Small Multifamily Extends Quarterly Valuation Gains

- Small multifamily price growth stayed positive in the third quarter of 2025, beginning a two-month streak of valuation gains.

- Valuations remain at a 16.2% discount compared to a 2023 peak.

- Steady rent growth, improving expense ratios, and rising occupancy rates have all contributed to recent price momentum.

Small multifamily assets have begun to settle into a consistent pattern of growth following two years of price corrections. Building on the findings of Arbor Realty Trust’s Small Multifamily Investment Trends Report Q4 2025, our research teams look more closely at recent pricing trends and the factors driving the turnaround.

Valuations Turn a Corner

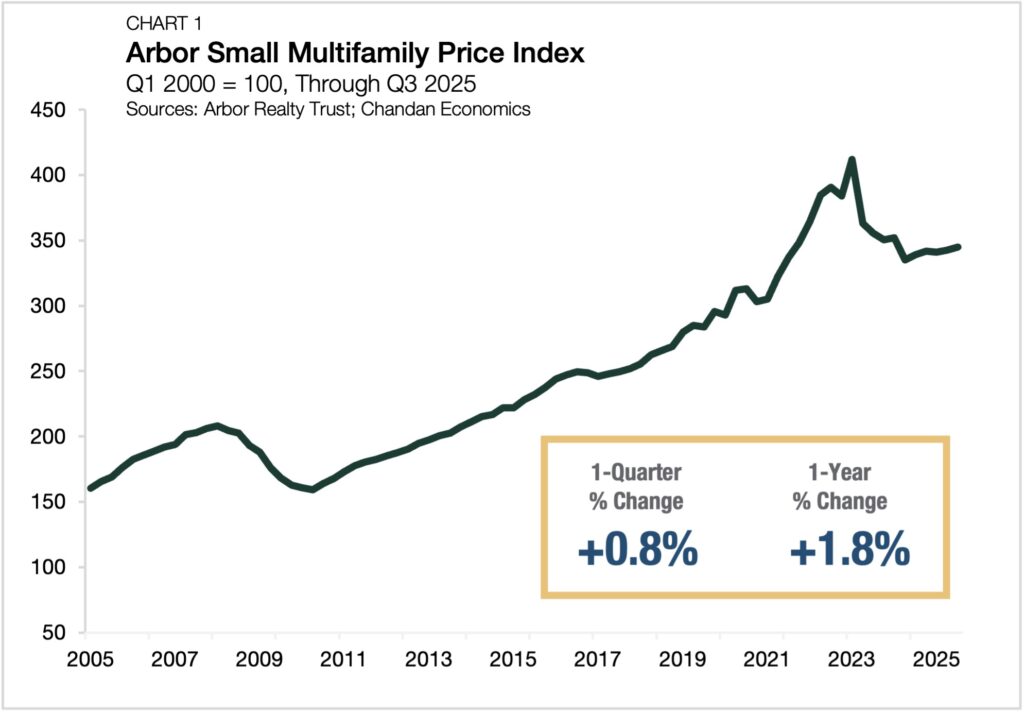

Small multifamily prices rose 0.8% in the third quarter of 2025, marking the fourth increase in the past five quarters (Chart 1). As positive price gains reappeared on quarterly ledgers, annual increases soon followed. After breaking through the positive growth barrier in the second quarter, year-over-year momentum continued in the third quarter, with valuations rising 1.8% annually.

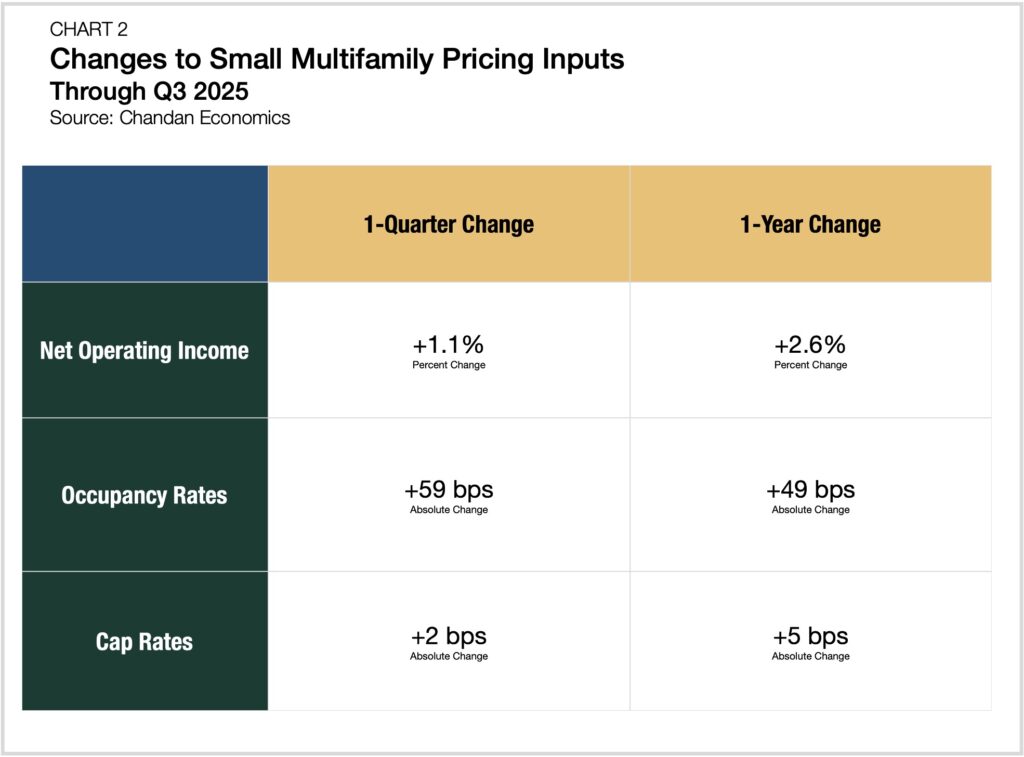

Several supportive factors have driven the small multifamily sector’s recent pricing inflection. Steady rent growth, rising occupancy rates, and declining expense ratios have all contributed to higher average net operating incomes (NOIs), which, in turn, has boosted valuations. Our model estimates that NOIs rose 1.1% in the third quarter compared to the previous period and are up 2.6% compared to the same time last year (Chart 2). Cap rates remained steady (+2 bps) at 6.0%, neither meaningfully aiding nor weighing on valuations.

The Pricing Road Ahead

Against a backdrop of heightened uncertainty, the small multifamily sector’s price recovery is notable. Compared to the 2023 market high, small multifamily valuations rested at a 16.2% markdown at the end of the third quarter of 2025. The price correction of the last two years puts small multifamily properties in an attractive position as overall economic conditions settle. With demand for affordable market-rate housing continuing to grow and valuations at a discount, small multifamily is well-positioned to build on pricing momentum in the current cycle.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.