eCore21 Recap: Industry Leaders Share Insights on Multifamily

The Arbor Realty Trust team recently attended the Executive Conference on Real Estate (eCore) in early November in Miami, FL, an exclusive event for leading multifamily industry executives, lenders, owners and operators to network and share their insights on the market.

The event began with Arbor’s Sunday Night Tailgate and Welcome Bash. Attendees had the opportunity to catch up with fellow colleagues, clients and partners to kick off the week.

Lively panel sessions started the next day with discussions on the capital markets, the national economic overview and multifamily outlook, how multifamily investors are navigating today’s market and a Fireside Chat with Arbor’s Chairman, CE and President Ivan Kaufman.

Multifamily Capital Markets

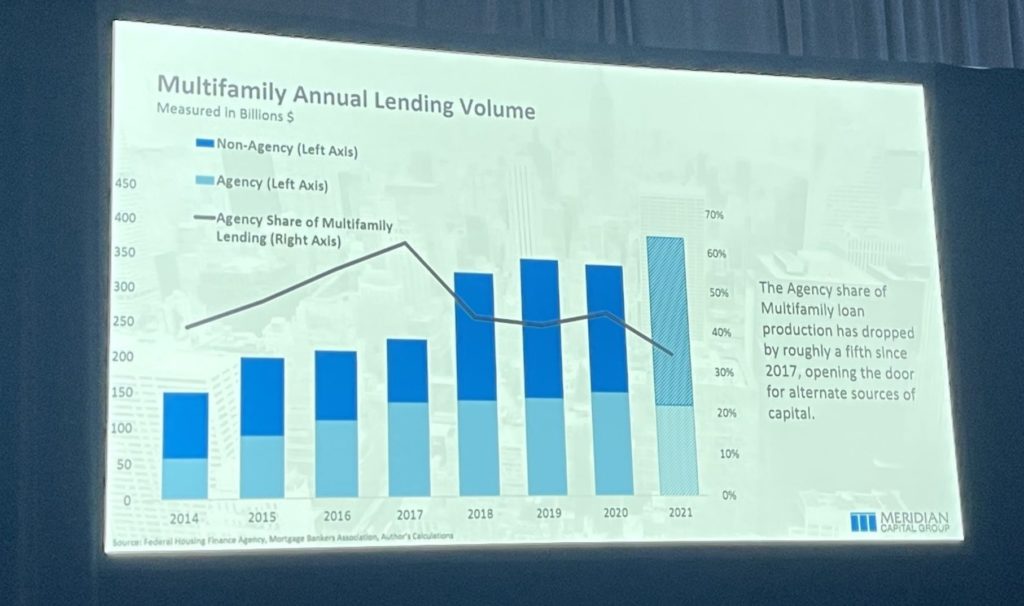

The capital markets panel featured bank and non-bank lenders who shared their views on the multifamily lending environment. They covered where they see transaction volume, rent growth and new supply heading into 2022. Panelists noted multifamily transaction volume this year reached new highs with substantial liquidity remaining on the sidelines. They acknowledged the development challenges seen earlier this year, with deliveries tapering off due to elevated construction costs, supply chain bottlenecks and labor shortages.

The panelists also discussed how cap rates have continued to compress. Multiple panelists agreed there is still room for further compression given the large amount of dry powder focused on the property type. On the lending side, panelists noted that he agencies will maintain their critical role in the market. However, because of their loan purchase caps, the non-agency lenders will continue to take on bigger roles in the market to fill the gap.

Multifamily Outlook and Economic Overview

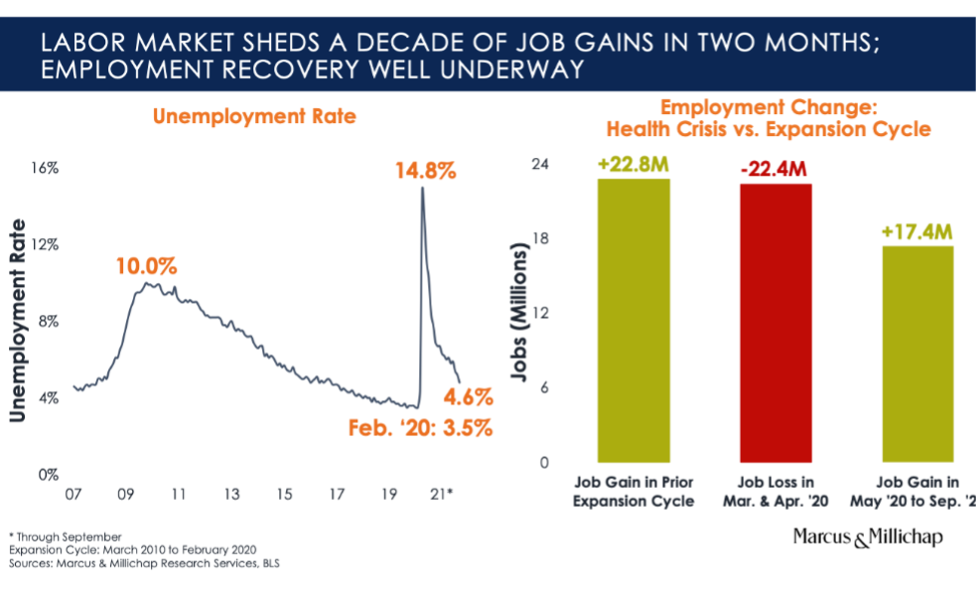

The second panel featured an insightful presentation from John Sebree, SVP and National Director, Multi Housing Division at Marcus & Millichap. In his presentation, Sebree discussed the V-shaped recovery. He noted that while COVID was a major shock, the economy has quickly rebounded. Nearly all the 22.8 million jobs created in the 10 years prior to COVID were lost in March and April of 2020. Through September of 2021, the labor market has gained back 17.4 million, or more than 76% of lost jobs.

The hardest-hit markets, including the Bay Area, Los Angeles and Northeast, are aggressively rebounding while Sun Belt markets like Phoenix, Austin and Jacksonville are seeing exponential job growth, with many having more jobs than they had prior to the pandemic.

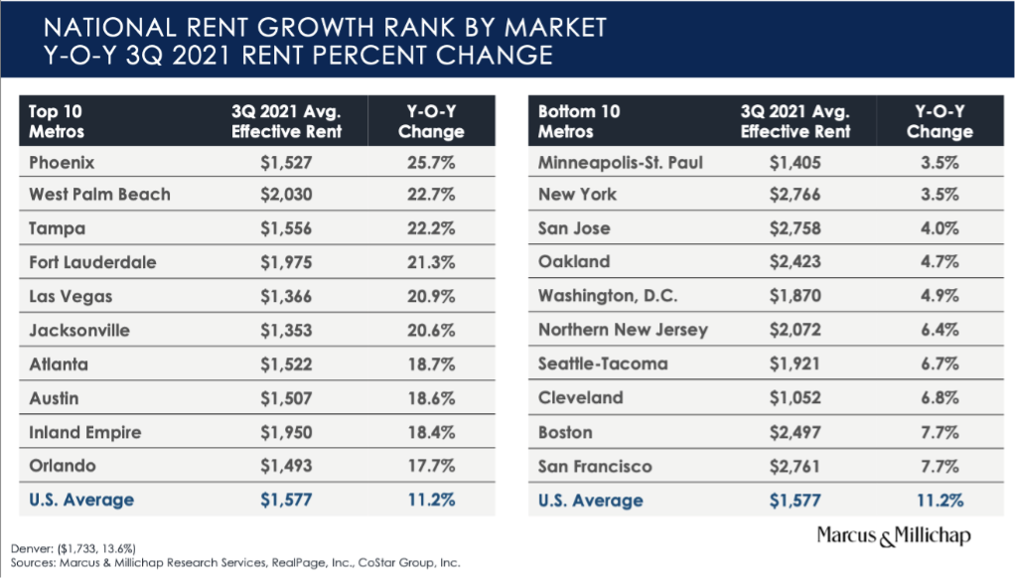

Unsurprisingly, the markets seeing strong job growth are also achieving robust rent growth. Year-over-year rent growth in the third quarter was above 17% for the top 10 metros, with Phoenix seeing over 25%. Outside of the Sun Belt, Las Vegas saw a significant jump in rents. Rent growth shows no signs of slowing down as apartment completions are also at all-time highs. Completions are expected to hit 385,000 by year-end, with absorption reaching pre-pandemic levels in many cities.

Multifamily Investment Strategies

Day 1 closed out with a panel featuring some of the nation’s top multifamily owner-operators. They shared their unique strategies for identifying properties and markets. While each panelist had their own preferred approach, they agreed it’s critical to focus on strong fundamentals and to follow the population growth. The Sun Belt has seen exponential growth, but many gateway markets are becoming more attractive as renters return. Competition is high, leading some panelists to look at less traditional cities where they can differentiate themselves and find yield. They noted the need to frequently evaluate their portfolio and remove assets that no longer generate value or sell assets once they’ve achieved their target returns.

Multifamily Crowdfunding

Starting off Day 2, Adam Kaufman, co-founder of real estate crowdfunding platform ArborCrowd, sat on a panel with industry colleagues to discuss how online investment platforms are changing the real estate landscape. Panelists agreed that crowdfunding is just beginning to tap into a new potential investor base and platforms will need to find ways to differentiate themselves.

“We’re just scratching the surface, there’s a lot of untapped areas to explore and it’s just growing, and access is just growing,” Kaufman said.

Kaufman emphasized his company’s focus on multifamily assets and its unique ability to provide the equity for transactions and while partnering with Arbor Realty Trust to provide the debt. He highlighted the importance of working with sponsors who are knowledgeable about the market and are fully committed to their business plan, something that all the panelists agreed on.

Learn more about the crowdfunding panel on Arborcrowd.com.

Multifamily Fireside Chat

The main event of Day 2 was the Fireside Chat between two major industry leaders, Arbor’s Chairman and CEO Ivan Kaufman and Starwood Capital Group’s Chairman and CEO Barry Sternlicht. The two discussed the major issues keeping them up at night, including the political climate, the impact of the infrastructure bill on construction costs and potential tax increases.

Another major concern the two CEOs discussed was rising interest rates as inflation is reaching new highs. Kaufman shared his view with attendees that now’s a good time to be cautious and understand your business. If interest rates do go up, cap rates will likely widen. The duo also discussed where they see multifamily in the year ahead, noting that the current level of rent growth and cap rate compression is not sustainable. Kaufman noted that current annual rent growth of 10 to 15% is likely an anomaly that he expects to level out to the 3% to 5% range in the future.

Stay tuned for more coverage from eCore21.