National rent growth in the single-family rental (SFR) sector remained strong and consistent in 2025 as market-level pricing momentum was broad-based and robust, according to an analysis of newly released data from the Zillow Observed Rent Index. Year-end annual rent gains averaged 2.9%, down from 4.1% in 2024, marking the most modest increase since 2015. But even as the intensity of SFR rent growth abated last year, its reach was extensive, with 98 of the 100 largest markets posting year-over-year gains.

Single-Family Rental Investment Trends Report Q4 2025

Cap Rates Rose as Rents Climbed Steadily

Key Findings

-

SFR cap rates trended higher for the third consecutive quarter, as rents outpaced home prices.

-

All of the 50 largest U.S. metros recorded positive year-over-year SFR rent growth.

-

Debt yields rose again and are now up 280 bps since the second quarter of 2022.

Table of Contents

State of the Market

The single-family rental (SFR) sector, supported by healthy fundamentals, demonstrated its strength and durability again last quarter as the for-sale home market softened.

From a cash-flow perspective, the investment return profile of the SFR sector is even more attractive this year than it was last year. Cap rates have risen by nearly two percentage points since 2021, driven by moderating home prices and consistent rent growth.

Homeownership remains prohibitively expensive for many, which continues to boost demand for single-family rentals. Today, the median U.S. household needs to devote 43% of its income to housing payments to buy a home, according to the Federal Reserve Bank of Atlanta. With demand up, SFR occupancy rates edged higher in the second quarter, bolstering rent growth in the Midwest and other regions.

As a result of the recent federal government shutdown, real-time insights, such as build-to-rent starts, were unavailable during this reporting period. However, available data points continued to show that the SFR sector remains firmly set on a path of steady growth after more than a decade of rapid expansion.

Performance Metrics

CMBS Issuance

Following a notable increase last year, structured SFR capital markets remained active in 2025, albeit at a slightly slower pace. According to Finsight, year-to-date SFR CMBS issuance totaled $5.5 billion through October, putting the sector on track to reach $6.6 billion for the year. If realized, 2025’s tally will be $1.2 billion behind 2024’s total of $7.8 billion (Chart 1).

Although deal flow in SFR CMBS can vary widely quarter-to-quarter, capital markets remained steady through the first three quarters of this year, demonstrating the sector’s increasing stability.

REIT Acquisitions & Dispositions

Public SFR REITs modestly increased their net buying activity through the first half of 2025, signaling a cautious return to growth after a pullback from 2022 to 2023. A Capright analysis of Nareit data shows net acquisitions improved over the past four consecutive quarters, reaching $0.45 billion in the second quarter of 2025, its strongest level since mid-2022 (Chart 2). The shift reflects slightly higher acquisition volumes alongside slower dispositions, as operators selectively deploy capital into higher-yielding markets and newly built inventory. While dispositions remained part of ongoing portfolio pruning, large-scale asset shedding eased. Overall, recent REIT activity suggests the market has been settling into a more typical, disciplined rhythm.

Occupancy

Note: Due to the recent federal government shutdown, updated data for this section was not available.

According to the U.S. Census Bureau, occupancy rates across all SFR property types averaged 94.5% in the second quarter of 2025 (Chart 3), 80 basis points (bps) higher than in the first quarter. Not only did the second-quarter increase break a four-quarter streak of declines, but it also marked the most significant quarterly improvement in the last four years. SFR occupancy rates averaged 93.9% between 2015 and 2019. After falling below this benchmark earlier in 2025, the second-quarter improvement moved the sector’s occupancy rate well above the pre-pandemic average.

Rent Growth: National

Nationally, SFR rent growth continued to ease down from the post-pandemic boom years. According to Zillow’s Observed Rent Index, rents were up 3.3% year-over-year through October 2025 (Chart 4). Annual rent growth peaked at 4.2% in November 2024 and has decelerated for 11 consecutive months, bringing its pace to roughly one percentage point below the pre-pandemic norm. Despite losing some momentum, rents have steadily increased on an annual basis.

Rent Growth: Metros

Among the 50 largest U.S. metros, Cleveland, OH, led the way with year-over-year SFR rent growth up 6.5% as of October 2025 (Chart 5). Indianapolis, IN (+6.1%) and Providence, RI (+5.8%) followed closely behind. Regionally, the Midwest continued to outperform, accounting for nine of the top 17 markets. Austin, TX, which has lagged other markets for nearly two years, returned to positive territory in October with 0.9% annual growth. While far from robust, its shift back to positive rent growth marks an important directional milestone.

Cap Rates

SFR cap rates trended upward again in the third quarter of 2025, rising six bps to reach 7.1% (Chart 6).1 Cap rates across the sector have experienced upward pressure as home price growth has stalled and rents have continued to rise, leading to higher operating income per dollar of asset value. Since bottoming at 5.4% in late 2021, cap rates have increased in 13 of the past 15 quarters, climbing a total of 177 bps.

1 Unless otherwise noted, the Chandan Economics data covering single-family rental cap rates and debt yields are based on model estimates and a sample pool of loans. Data are meant to represent conditions at the point of origination.

The spread between SFR cap rates and the 10-year Treasury yield — a proxy for the sector’s risk premium — widened to 288 bps in the third quarter (Chart 7). Treasury yields averaged 4.3%, down 0.1% quarter-over-quarter. Similarly, the spread between single-family rentals and multifamily properties widened slightly (+8 bps) to 144 bps.

Pricing

Measured year-over-year, single-family home valuations remained positive through October 2025, though by only a thin margin. Zillow’s Home Value Index shows the average U.S. single-family home value rose to $362,501 — up just 0.2% from one year earlier (Chart 8). Home values fell for six consecutive months through August before turning positive again in September and October. From the February 2025 peak, prices were down by 0.5% (or $1,768). Over the next 12 months, Zillow forecasts home price growth of 1.5%.

Debt Yields

Debt yields — a key measure of credit risk — rose again in the third quarter of 2025, increasing 22 bps to 11.2% (Chart 9). Compared to the low of 8.4% in the second quarter of 2022, debt yields have climbed 280 bps. Rising yields reflect lenders’ preference for higher cash-flow cushions and lower leverage when pricing uncertainty increases.

These higher yields mean SFR investors have been securing less debt capital for every dollar of property-level net operating income (NOI). Through the third quarter, investors obtained an average of $8.96 of debt per $1.00 of NOI, down $3.00 from the 2022 peak and down $0.61 from one year prior. As leverage tightens, investor focus is shifting toward stabilized assets and portfolios with strong operating fundamentals.

Residential Distress

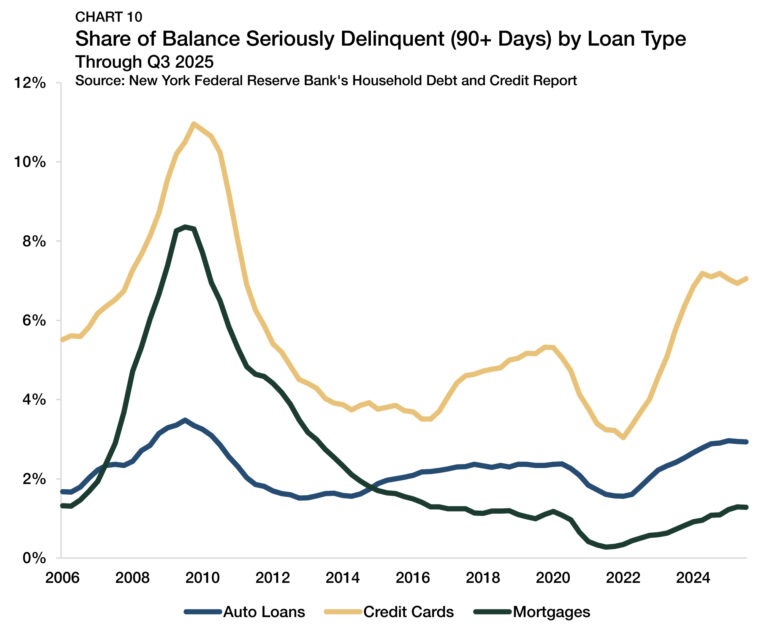

Distress across the U.S. housing market has continued to revert toward pre-pandemic norms. According to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, the share of mortgages more than 90 days delinquent averaged 1.3% in 2025, matching the 2015–19 baseline (Chart 10). Pandemic-era forbearance programs and ultra-low interest rates pushed serious delinquencies below 0.3%, but rates rose steadily over the past three years. The latest data shows that stabilization has returned to long-term norms, breaking a 15-quarter streak of increases.

Delinquencies in the SFR sector have improved even more dramatically. According to DBRS Morningstar, SFR delinquency rates fell from 5.8% in January 2023 to 1.4% as of July 2025 (Chart 11).

Supply & Demand Conditions

Build-to-Rent (BTR)

Note: Due to the recent federal government shutdown, updated data for this section was not available.

Build-to-rent (BTR) has become a driving force behind the growth of the SFR sector. As purpose-built communities are increasingly popular with both renters and investors, they have become the primary method for efficiently expanding supply while also creating product differentiation from typical single-family homes.

In the 12-month period that ended in the second quarter of 2025, 71,000 BTR units were started. During this period, BTR accounted for 7.2% of all SFR construction starts, a quarterly decline of 1.2 percentage points (Chart 12).

After BTR’s market share of single-family construction rose consistently throughout the 2010s and early 2020s, a modest reversion appears to be underway. Still, the pipeline of BTR starts remains robust compared to any benchmark except the recent market peak. The volume of starts in the past year is greater than at any point before the fourth quarter of 2023, and its single-family market share remains above its five-year average (6.5%).

Outlook

So far this year, home price appreciation has softened, and rent growth has slowed, yet the SFR sector will enter 2026 on solid ground supported by a clear set of tailwinds. Mortgage rates are expected to remain elevated well into next year, according to Fannie Mae forecasts, keeping homeownership out of reach for many and sustaining high demand for single-family rentals.

Institutional sentiment remains broadly constructive, with the ULI-PwC Emerging Trends in Real Estate 2026 survey highlighting a favorable investment outlook for the SFR sector due to its relative stability and strong demographic drivers. While tighter capital markets and higher debt yields may have limited leverage and restrained acquisition activity, operators increasingly have focused on disciplined expansion, prioritizing markets with stronger cash-flow performance and reduced development risk.

Although near-term considerations remain, the long-term trajectory for single-family rentals is underpinned by durable demand and a maturing institutional ecosystem.

For more single-family rental research and insights, visit arbor.com/research

Disclaimer

This report is intended for general guidance and information purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. Please note that this is not an offer document. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein and is not prepared in accordance with the regulation regarding investment analysis. The material in the report is obtained from various sources per dating of the report. We have taken reasonable care to ensure that, and to the best of our knowledge, material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. That said, all content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations or warranties, express or implied, as to the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third-party rights. The Companies shall not be liable for any direct, indirect or consequential damages to the reader or a third party arising from the use of the information contained herein. There may have been changes in matters which affect the content contained herein and/or the Companies subsequent to the date of this report. Neither the issue nor delivery of this report shall under any circumstance create any implication that the information contained herein is correct as of any time subsequent to the date hereof or that the affairs of the Companies have not since changed. The Companies do not intend, and do not assume any obligation to update or correct the information included in this report. The contents of this report are not to be construed as legal, business, investment or tax advice. Each recipient should consult with its legal, business, investment and tax advisors as to legal, business, investment and tax advice. The information contained herein may be subject to changes without prior notice. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person.