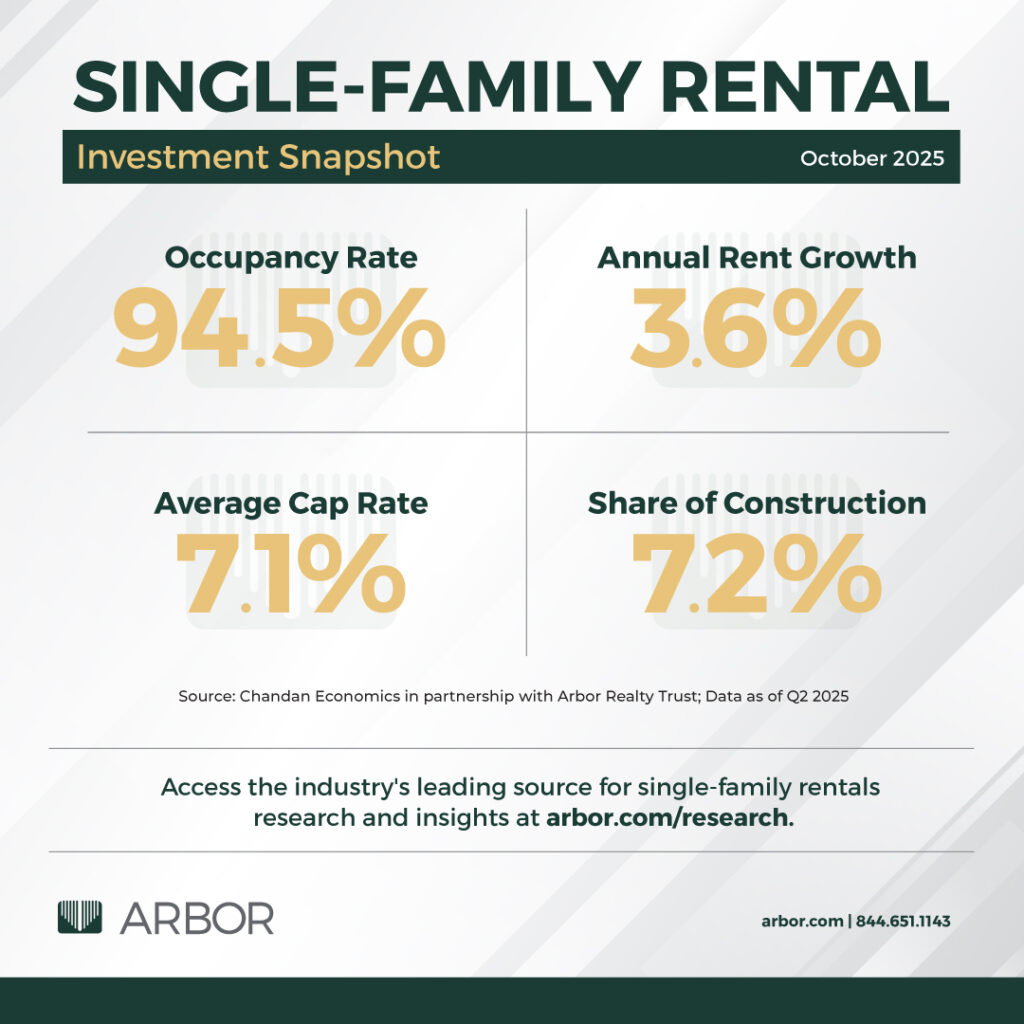

Single-Family Rental Investment Snapshot — October 2025

The single-family rental (SFR) sector shows renewed operational strength, supported by higher occupancy rates and improving tenant retention even as home prices have softened in mid-2025.

According to the U.S. Census Bureau, occupancy rates across all SFR property types averaged 94.5% in the second quarter of 2025, 80 basis points (bps) higher than in the first quarter. Not only did the second-quarter increase break a four-quarter streak of declines, but it also marked the most significant quarterly improvement over the last four years. SFR occupancy rates averaged 93.9% between 2015 and 2019.

Build-to-rent (BTR) has become a driving force behind the growth of the SFR sector. As purpose-built communities are increasingly popular with both renters and investors, they have become the primary method for efficiently expanding supply while also creating product differentiation from typical single-family homes.

Although localized oversupply and business cycle uncertainties are likely to persist through the year, SFR’s long-term outlook remains solidly positive as a set of steady tailwinds drives its growth forward.

Access key highlights in our latest Single-Family Rental Investment Trends Report.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.