Articles

For more than 30 years, Arbor has been committed to growing financial partnerships that meaningfully impact communities nationwide. From planting trees to celebrate closed loans to supporting environmental organizations, our work has always been a win-win for our financial partners and the planet. But just as leaves change with each passing season, Arbor’s branding is evolving to seize the moment by embracing our roots with True Colors.

Articles

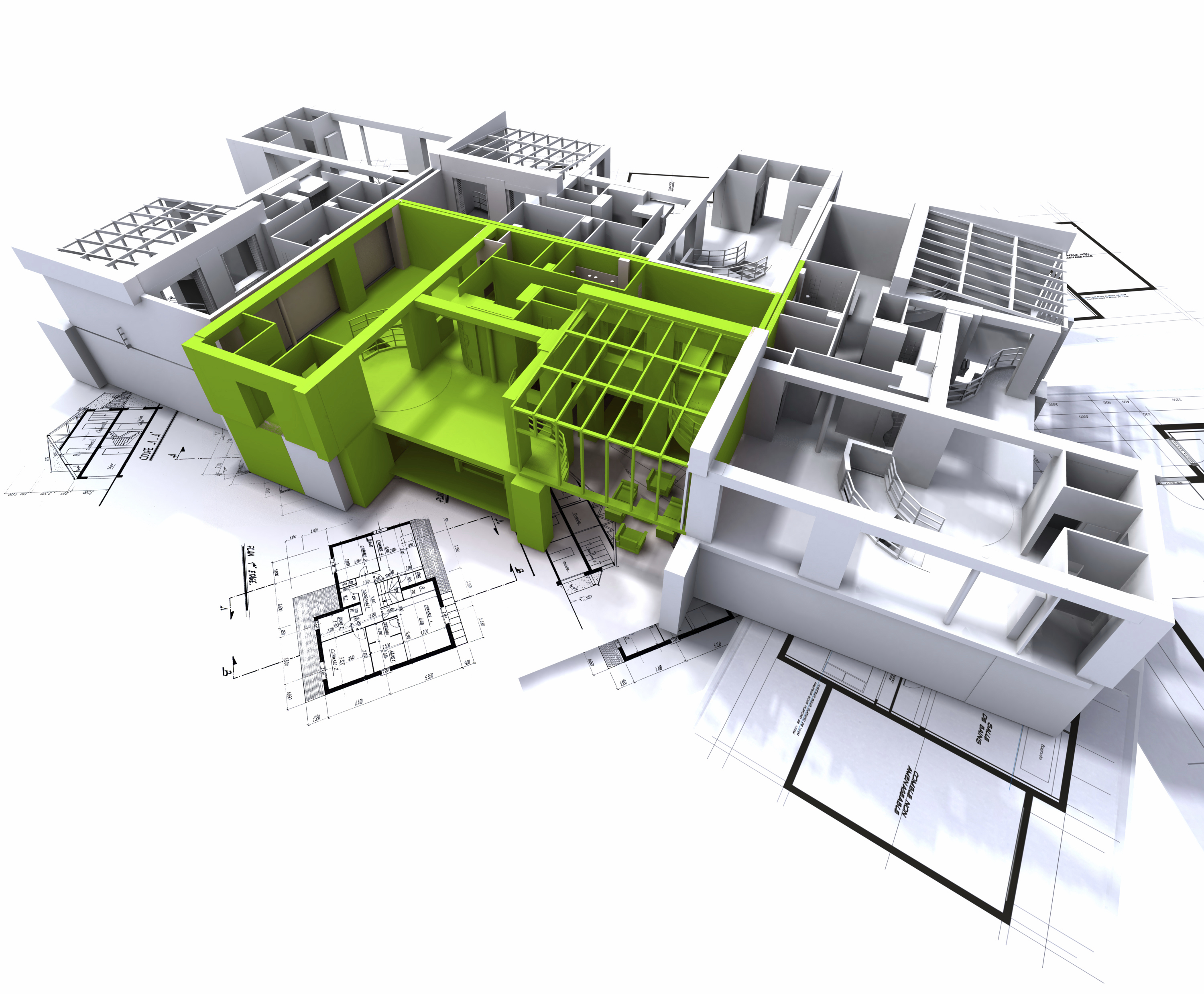

Since the Fannie Mae Green Rewards program launched in 2015, green financing has become a mainstay of commercial real estate. In addition to reducing the environmental impact of multifamily housing, the Green Rewards program creates a triple bottom line with increased cash flows, higher quality housing, and lower energy and water usage. With a high upside and little downside, the program is well worth multifamily borrowers’ consideration.

Articles

From California wildfires to rising sea levels to Florida hurricanes, the direct and indirect risks of climate change have grown in recent years, making a more substantial impact on the multifamily sector. As the need for sustainability becomes increasingly apparent, lawmakers and lenders have advanced programs and policies that show “going green” is a win-win.

Current Reports

As housing costs spiral, rental affordability has become a more urgent issue, burdening a greater number of Americans. Arbor’s Affordable Housing Trends Report Spring 2024, developed in partnership with Chandan Economics, examines the major policies and programs shaping the marketplace at a time when overdue federal funding expansions have increased agency budgets.

Articles

In front of professionals and executives from more than 120 companies at the Real Estate Pride Roundtable in New York City in April, dozens of speakers shared honest perspectives on how far the commercial real estate industry has come on LGBTQ+ inclusion and how much more it has to go.

Articles

Lifestyle renters — those who have the means to own but prefer to rent or are willing to pay more for apartments with amenities — have become a key driver of rental demand in single-family rental homes, build-to-rent communities, and other types of high-quality multifamily housing. With this small yet influential demographic growing, our research teams examine and explain the factors driving lifestyle renter demand.

Articles

On balance, the SFR sector continues to demonstrate strength amid economic turmoil, attracting increased attention from the broader multifamily investment community.

Articles

With nearly one-fifth of multifamily properties now over 65 years old, it’s time to consider solutions for rejuvenating the rental housing stock in the U.S. While building rehabs are a tried-and-true solution, build-to-rent (BTR) is an alternative that is well-positioned to expand as Americans increasingly favor renting over homeownership.