Market Shifts Fuel Rental Demand

- Rents are surging, rising by double digits nationally.

- Housing demand remains inflated, outstripping the current supply.

- In areas with a supply/demand mismatch, affordability is declining.

In many parts of the U.S., a supply/demand mismatch is pushing rents higher at a time when interest rate hikes are causing some would-be home buyers to consider delaying ownership, Kimberly Byrum, Zonda’s Managing Principal explained in a recent presentation about the state of the multifamily housing market.

The Rent Surge

Rent prices have surged in the last nine months. All markets have seen an increase of at least 10% and have risen 19% nationally. According to Byrum, there is nothing in the data that would suggest this trend will reverse itself anytime soon. Three reasons why:

– Low availability of vacant units

– A limited pipeline of new housing

– Highest renewal rates in history (58% in Q1 2022)

Supply and Demand

Housing demand is inflated across the country, but it is particularly high in many Sun Belt cities. In fact, nine U.S. markets saw a 40% or more increase in demand, including Fort Worth (+143%), Houston (+74%), and Los Angeles (+73%).

A lack of supply may be to blame. Demand was two times higher than supply in 2021. This mismatch has resulted in a 5.6% increase in renewal rates between Q4 2020 and Q4 2021, and the number of vacant units has fallen below one million nationally.

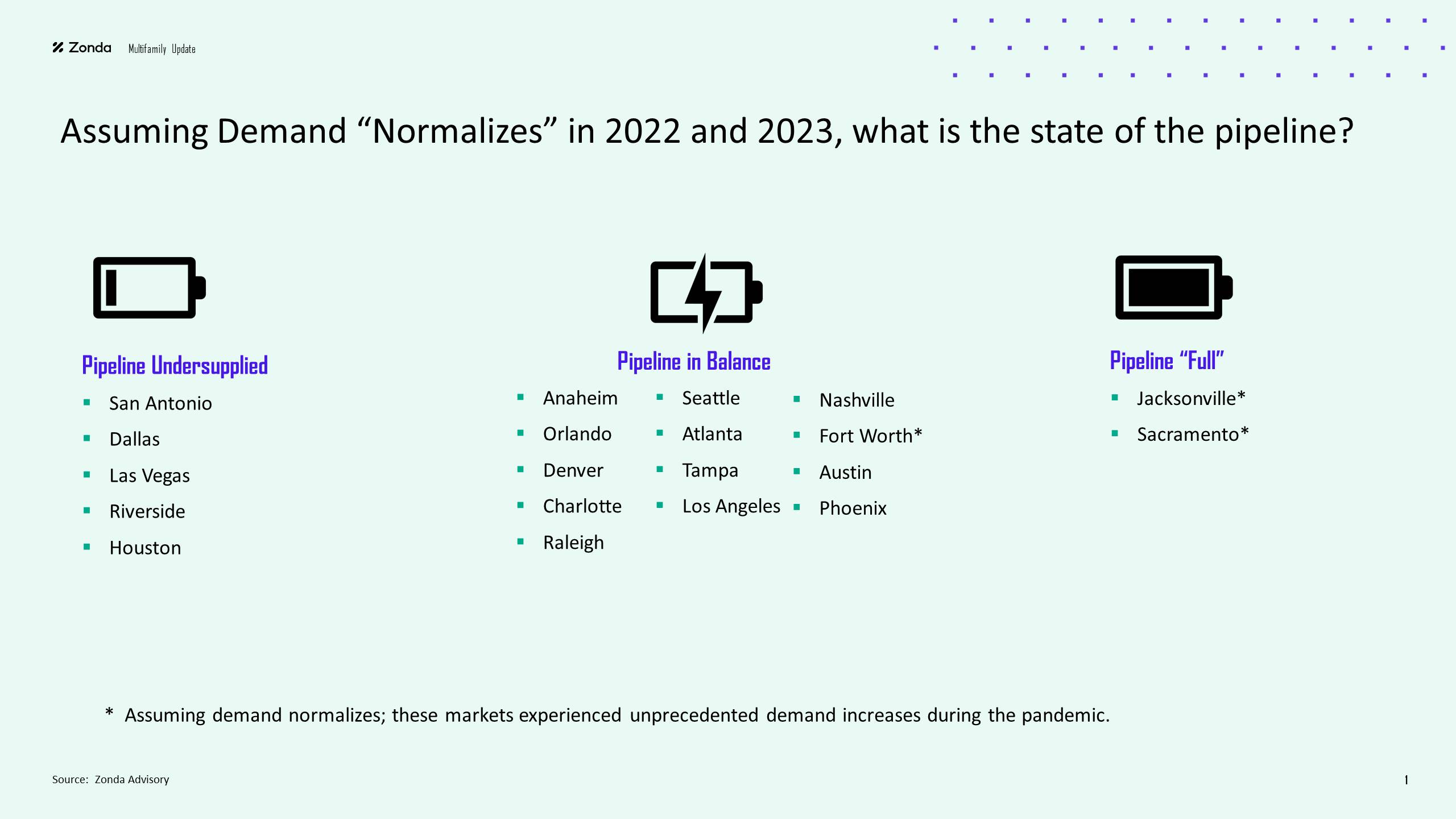

The State of the Housing Pipeline

The pipeline of new housing offers a glimpse into the future of the homebuilding market. In many large markets rising demand outstrips current supply.

The New Calculus of Affordability

In places where there is a supply/demand mismatch, declining housing affordability has become pervasive. In Nashville, Jacksonville, Atlanta and 10 other U.S. cities, average Class A rents have risen above 100% of that area’s median income. At the same time, would-be home buyers now face rising interest rates, which have pushed up the monthly mortgage payment over 30% in some places such as Dallas.

These market shifts have quickly combined to create a new calculus of renting vs. buying, which is likely to fuel demand in the rental market. For example, in Plano, TX, the length of time it would take to make economic sense to buy a house rather than rent one has now been extended from six to nine years.

According to Byrum, these indicators point to a solid multifamily housing market poised to continue growing in the coming quarters.

Visit Zonda’s blog & news page to watch the full webinar.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.