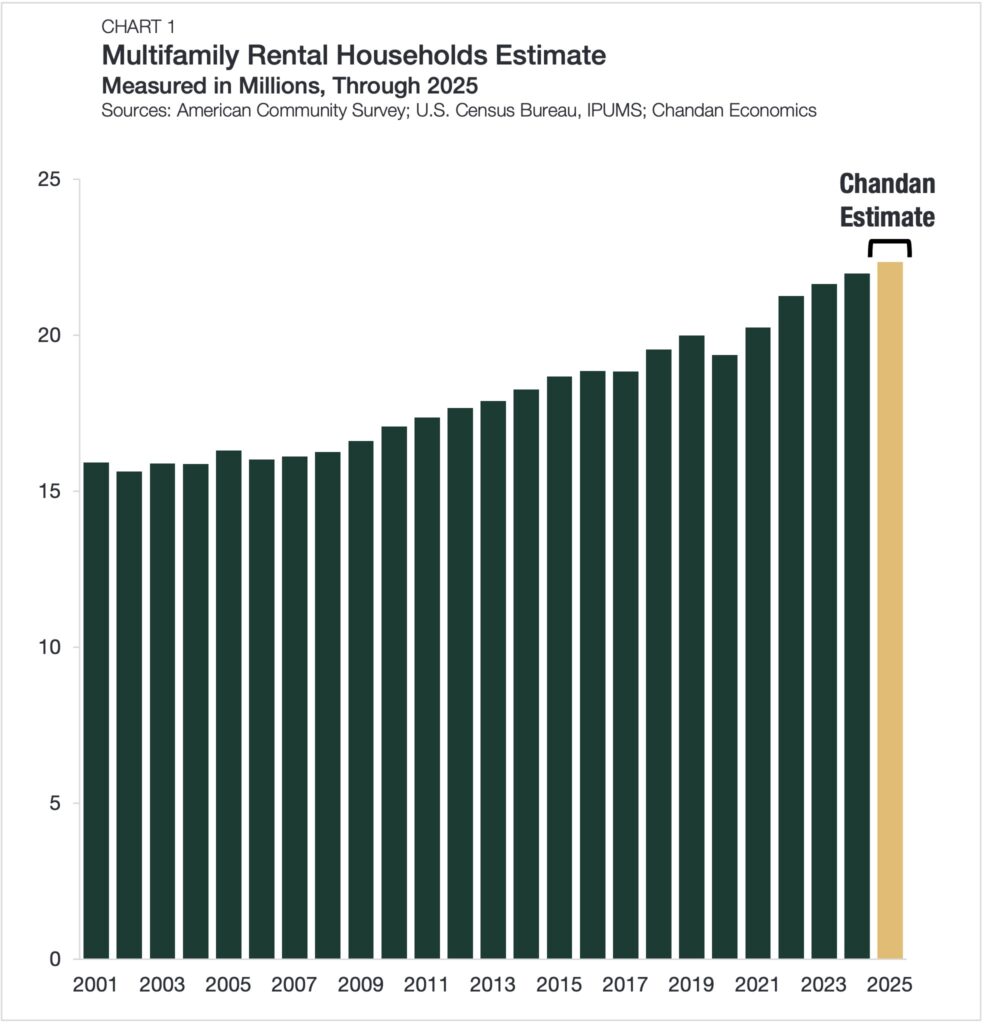

Multifamily Households Estimate Hits Record High

- According to preliminary estimates, the number of multifamily rental households grew to 22.4 million in 2025.

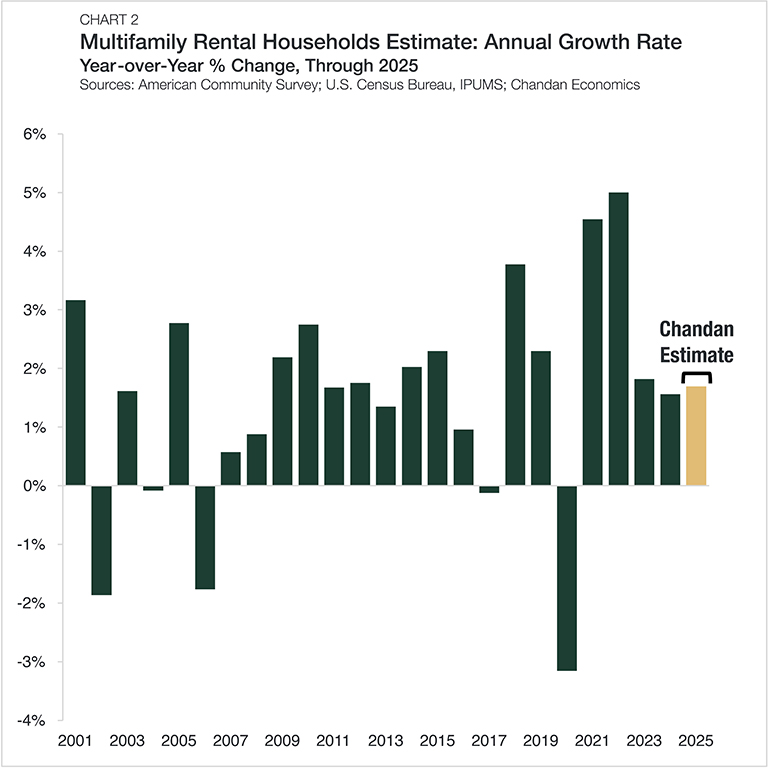

- Multifamily household growth has held between 1.6% and 1.8% for three consecutive years.

- Historically elevated completions and strong demand factors combined to support sustained growth in multifamily households last year.

The multifamily rental households estimate reached an all-time high of 22.4 million in 2025, following meaningful post-pandemic shifts in affordable housing and rental demand (Chart 1). The commercial real estate pillar maintained its growth, as new inventory and persistent homeownership constraints supported a rising number of multifamily household formations.

Newly released official estimates from the U.S. Census Bureau’s American Community Survey indicate that multifamily rental households hit another record of 22.0 million in 2024. Looking at the most recent calendar year, forecast models from Chandan Economics estimate that the multifamily sector remained in growth mode in 2025, with the number of households rising by 372,944.

The new estimates show that household growth in the multifamily sector has settled into a healthy pattern, with the annual growth rate remaining between 1.6% and 1.8% in each of the past three years (Chart 2).

Compared to 2020, when the multifamily household estimate dipped to 19.4 million, 2025 posted a robust 15.4% increase. By contrast, total U.S. households grew by 5.3% over the same period. The net gain of 3.0 million multifamily households since 2020 is the most for a five-year period in more than 20 years.[1]

Factors Supporting Growth

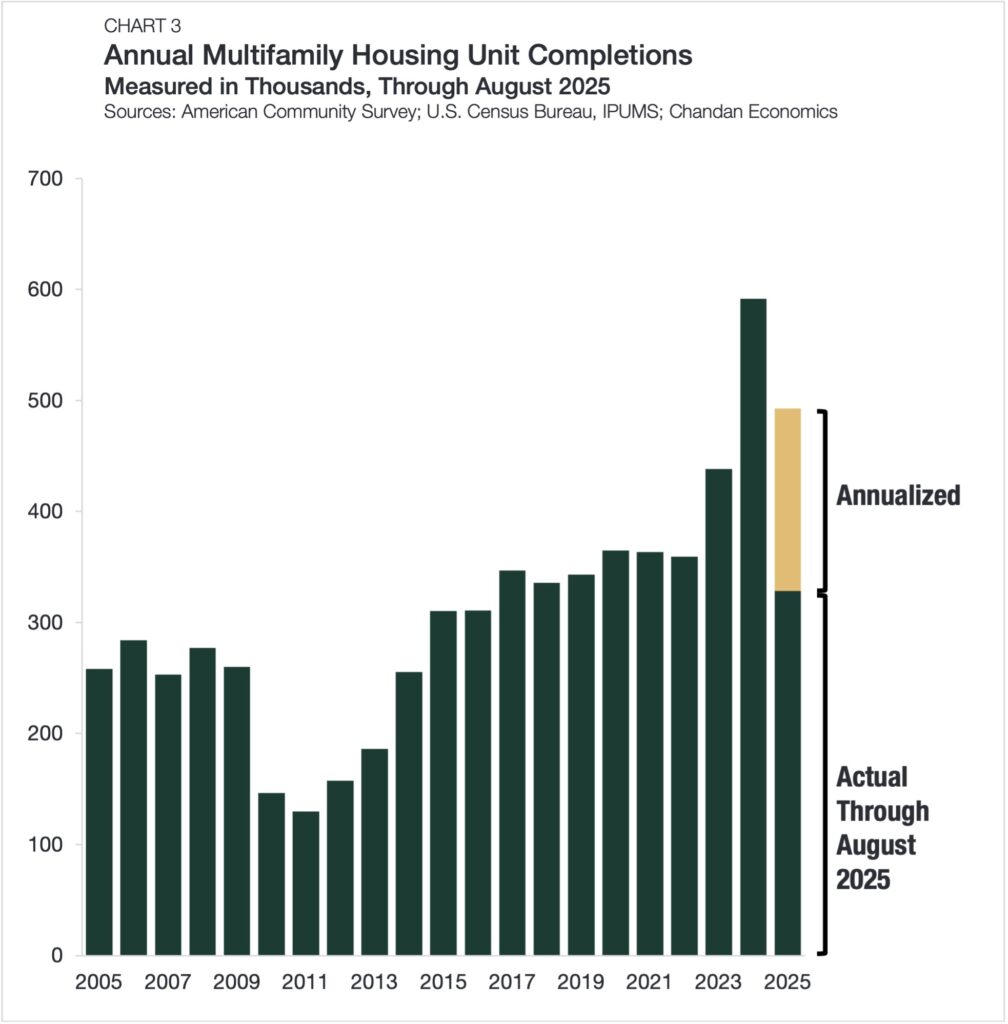

The multifamily sector has had consistent household growth over the past two years, driven by a combination of supply- and demand-side factors. According to the Census Bureau, 591,400 multifamily units were completed in the U.S. in 2024 — the highest annual total since 1974. Through August 2025, another 328,500 units were delivered in 2025, increasing the annualized pace to 492,750 multifamily completions (Chart 3). Without inventory rising at such a robust pace over the past three years, the potential ceiling for multifamily household formations would be lower.

[1] Note: The Census Bureau’s American Community Survey began annual tracking in 2000 — making 2005 the first possible observation for 5-year cumulative growth.

Factors Supporting Demand

On the demand side, corporate efforts to bring employees back to the office have supported rental demand in many major metropolitan areas. A return to on-site work has reinforced the appeal of proximity to employment hubs, particularly in large coastal metros where multifamily housing is closely integrated with transit networks and job centers. As a result, urban submarkets where demand softened during the pandemic have been rebounding.

At the same time, the transition to homeownership has become tougher. The Federal Reserve Bank of Atlanta estimates that homeownership-related costs now consume roughly 43% of the median household’s income, well above the 30% threshold commonly used to define affordability.

Supply and demand dynamics help explain why multifamily household growth remained resilient despite a sharp increase in new deliveries. The continued growth of the rental population has eased pressure on rents and maintained high occupancy, a combination that supports the overall stability of the sector.

The Bottom Line

Multifamily household growth in 2024 and 2025 was supported by a range of factors, including limited pathways to affordable homeownership, a renewed push toward in-office work, and historically elevated supply deliveries. While the surge in new supply expanded rental availability and facilitated absorption of pent-up demand, it also steadied annual rent growth.

With strong structural demand intact and the supply pipeline reverting toward historical norms, 2026 should bring stabilization in both multifamily household growth and rent performance.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.