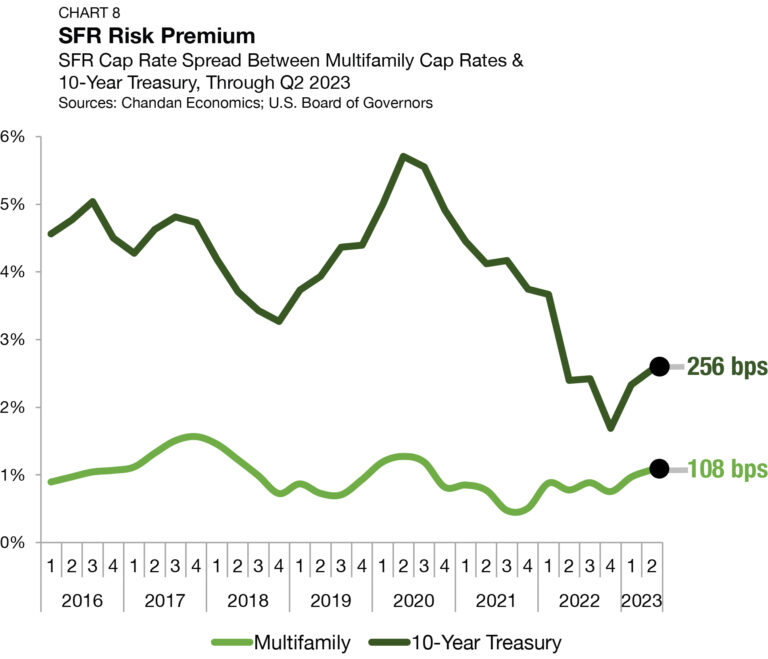

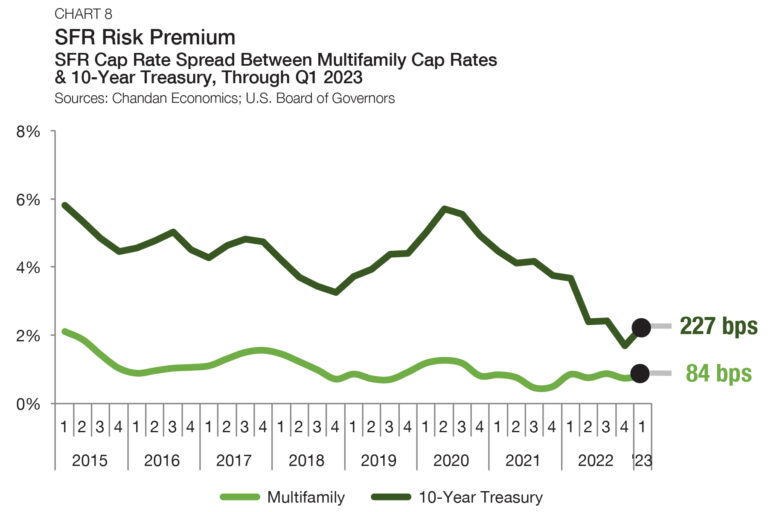

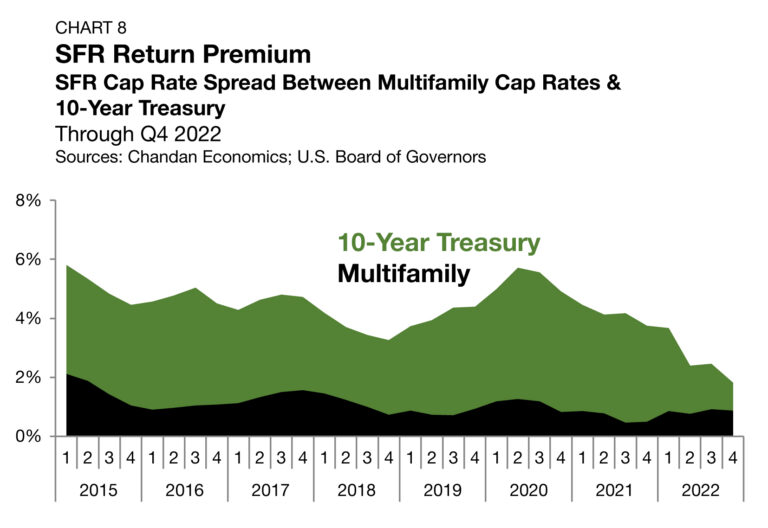

Another key measure of the health of the SFR market is the spread between SFR cap rates and 10-year Treasury yields that approximates the SFR risk premium. In the first quarter, 10-year Treasury notes carried an average yield of 4.2%, falling from 4.5% during the fourth quarter of 2023. As average Treasury yields fell and SFR cap rates rose, the SFR risk premium climbed 243 bps in the first quarter (Chart 8). At the same time, the spread between SFR and multifamily properties widened slightly by 5 bps, averaging 116 bps.

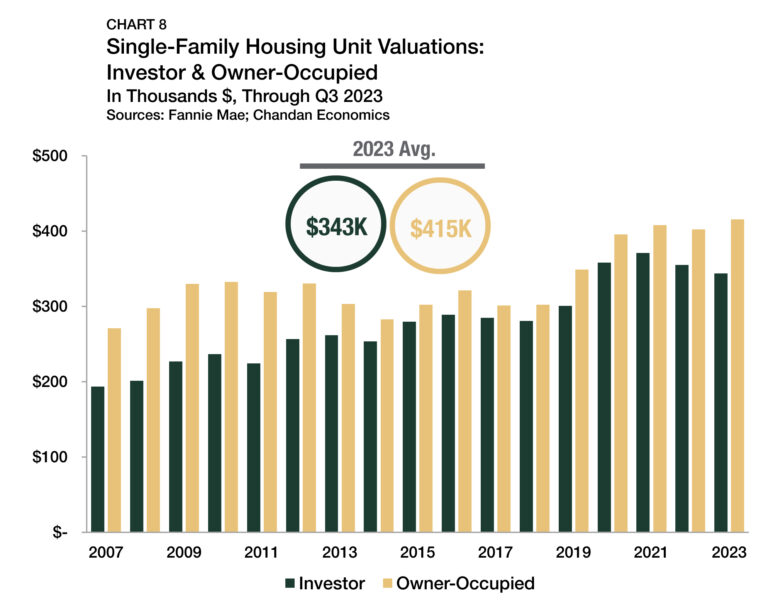

Pricing

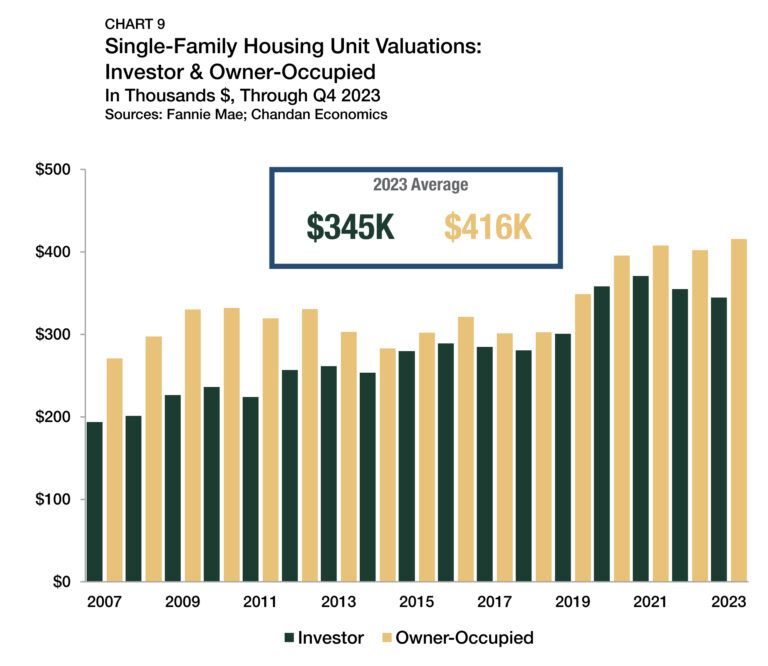

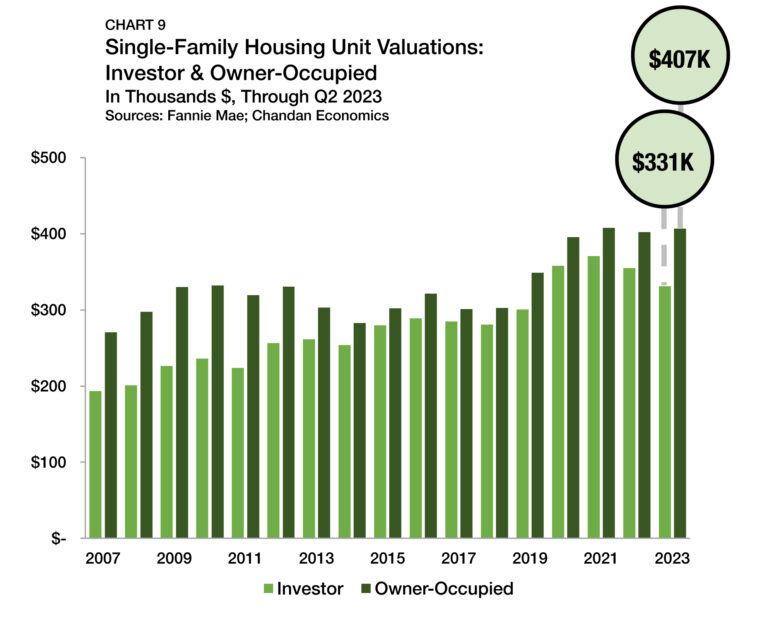

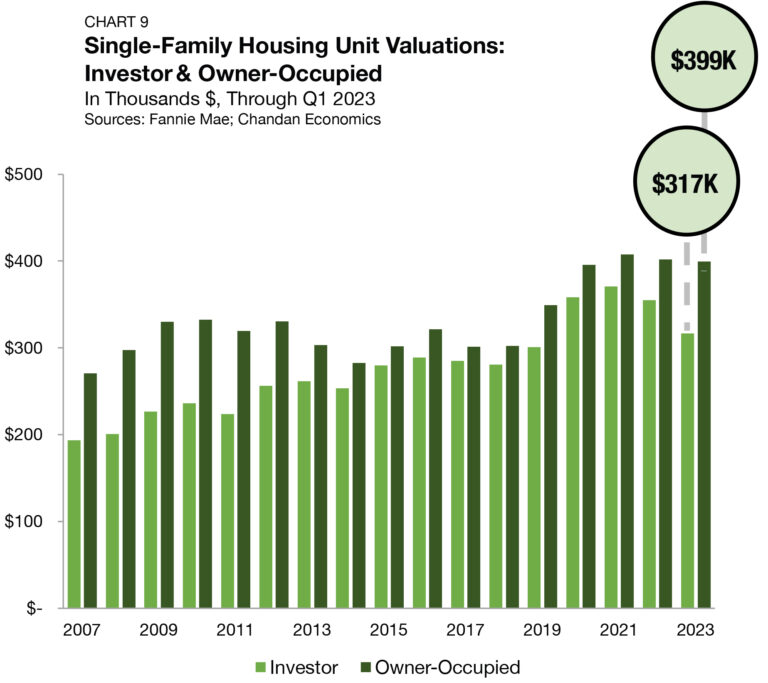

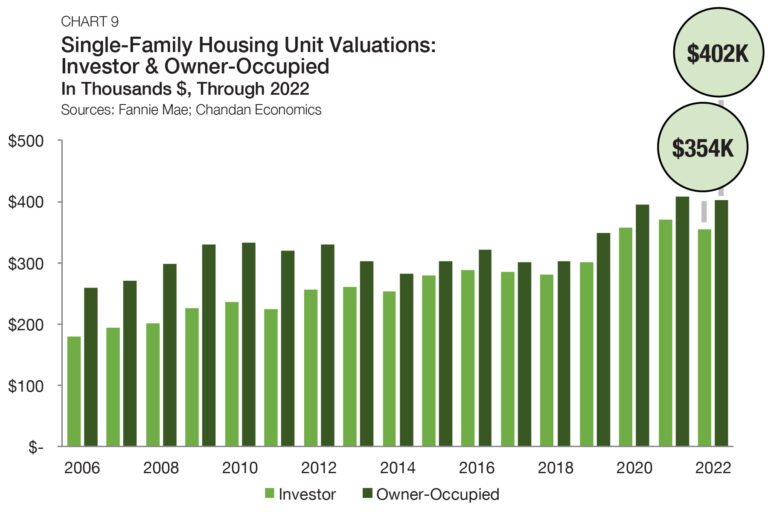

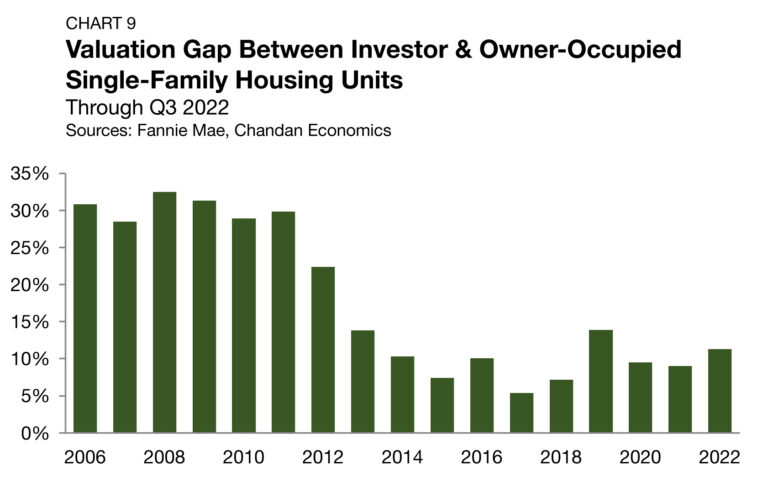

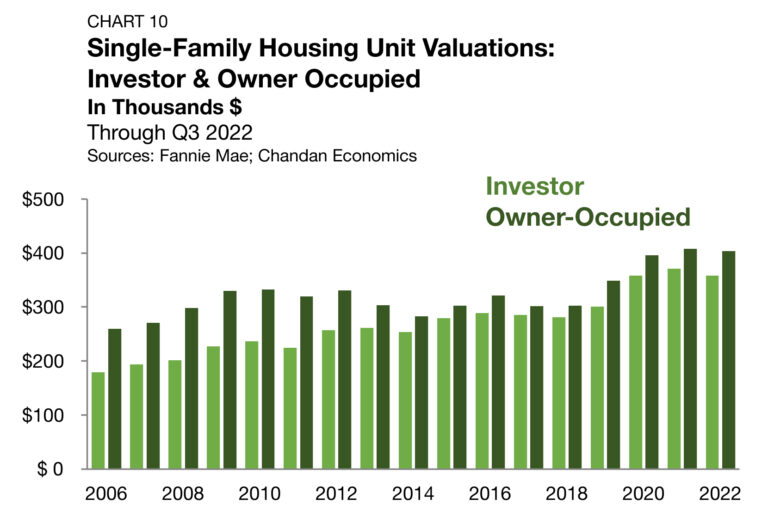

There are consistent differences between the average assessed property values on mortgages originated to single-family owner-occupants versus single-family investors. Underwriters consider factors, such as vacancies, turnover, and management-related expenses, not present in owner-occupied units, that contribute to generally lower assessed values for rental units. Additionally, SFR investors often target value-added assets instead of paying premium prices for properties with higher existing value.

The average valuation of a single-family rental property that received a Fannie Mae mortgage in 2023 was $344,761 — down 2.8% from the 2022 average (Chart 9). During the same time period, average valuations for owner-occupied units increased 3.3%, reaching $415,575. Subsequently, the average underwritten valuation gap between the two groups of properties increased to 17.0% — its widest point since 2012.

The drop-off in SFR valuations on properties with Fannie Mae mortgages in 2023 reflects heightened caution among buyers. Investors want to have a high degree of confidence that their assets will appreciate over the short term to justify making a purchase. In a housing market with recent price instability and a dearth of transaction activity, many investors require higher yields and lower prices to execute an acquisition.

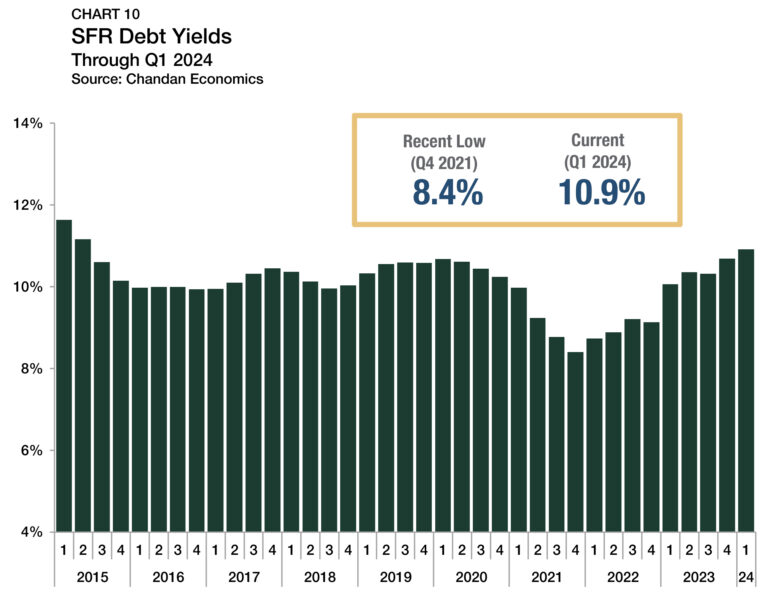

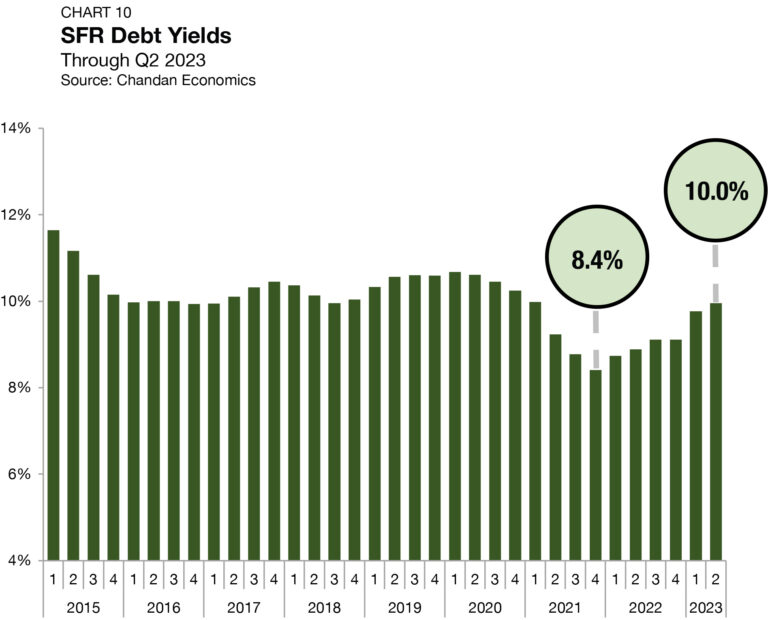

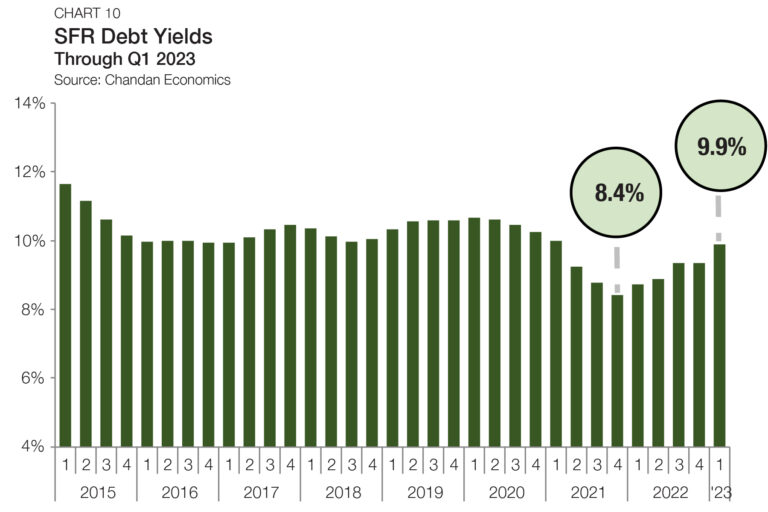

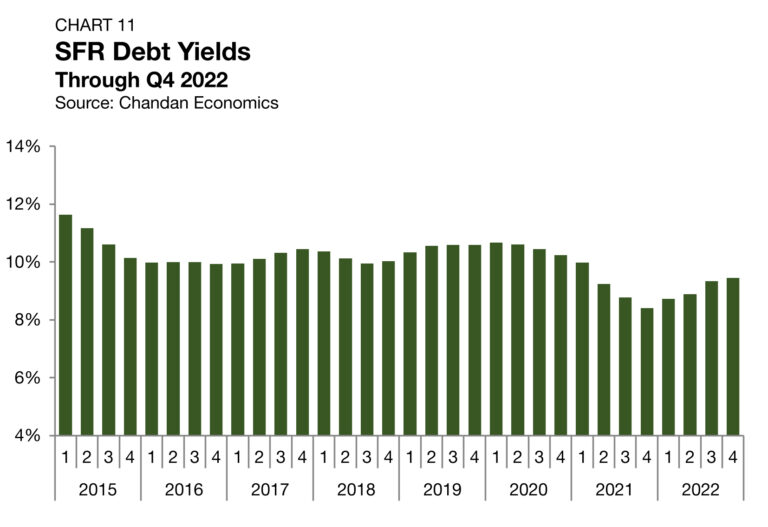

Debt Yields

Debt yields, a key measure of credit risk, jumped again during the first quarter of 2024, rising by 23 bps to land at 10.9% (Chart 10). The increase marked the seventh time debt yields have risen in the past nine quarters, highlighting that lenders have remained diligent in an unsettled investment climate. The rise in debt yields in recent quarters translated to SFR investors securing less debt capital for every dollar of property-level net operating income (NOI). Through the first quarter of 2024, SFR debt declined to $9.16 for every dollar of NOI, a decrease of $0.20 from the previous quarter and a drop of $0.78 from the same time last year.

Supply & Demand Conditions

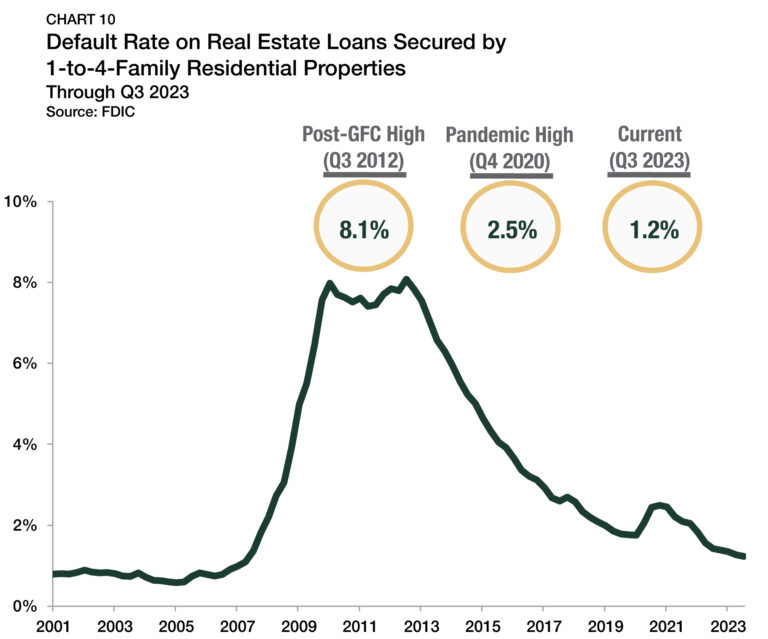

Residential Distress

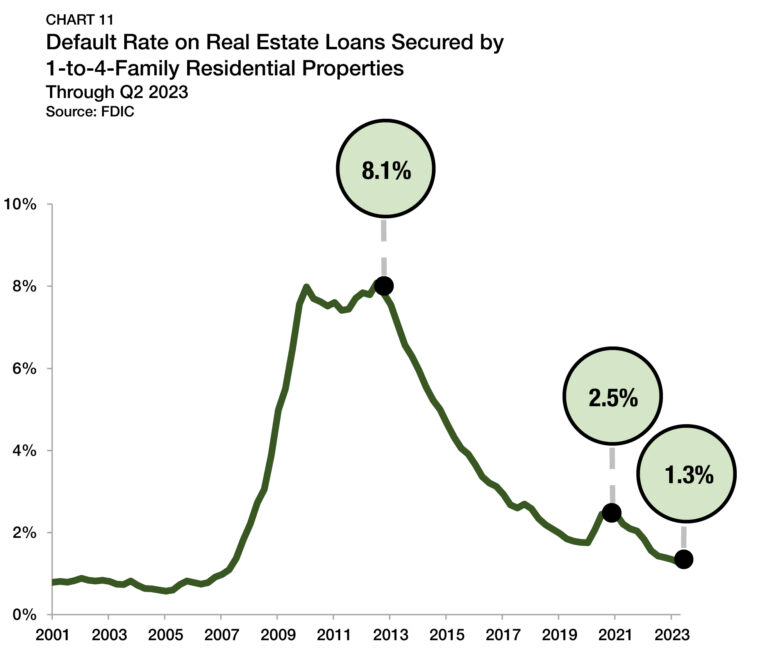

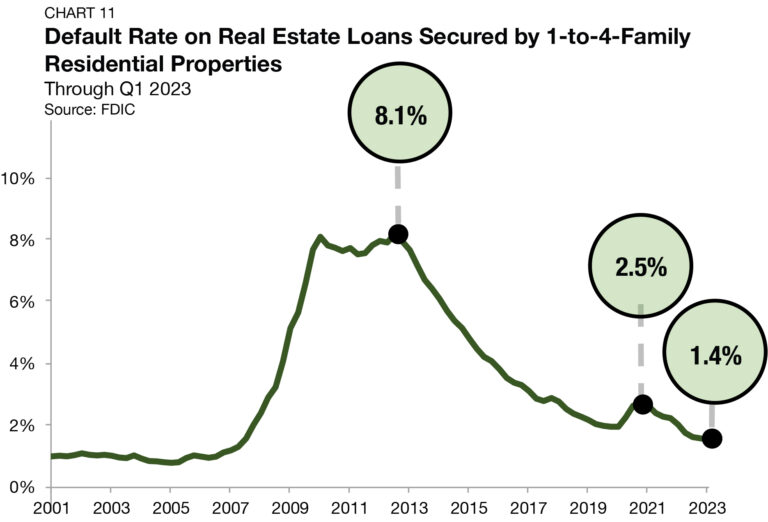

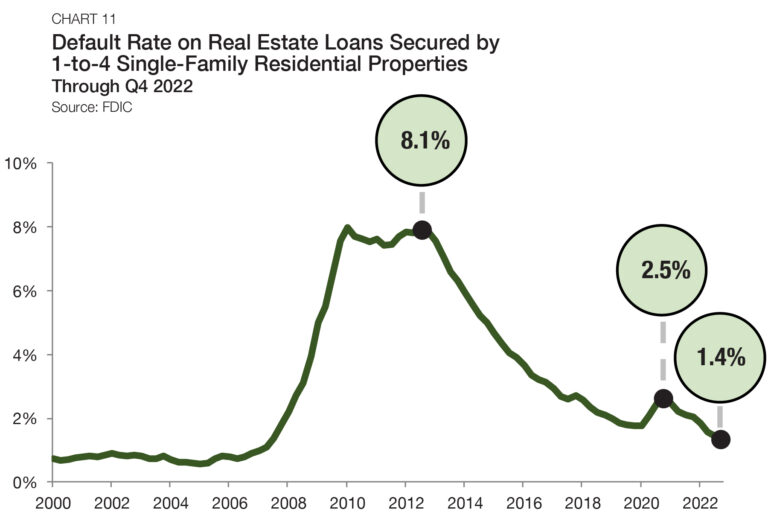

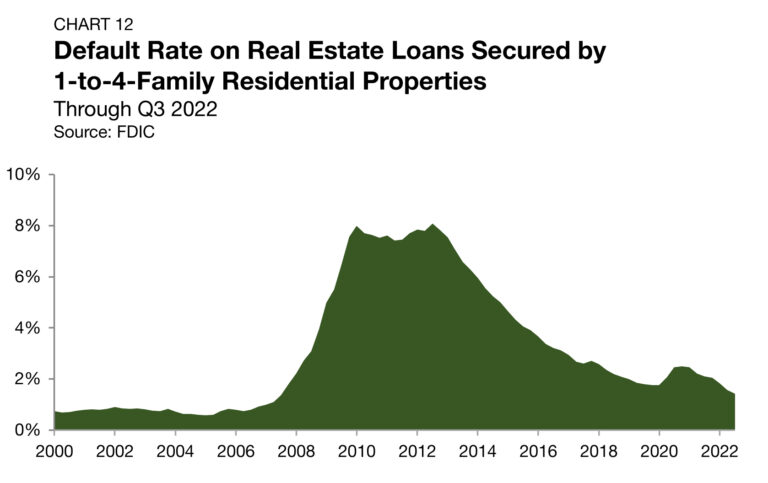

Even with mortgage rates remaining above 7%, there has been little to no distress across the U.S. housing market. Most homeowners have locked-in rates that are well below prevailing market norms, resulting in a shrinking of available housing inventory, and home valuations pressing all-time highs. Meanwhile, underwriting standards have tightened for borrowers who are applying for mortgages. According to the Federal Reserve Bank of New York’s Q1 2024 Quarterly Report on Household Debt and Credit, the share of new borrowers with a credit score above 760 has risen in four consecutive quarters and currently sits at 70.5%.

The New York Fed’s report indicated that only 0.9% of household mortgages are more than 90 days delinquent, slightly below where default rates were at the start of the pandemic (Chart 11). Mortgage performance trends differ from other types of household debt that are more sensitive to variable interest rates, such as credit cards. In the past year, the share of mortgages that are more than 90 days delinquent rose by 16 bps. Meanwhile, the share of credit card debt that is seriously delinquent rose 245 bps. These two disparate trends underscore that although some of the conditions necessary for distress are present, the unique contours of the mortgage market have thus far insulated the housing sector from interest-rate-driven defaults.

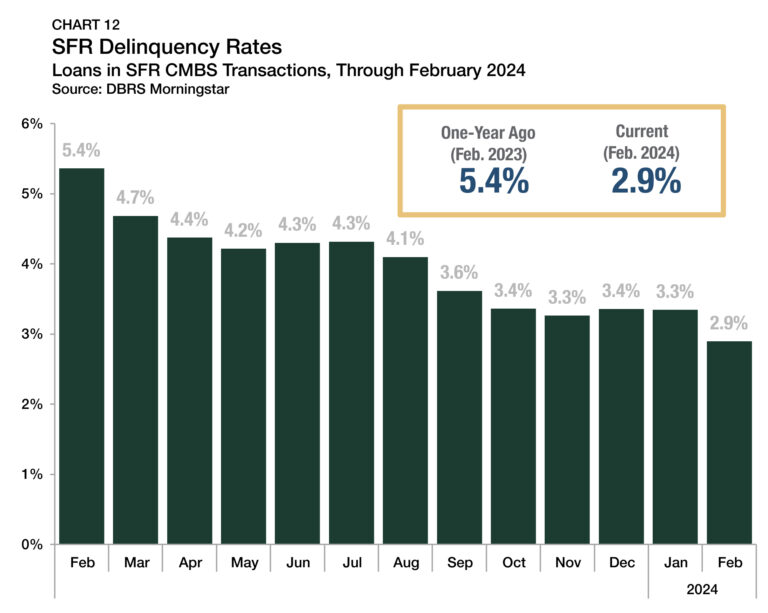

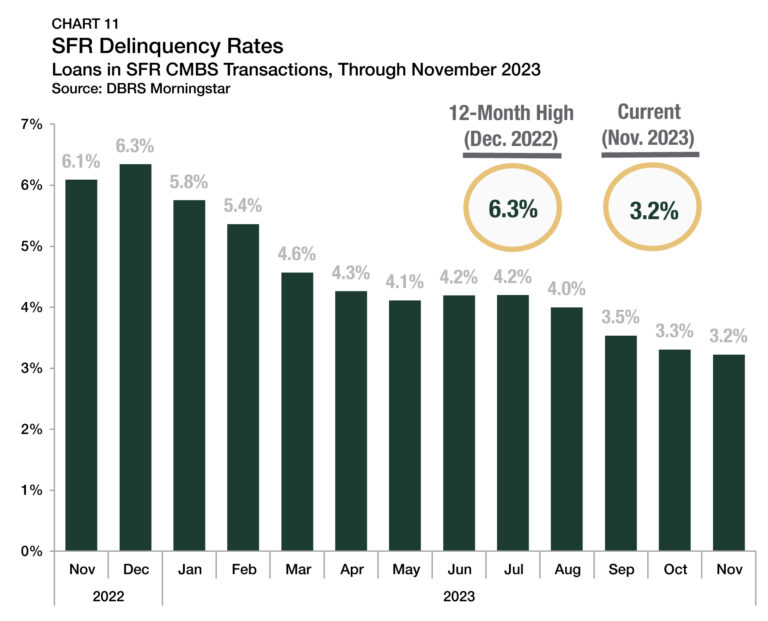

Within the SFR sector, newly released data suggests that distress patterns mirror the broader single-family ecosystem. According to DBRS Morningstar, within rated SFR CMBS transactions, only 2.9% of loans were delinquent in February 2024 — nearly half the 5.4% rate reported one year earlier (Chart 12).

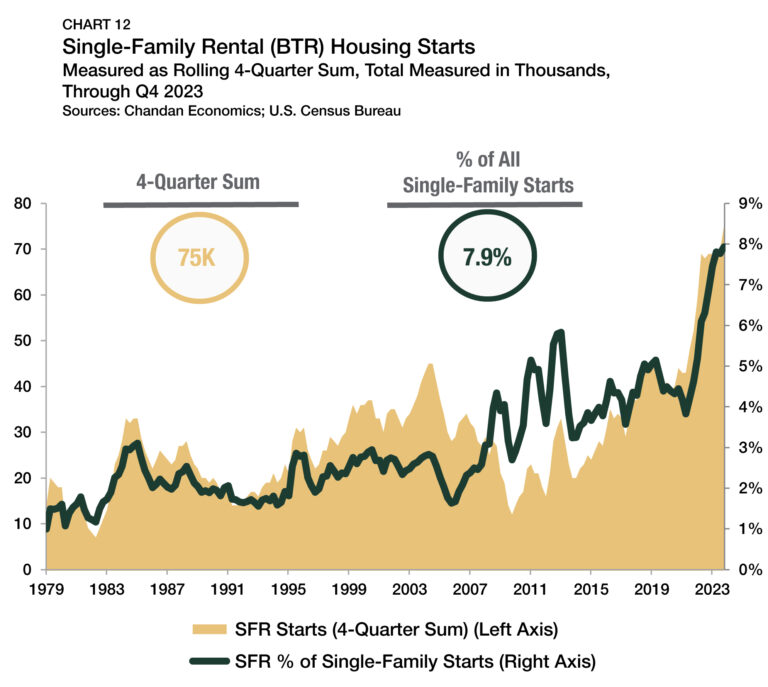

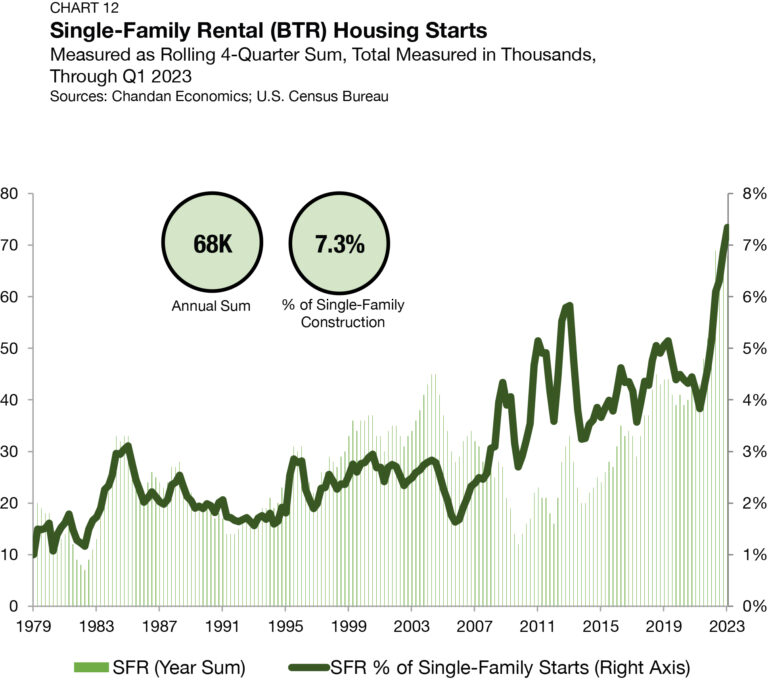

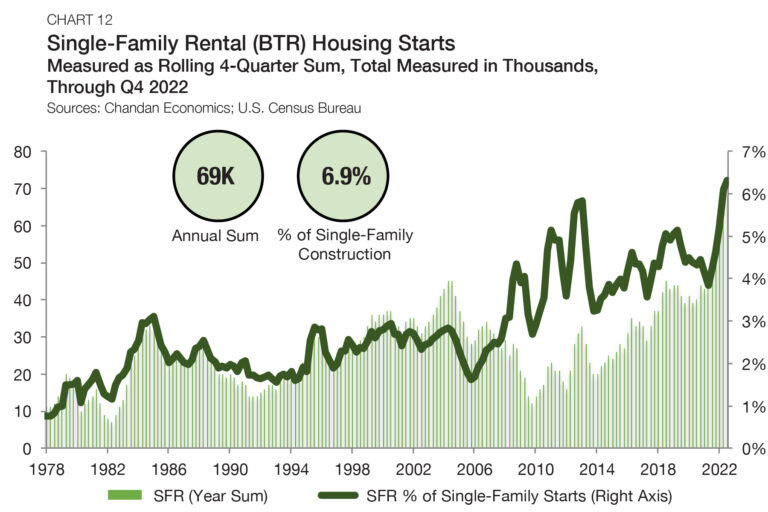

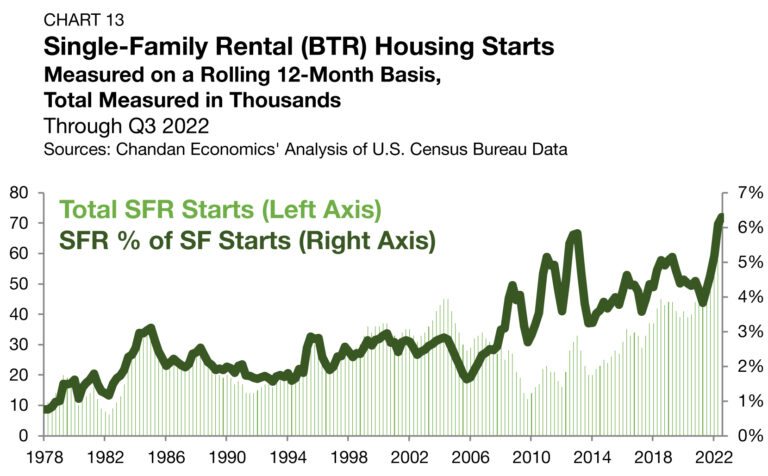

Build-to-Rent

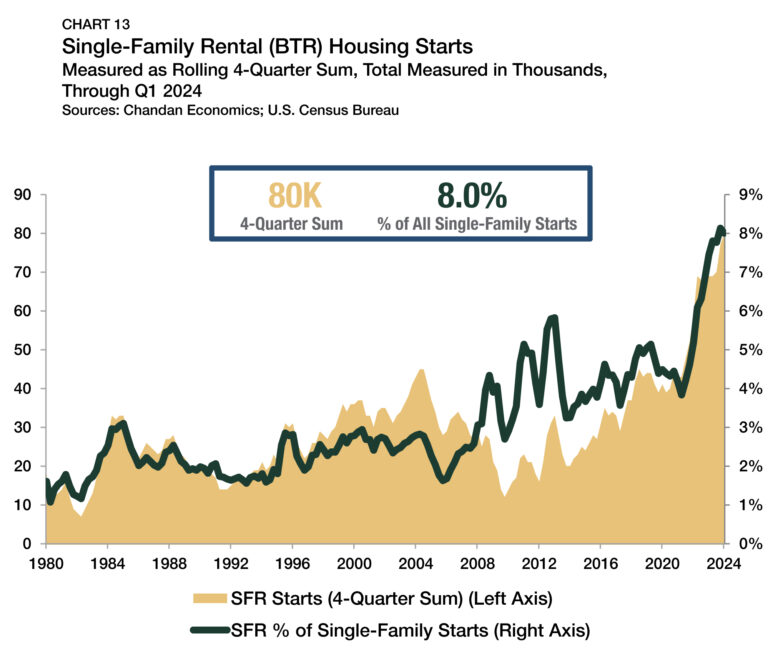

BTR communities have become a defining feature of the SFR sector. Through the first quarter of 2024, BTR production was robust. Over the past 12 months, BTR accounted for 8.0% of all single-family construction starts, remaining near its record high (Chart 13). For comparison, before the 2007-2009 recession ended, the BTR share of single-family construction never eclipsed 3.1%. By unit count, there were 80,000 BTR construction starts in the 12 months ending in the first quarter of 2024 — also a new record high. Compared to a year ago, the rolling annual sum is up by 15.9%, demonstrating a sustained surge in development.

Outlook

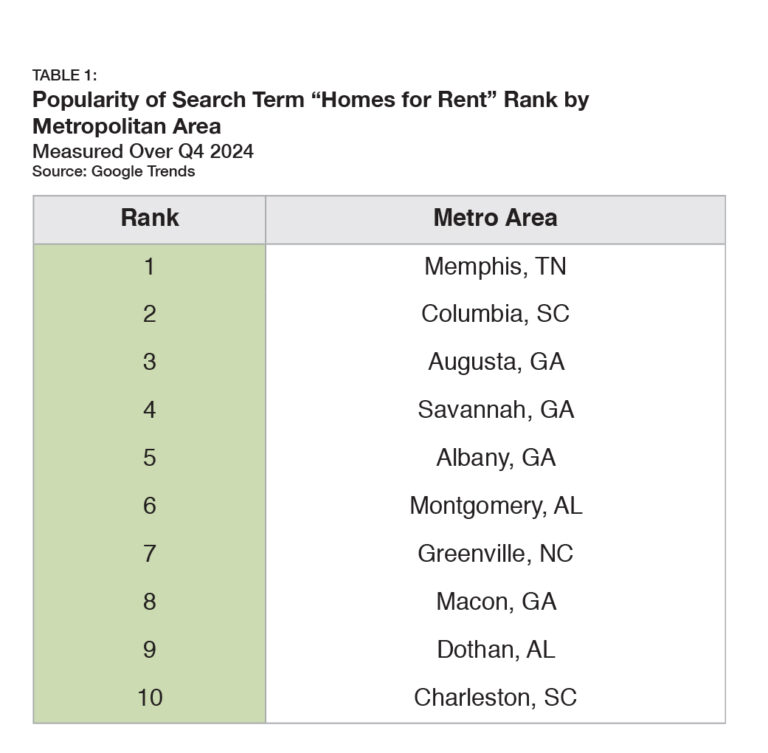

Even as the impact of persistently high interest rates is readily apparent, the structural strengths of the SFR sector are impossible to ignore. The continued surge in BTR construction shows undeterred optimism in SFR’s long-term prospects. Its strengthening pipeline continues to reduce the need for converting existing single-family homes into rental units. Property-level yields remain heavily influenced by movements in the broader interest rate environment. With barriers to ownership increasing for would-be homebuyers, single-family rental homes continue to absorb an increasing share of housing demand generated by Generation Z, lifestyle renters, and even downsizing Baby Boomers. Strengthened by sound fundamentals, SFR is surging and has room to grow within the multifamily real estate sector.

1 Unless otherwise noted, the Chandan Economics data covering single-family rental cap rates and debt yields are based on model estimates and a sample pool of loans. Data are meant to represent conditions at the point of origination.

For more single-family rental research and insights, visit arbor.com/research