U.S. Multifamily Market Snapshot — February 2026

The U.S. multifamily market finished 2025 with growing optimism and resilience. Investment volume accelerated to a three-year high, bolstered by greater interest rate clarity and the tightest cap rates across major real estate sectors. Despite stagnant growth in rents and vacancy rates, supply concerns have diminished, as investors are focusing beyond current headwinds and anticipating robust performance ahead.

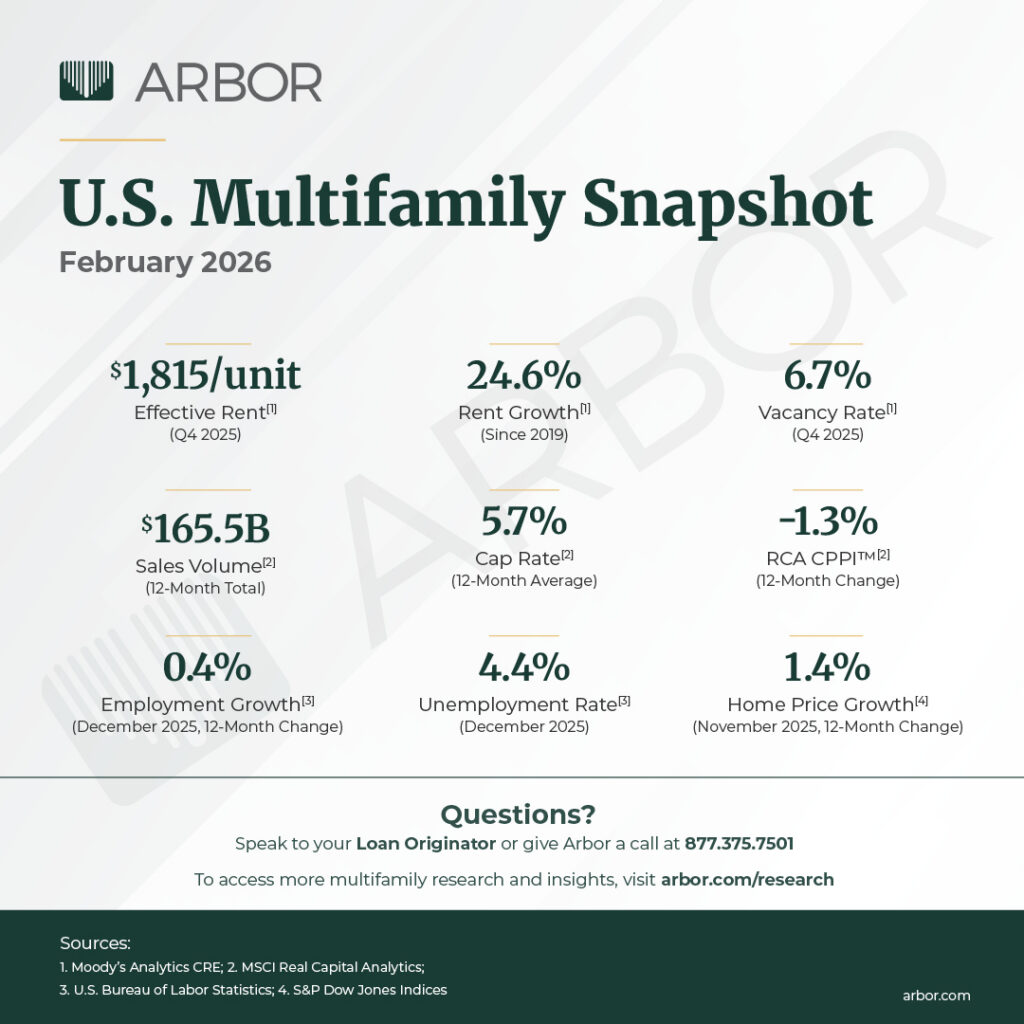

According to data from Moody’s Analytics CRE, effective rent growth was sluggish during the year, falling 0.8%. However, rents remain 25% higher than the pre-pandemic levels measured in 2019. The overall vacancy rate finished at 6.7%, up from 6.4% in 2024, although slowing development may signal a peak to the rising trend.

During the year, 297,000 new multifamily units were added to the market, up from 371,600 during 2024. With supply pressures easing and multifamily rental households hitting record highs, demand assumptions should revise upward going forward.

MSCI Real Capital Analytics reported that apartment investment volume during 2025 totaled $165.5 billion. It was the second consecutive year of expansion, outpacing 2024 by 9.4%, and was higher than the 15-year annual average of $155.0 billion. Cap rates for 2025 apartment transactions averaged 5.7%, unchanged from 2024 and remained the tightest among all major property types.

Although valuations declined, the rate of price deterioration slowed as compared with the previous two years, with the RCA Apartment CPPI finishing the year down only 1.3%. The sector’s sustained activity indicates that investors are confident in underlying income fundamentals despite modest price pressures.

Once again, Dallas, TX, led the nation in apartment investment volume, finishing the year at $9.6 billion. The total was 3.0% higher than the previous year and more than 2.7 billion higher than the next-highest market. Cap rates have also remained steady in Dallas, averaging 5.5% during 2025, up from 5.4% in 2024.

Nashville, TN, was ranked the most appealing multifamily market for investors during the year, according to the latest Arbor-Chandan Multifamily Opportunity Matrix. The market stood out for its robust labor market and youthful population profile.

Results of the National Multifamily Housing Council’s (NMHC) latest Quarterly Survey of Apartment Market Conditions signaled that rent control remains a significant deterrent to apartment investment and development, despite the improved conditions for debt financing and an uptick in apartment deal flow. Participants in NMHC’s Quarterly Survey of Apartment Construction & Development Activity that reported a decrease in starts over the past three months cited economic feasibility (18% of respondents), low rent growth (14%), and economic uncertainty (12%) as the cause of their reduced construction activity.

The multifamily market in 2025 further cemented its status as a leading asset class built on a stable foundation. Investment volume continues to accelerate, driven by clearer interest rate expectations and steady returns. Even though rent growth has weakened, slower development activity will help keep vacancy rates steady.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our multifamily articles and research reports.