5 Key Takeaways From eCore21 Summit

At the early-November Executive Conference on Real Estate (eCore21) event in Miami, FL, top multifamily industry leaders gathered to share their insights, outlooks and concerns about the market heading into 2022. Here are five key takeaways from the various panels and discussions during the event.

Sun Belt Benefits from Pandemic-Related Migration

A much-discussed topic was the immense growth of the Sun Belt. The region was already benefitting from in-migration and job creation prior to the pandemic. COVID-19 accelerated households’ decisions to move to more affordable metros, boosting the labor market and multifamily demand in secondary and tertiary markets.

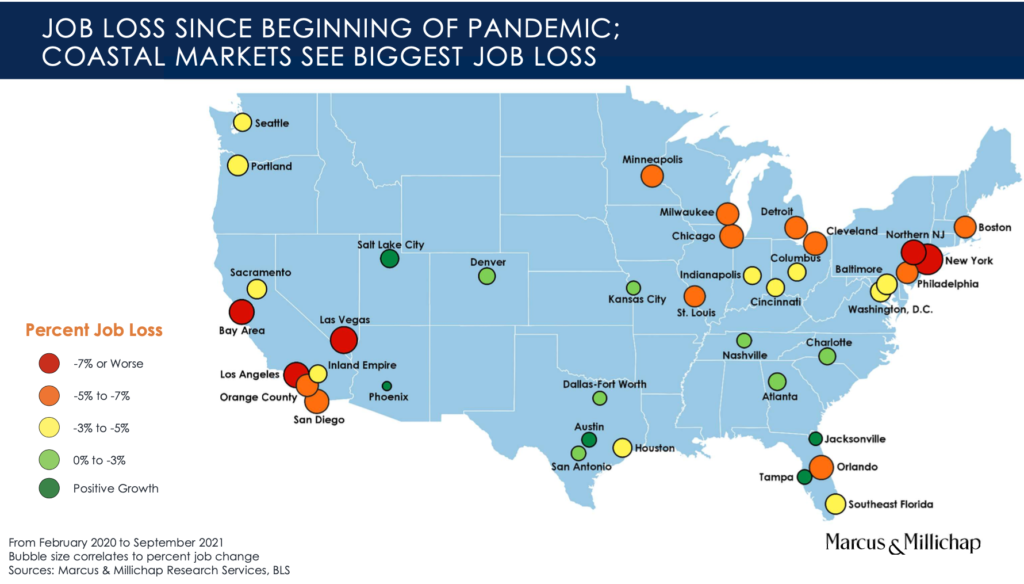

Markets like Charlotte, Atlanta, Austin and Jacksonville have achieved positive job growth since the beginning of the pandemic. In contrast, gateway markets like New York and Los Angeles saw job losses of 7% or more, according to Marcus & Millichap data presented by John Sebree, National Director of the Multi Housing Division. Sun Belt cities “bounced back aggressively, with many having more jobs now than prior to COVID,” Sebree noted.

Labor Shortages Remain a Nationwide Challenge

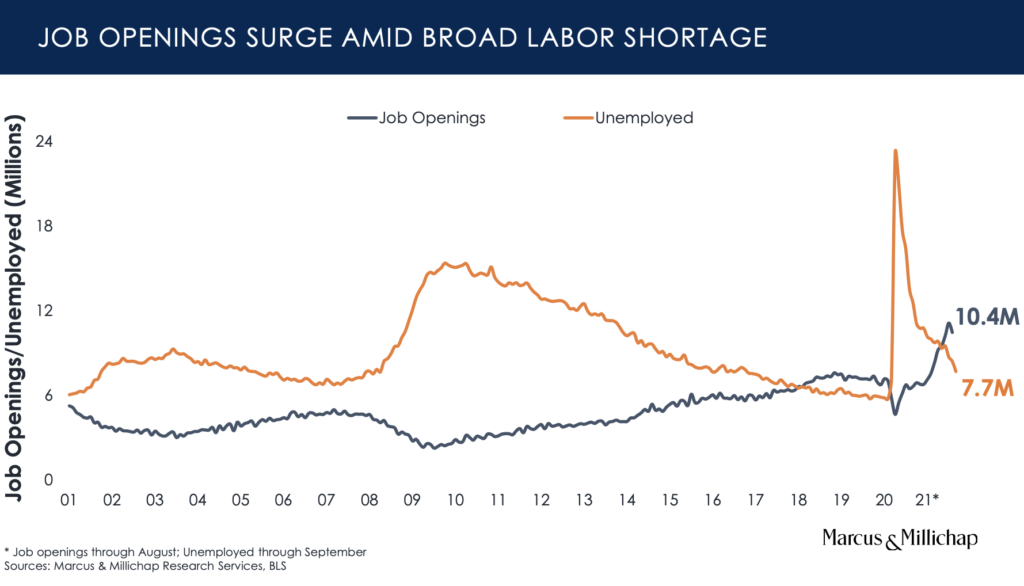

Nearly all the 22.8 million jobs gained in the 10 years prior to the pandemic were lost in just the first two months of the pandemic. However, the labor market has recovered quickly, bringing back over three-fourths of the jobs lost, Sebree said. Despite this progress, the number of jobs available (10.4 million) outweighed the number of people unemployed (7.7 million) as of September. Sebree noted, however, the labor participation rate will likely rise as federal stimulus money winds down.

Panelists discussed the cross-industry challenge of hiring new workers, especially in the leisure and hospitality sector that requires in-person work, Barry Sternlicht of Starwood Capital Group shared during the Fireside Chat with Ivan Kaufman, Chairman and CEO of Arbor. The proliferation of work from home has created another obstacle for many industries looking to bring people back to the office.

“We’re trying to hire, and a lot of candidates are saying they won’t take a job unless they can work remotely,” explained Jeff Lee of NewPoint Real Estate Capital speaking on the Capital Markets panel.

Multifamily Rent Growth is Off the Charts

Across the board, eCore21 panelists discussed their shock at the exponential multifamily rent growth seen through 2021. Most of the top 10 metros for year-over-year rent growth through the third quarter were in the Sun Belt. All 10 achieved rent increases over 17%. Phoenix topped the list with 25% annual growth. Panelists had differing opinions on how much longer this growth will continue, but all agreed these increases will likely decline to more normal levels over time.

“The market is very hot, but that run is going to end,” noted Pat Carroll of real estate firm CARROLL on the Navigating Multifamily panel. He noted that now is a good time for multifamily owners to evaluate and upgrade their portfolios to ensure their assets are all generating value. Kaufman added during the Fireside Chat that he expects rent growth to normalize back to 3% to 4%. “I don’t think you can buy properties going forward thinking that 10 to 15% rent growth is the new normal,” he said.

Record Apartment Supply Can’t Keep Up With Demand

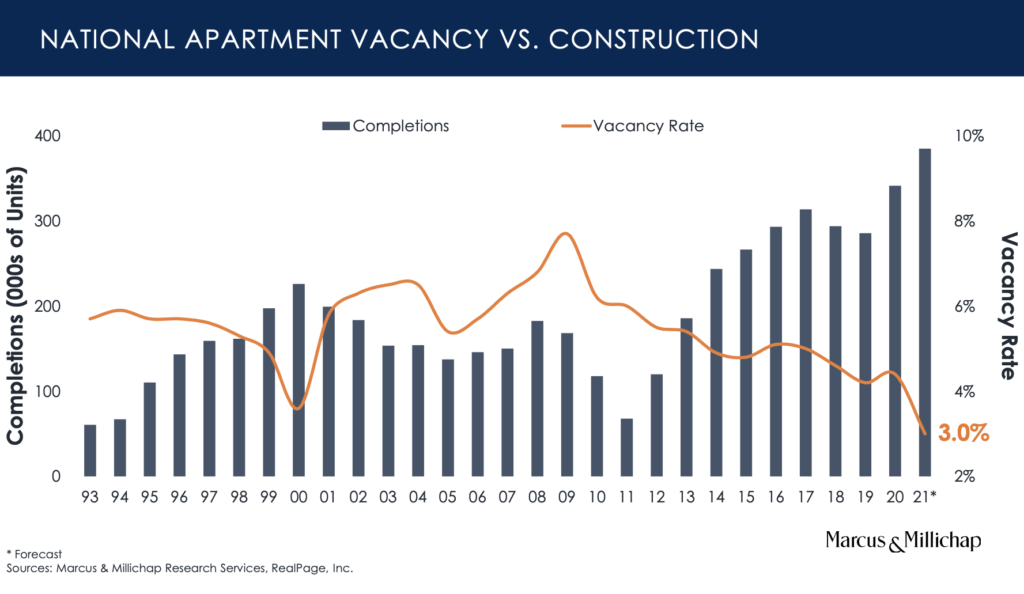

In 2021, 385,000 new multifamily units are expected to be delivered, over 100,000 units more than the six-year average of 280,000, according to Marcus & Millichap data. Despite record supply, the vacancy rate continues to decline, nearing 3%. Through the first three quarters of the year, “net absorption was greater than any time on record,” Sebree explained, reflecting the robust demand remaining for multifamily housing. Even gateway markets that saw renter out-migration during the pandemic are creating new supply. New York is forecast to deliver 18,000 units, coming in second among the top 10 metros for 2021 completions, Sebree explained.

Rising Interest Rates

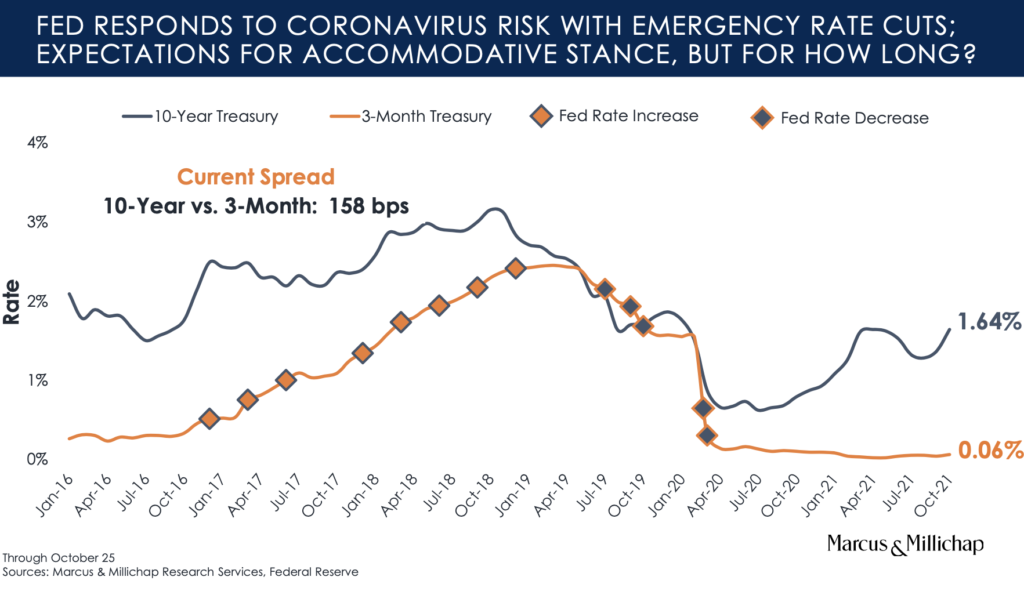

A top concern mentioned by panelists during eCore21 was potential interest rate increases given the high inflationary environment. As the Federal Reserve begins to taper its pandemic-related bond buying program and consider monetary tightening, Federal Reserve Chair Jerome Powell may be pressured to raise interest rates, Sebree noted, but any movements remain to be seen.

While interest rates are at historic lows, it’s a great time to lock in fixed-rate debt, noted Jordan Slone of Harbor Group on the Capital Markets panel. Kaufman added during the Fireside Chat that if interest rates go up, cap rates will widen and the robust price appreciation we’ve seen this year will likely begin to decline.

Panelists throughout eCore21 noted their surprise at multifamily’s quick recovery from the pandemic, with surging rent growth and robust demand in many markets. There are concerns about how long this run can last, but right now there are no signs of a slowdown for the multifamily market.

For more multifamily research and insights, visit arbor.com/blog.