LIHTC Increase Set to Support Affordable Housing Expansion in 2026

- LIHTC allocations will increase in 2026, creating a more supportive financing environment for affordable housing development.

- Lowering the private-activity bond financing requirement from 50% to 25% will expand eligibility for 4% LIHTC rehabilitation projects and free up bond capacity for additional developments.

- FHFA’s decision to double the amount Fannie Mae and Freddie Mac can invest in LIHTC properties will address rising demand, including in underserved and rural markets.

Low-Income Housing Tax Credit (LIHTC) allocations are about to grow following funding extensions included in the One Big Beautiful Bill Act (OBBBA), signed into law in July. With market-based borrowing costs also declining, the affordable rental sector could be on the verge of its most accommodative financing environment in years.

As highlighted in Arbor Realty Trust’s Affordable Housing Trends Report, OBBBA permanently extends funding increases for each state’s 9% LIHTC allocations. These tax credits support new development, particularly higher-risk projects, by allowing developers to exclude roughly 9% of qualified costs from taxable income each year over 10 years.

Novogradac estimated that, when combined with OBBBA’s reduction in private activity bond (PAB) financing requirements for rehabilitation projects, the LIHTC expansion could finance roughly 1.22 million additional affordable rental homes from 2026 through 2035.

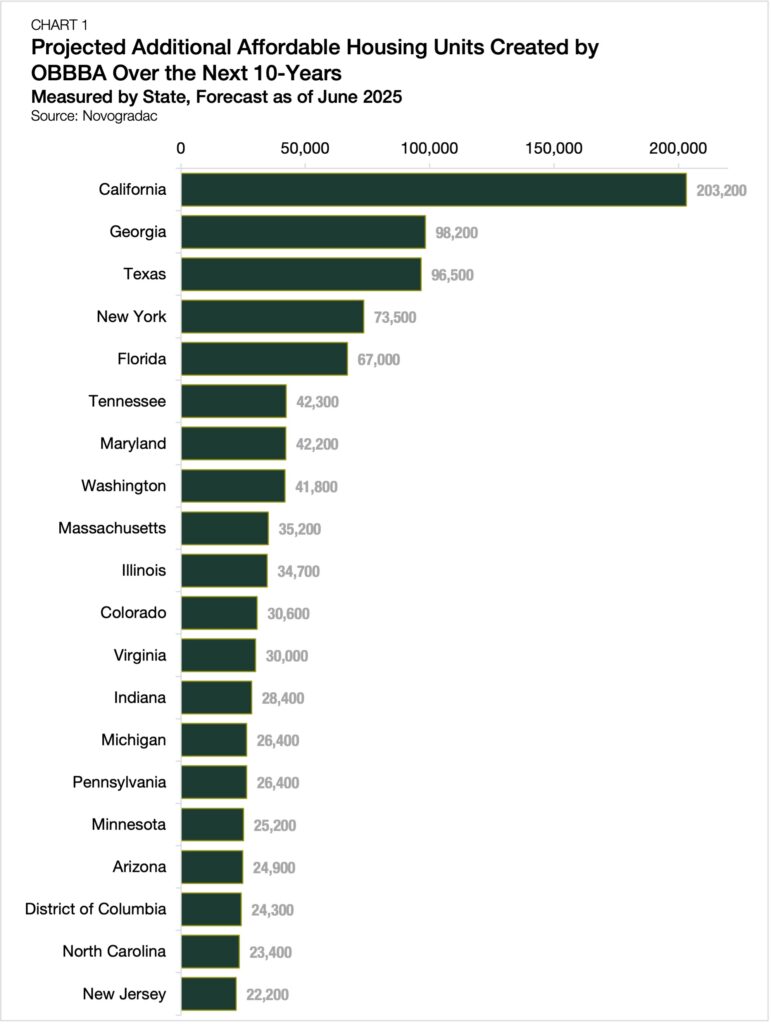

According to Novogradac’s state-level estimates of the expansion’s impact, California is projected to add the most units over the next decade, at just over 200,000. Georgia follows with an estimated 98,000, and Texas is close behind with roughly 97,000.

However, borrowers could stand to receive greater-than-expected benefits from LIHTC’s amended financing requirements. Previously, developers using the 4% LIHTC for rehabilitation projects were required to finance at least 50% of project costs with municipal private-activity bonds — a threshold that constrained eligibility. Under OBBBA, the 50% test is dropping to 25% for buildings placed in service after 2025. As a result, bond capacity previously used to meet individual projects’ 50% requirement can instead be allocated to a broader pool of developments.

States will have discretion over how to deploy the freed-up capital. Still, most estimates of the LIHTC expansion assume that a substantial portion of this capacity will support additional rental housing through expanded financing channels. At the federal level, the Federal Housing Finance Agency (FHFA) announced it is doubling the annual amount that Fannie Mae and Freddie Mac can each invest in safe and sound LIHTC properties, from $1 billion to $2 billion. While the cap increase will have nationwide implications for multifamily real estate, half of these allocations will be dedicated to markets where LIHTC has faced challenges meeting local needs, with at least 20% of that half targeted specifically to rural communities.

The Bottom Line

Already one of the most relied-upon affordable housing financing programs, LIHTC has proven its effectiveness. With rates moving lower and credit availability improving, its expansion provides states and developers with timely reinforcement as they work to meet the nation’s rising demand for quality, affordable rental housing.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.