Multifamily households reached a new high for the third consecutive year in 2023, extending a growth spurt that began after the 2008 housing crisis. With strong tailwinds at its back, multifamily’s latest record may not stand for very long.

Multifamily is Well-Positioned for Short- and Long-Term Growth

With the macroeconomy maintaining its underlying strength and a handful of rate cuts expected by the Fed within the next 18 months, green shoots of optimism within the multifamily sector are multiplying. Even as high interest rates impede normal operations, stabilization is underway while the sector’s long-term prospects remain unwavering. In this deep dive, our research teams will explore the tailwinds underpinning the multifamily sector’s short- and long-term outlook.

Regional Construction Trends: Annual Multifamily Completions Surged in the South and West

After the volume of newly issued multifamily permits hit a 37-year high in 2022, multifamily completions surged another 22.3% last year. As the sector continues to gain strength, its growth has remained concentrated in the southern and western regions of the country, according to an analysis of new data from the U.S. Census Bureau’s Survey of Construction.

The Evolving Characteristics of Multifamily Construction

During the post-global financial crisis (GFC) cycle, a disproportionate share of new multifamily construction was of high-rise units in properties with amenities. However, the tides have turned. The rising cost of homeownership has brought the need for more affordable housing development in the U.S. to the top of many legislative agendas. In this deep dive, our research teams utilize data from the U.S. Census Bureau’s Annual Survey of Construction to show how and why the characteristics of new multifamily properties continue to evolve alongside shifting market needs.

Single-Family Rental Investment Snapshot — July 2024

On balance, the SFR sector continues to demonstrate strength amid economic turmoil, attracting increased attention from the broader multifamily investment community.

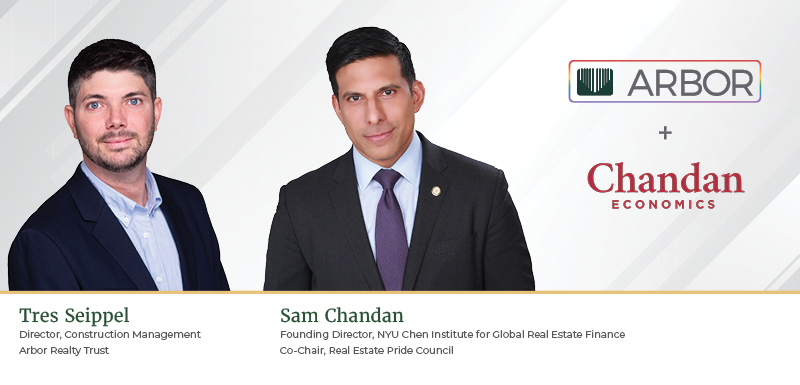

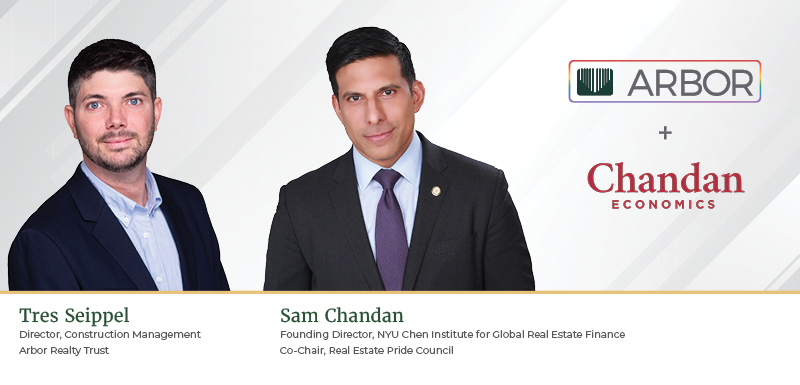

Video: Growing LGBTQIA+ Visibility in the CRE Industry

LGBTQIA+ Pride Month is recognized in June, but its lessons are timeless. During a recent conversation between Tres Seippel, Director, Construction Management at Arbor, and Dr. Sam Chandan, Founder of Chandan Economics, Founding Director, NYU Chen Institute for Global Real Estate Finance, and Co-Chair of the Real Estate Pride Council, Seippel shared why it is more important than ever for the industry to embrace visibility and show support for employees who identify as LGBTQIA+ or other diverse backgrounds.

Video: Dr. Chandan’s Affordable Housing Trends Report Takeaways

In this exclusive, new video, Dr. Sam Chandan, Founding Director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business and non-executive chairman of Chandan Economics, contextualizes the key takeaways from Arbor’s Affordable Housing Trends Report Spring 2024, developed in partnership with Chandan Economics.

Rare Cross-Aisle Consensus Backs Housing Choice Vouchers

In Washington, D.C., the Section 8 Housing Choice Voucher (HCV) program is championed by Republicans and Democrats alike, making it a rare meeting ground for consensus.

Small Multifamily Investment Snapshot — June 2024

Although many anticipate more hawkish monetary policy in the months ahead, multifamily’s structural strength has historically helped it withstand heavy headwinds.

How Multifamily Property Renovations Add Value and Marketability

The ideal time to renovate is when the rental market is strong. With high occupancy rates, borrowers are more likely to quickly realize returns on their multifamily property renovations through higher rents. However, renovating during a market downturn, when rents are often cheaper, inventory is higher, and materials are more affordable, is also a sound strategy.

Single-Family Rental Investment Trends Report Q2 2024

Quarter after quarter, the single-family rental (SFR) sector reaches new heights. From new construction to cap rates, Arbor’s Single-Family Rental Investment Trends Report Q2 2024, developed in partnership with Chandan Economics, details how the sector’s healthy fundamentals create profound optimism in its long-term prospects.