Regional Multifamily Cap Rates Converge

- The gap between high-cap-rate and low-cap-rate regions narrowed in recent years as affordability-driven migration and capital reallocation compressed yield gaps.

- Cap rates have risen the least in the Midwest during the current cycle.

- Uneven population growth in major West Coast metros challenges near-term NOI assumptions, leading to sharp increases in cap rates.

Multifamily cap rates remain stable nationally, even as regional pricing diverged through the end of last year. While some regions saw compression and others late-stage repricing, regional cap rates show less variation as affordability-driven migration and capital reallocation compressed yield gaps.

U.S. Regions See Tighter High-Low Spreads

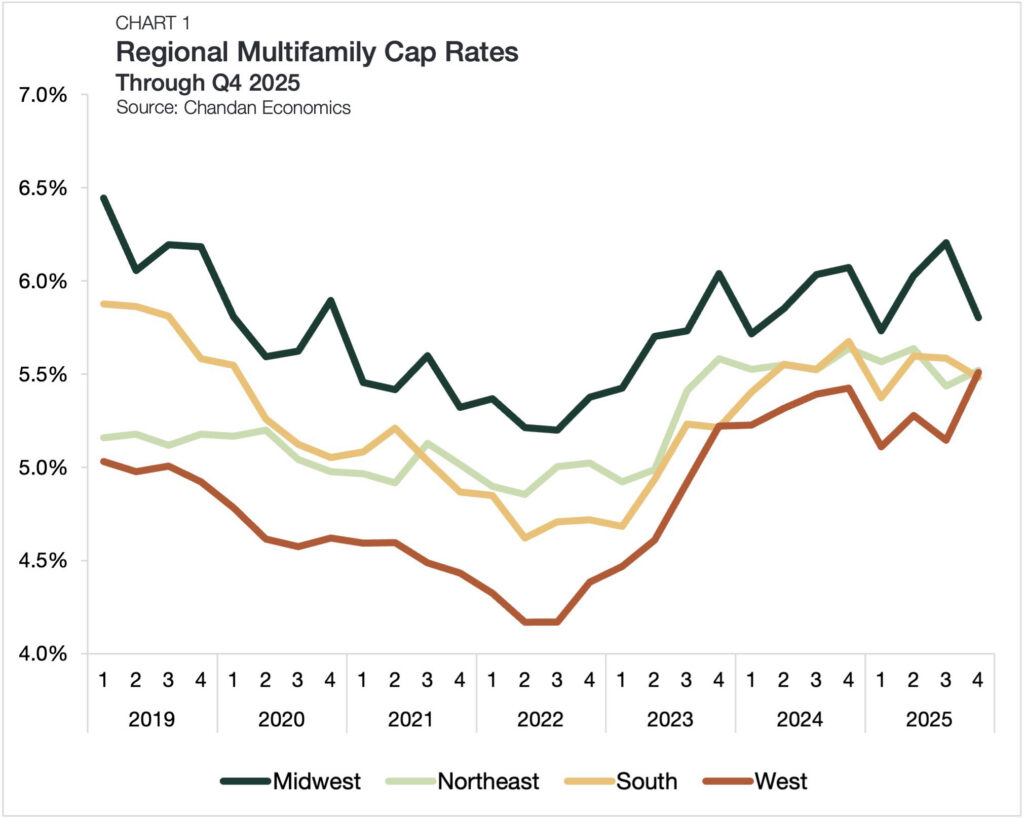

Measured nationally, multifamily cap rates held steady between the third and fourth quarters of 2025 at the sector-wide average of 5.7%. However, beneath the surface of national stability, regional movements resulted in tighter high-low spreads. In the fourth quarter, two regions had cap rates rise, while two saw them fall.

The Midwest, where property-level yields fell by 40 basis points (bps), had the most quarter-over-quarter cap rate compression in the final quarter of 2025 (Chart 1). It also had the highest cap rate of any region, at 5.8%. Coincidentally, all three other regions finished the year with a 5.5% average cap rate. The Northeast had the smallest net change of just 8 bps, while the South fell by a meager 10 bps. The West posted the largest quarter-over-quarter cap rate increase of 36 bps.

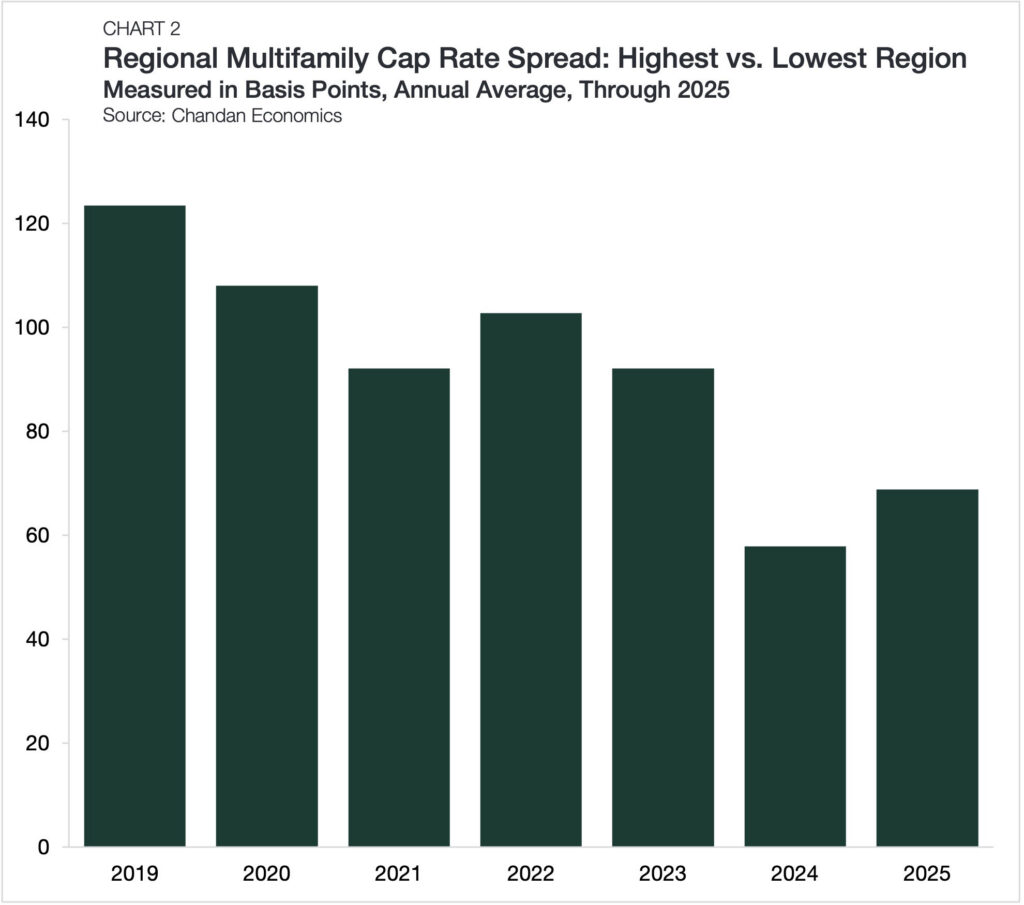

The yield spread between high-cap-rate and low-cap-rate regions compressed meaningfully in recent years. In 2019, Midwest cap rates were on average 123 bps higher than those in the West (Chart 2). This spread fell to an annual low in 2024 (59 bps) and remained compressed in 2025 (69 bps). Notably, while these high-low spreads tend to be volatile on a quarter-to-quarter basis, the spread in the fourth quarter of 2025 was 32 bps, the lowest on record since Chandan Economics began tracking regional cap rates in 2019.

Midwest Outperforms; Cap Rates Climb in the West

Historically, the combination of lower institutional capital penetration, slower population growth, and fewer supply constraints has kept entry costs in Midwestern markets low and cap rates comparatively higher. However, as renters migrated to more affordable locations, investment capital followed suit, limiting the scale of regional cap rate increases during the current cycle.

The Midwest’s attractive mix of stability, growth, and accessible pricing led to the region’s strong showing in Arbor Realty Trust’s latest Top Markets for Multifamily Investment Report, with six of the top 10 markets hailing from the Midwest.

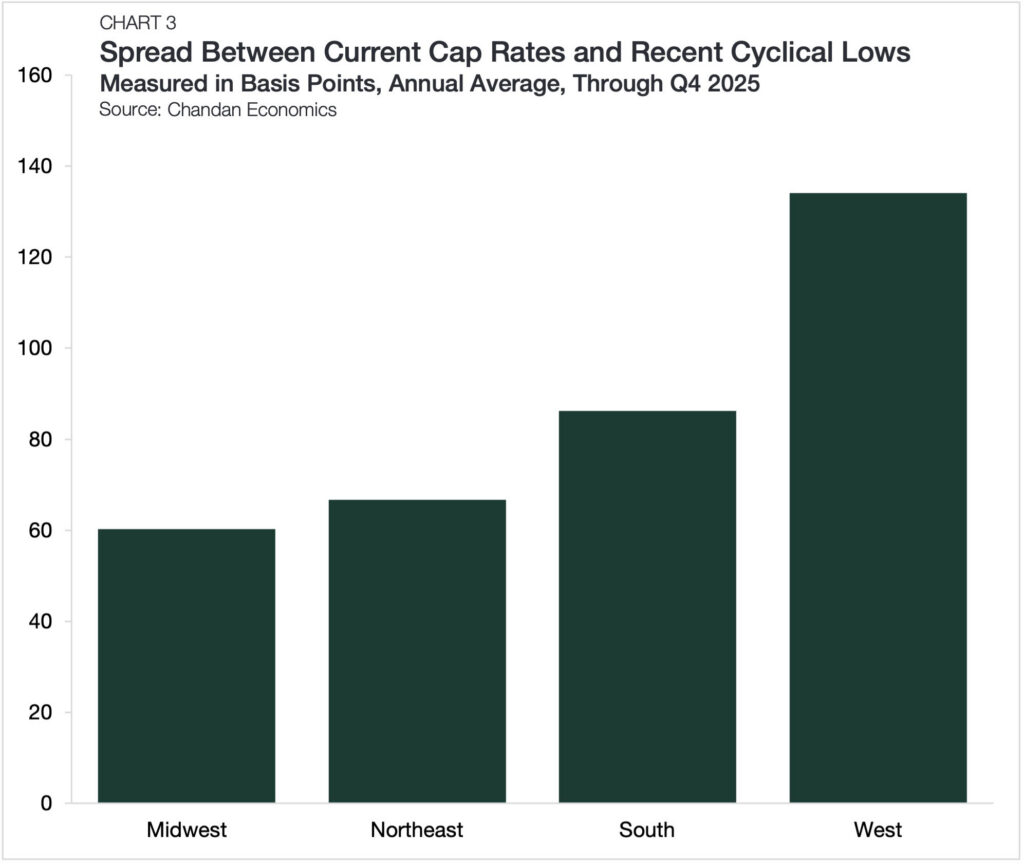

Compared to recent cyclical lows, cap rates in the Midwest are up by only 60 bps, less than increases seen in the Northeast (+67 bps) and the South (+86 bps) (Chart 3). Meanwhile, in the West, cap rates have risen by a sizable 134 bps from a low point in 2022.

Looking at the West, several factors underpin the region’s widening cap rates. High housing costs in many of the West’s principal cities, combined with the adoption of remote work, have led locationally flexible renters to consider more affordable markets, weakening near-term rent growth assumptions and compelling investors to seek higher going-in yields.

The Bottom Line

While national multifamily cap rates have leveled off, regional pricing dynamics remain less static, reflecting differences in income durability, affordability, and investor risk tolerance. The Midwest’s relative stability stands in contrast to sharper repricing in the West, while the Northeast and South have settled in the middle. Taken together, the current environment points to a market that is no longer repricing uniformly, but instead differentiating more clearly across regions based on local fundamentals.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.